Insight / Blog

What do out-of-home networks look like in the UK?

Summary: We dive into the biggest logistics operators and their current OOH networks in the UK

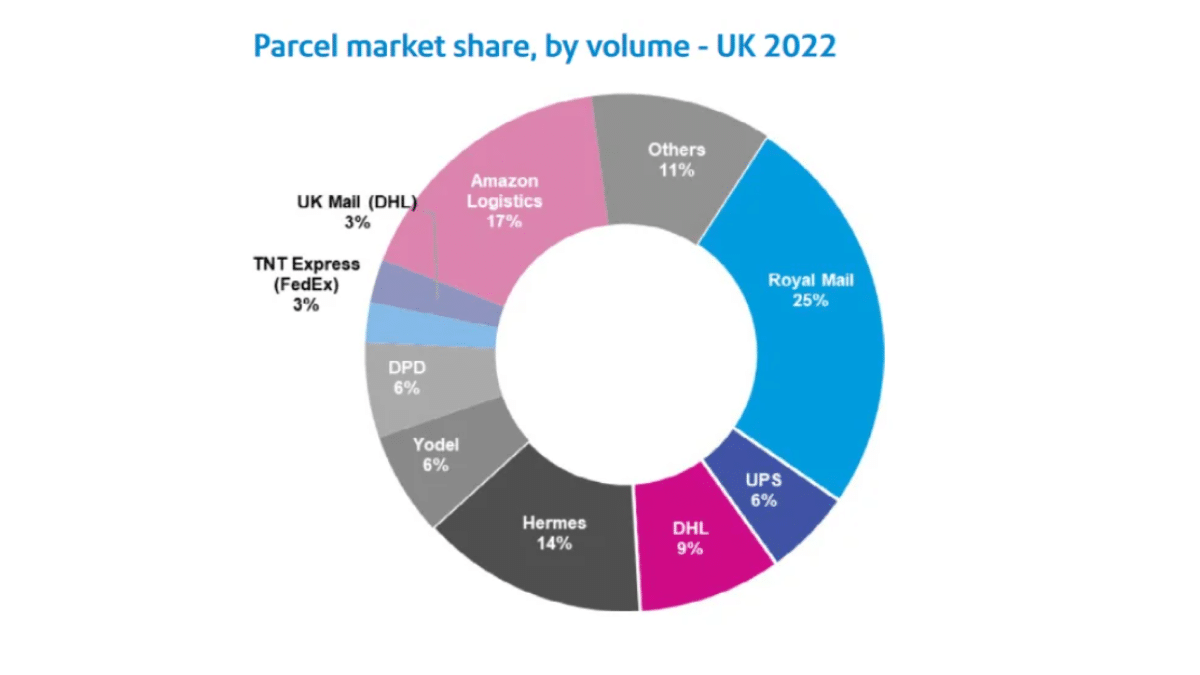

The UK has a fiercely competitive fragmented carrier market, where national mail service Royal Mail only just holds the largest share with 25% of volume according to Pitney Bowes’ 2023 Parcel Shipping Index, with the total number of parcels it carries down by 19% from the previous year. Nipping at its heels is Amazon (17%) & Evri (14%), with carriers like DHL (9%), UPS, Yodel and DPD (all at 6%) claiming their share of UK parcel volume.

Traditionally, UK consumers have always favoured home delivery. However, to increase efficiency, cut costs and reduce emissions, carriers and postal operators are more aggressively pushing their alternative delivery options.

With the consumer benefits of greater flexibility and choice of how and when they collect parcels, out-of-home (OOH) delivery is also growing in popularity in the UK – aided by a rise in C2C e-commerce and the increasing popularity of second-hand websites like Vinted. Our own research has shown that nearly three-quarters (74%) of UK adults expected to use out-of-home delivery options in future.

Fundamentally, OOH delivery is good for carriers and consumers, which is why many carriers have made headlines by building and investing in locker units dominated headlines by building and investing in locker units and PUDO networks over the past few years. This demand is forecast to continue, with Analysys Mason and LME projections estimating over 50,000 APMs (Automated Parcel Machines) will be deployed before 2030, with a cumulative investment of £1 billion in the UK alone. There’s a history of competition in the UK, with carriers fighting to secure the best partnerships with retail chains and franchises through years of developing networks and relationships. However, with a growing emphasis on sustainability and the need to navigate low-emission zones, carriers may face more regulations, leading to OOH networks becoming even more crucial to UK carrier operations.

Let’s dive into the biggest operators and their current OOH networks, focusing on locker locations and over-the-counter PUDO networks.

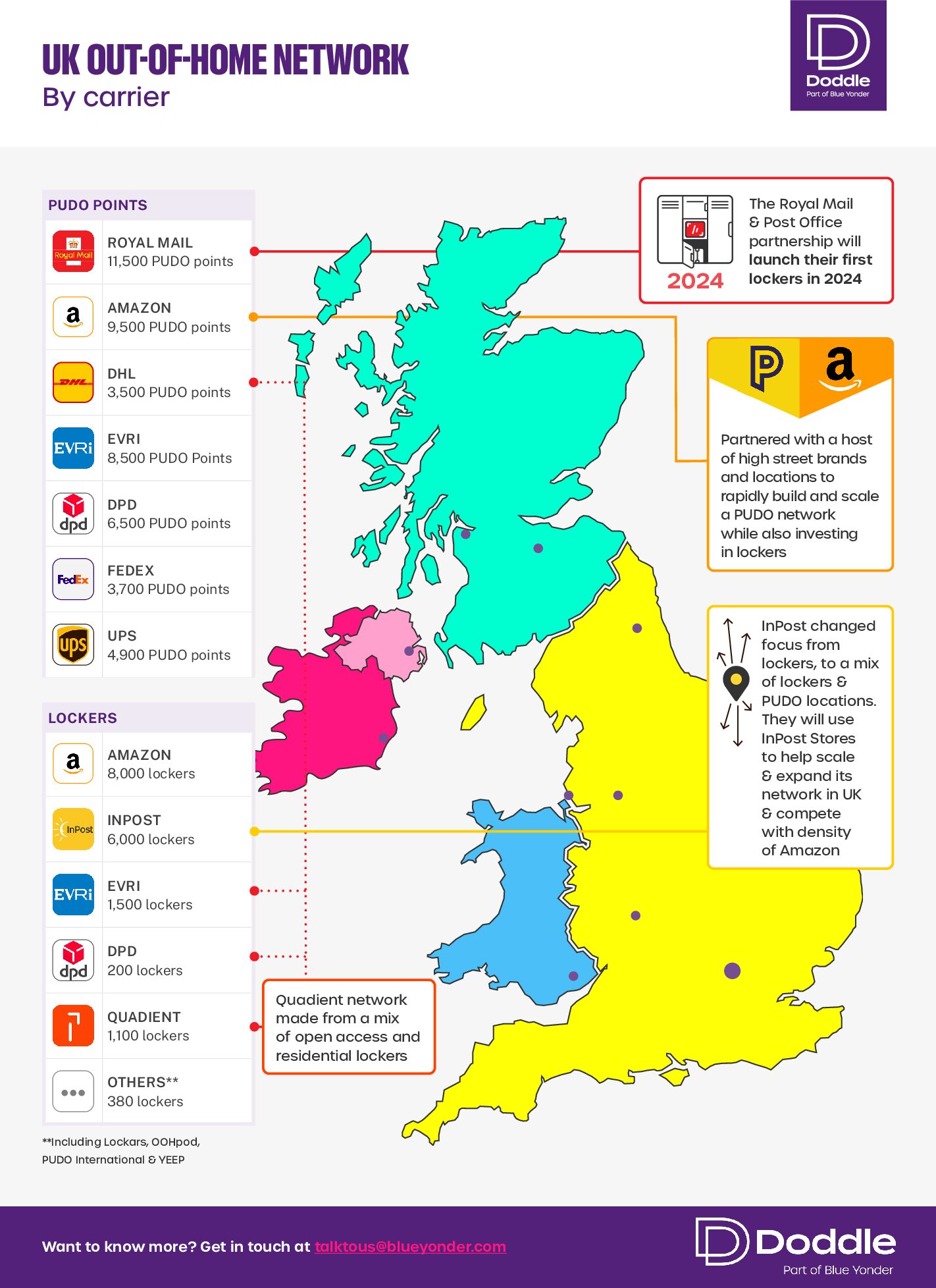

Infographic: UK OOH Networks

Royal Mail

Royal Mail handles the largest share of parcel volume in the UK and has one of the biggest OOH networks thanks to its access to 11,500 Post Offices. However, this network is no longer a monopoly for Royal Mail, as the Post Office has recently opened up to competitors such as DPD, Evri and Amazon at participating branches.

Update: Royal Mail have announced a partnership with Collect+, which will give the postal service access to 5,000+ Collect+ stores by summer 2024.

“We are delighted that Collect+ will be playing a key role in our partnership with Royal Mail. As consumer channel shift continues to move towards Out of Home (OOH), our fantastic retailer partners will now have an even greater opportunity to serve the needs of their customers in communities across the UK through our leading OOH network.”

Nick Wiles, CEO of PayPoint

Outside PUDO locations, Royal Mail has no existing locker network in the UK. However, this will soon change with the recent news that the company plans to implement ‘Amazon-style’ lockers this year. Speaking to the Financial Times, Royal Mail CCO Nick Landon said that both consumers and companies were becoming ‘increasingly reliant’ on lockers, and Royal Mail needed to make sure it was ‘addressing all of the market’ through a locker solution. The move into lockers stresses the increased competition Royal Mail is facing. Other carriers already have locker networks, and now they are encroaching on Royal Mail’s traditional post office locations, making it more difficult for the company to maintain its dominant position.

In addition, Royal Mail did not have a previous need for a locker network because of its Universal Service Obligation (USO), which means that it is required to deliver to every address in the UK, reducing the possibilities for consolidation. In recent years, Royal Mail have used its USO to launch a home collection service, allowing customers to return and send packages without leaving their home. In terms of sends and returns, Royal Mail already have thousands of Post Offices and millions of addresses to collect from – there’s no reason for them to expand.

However, with increasing demand for convenience and delivery options, investing in lockers now will allow Royal Mail to offer a more flexible and convenient delivery service to its customers. Customers will be able to choose to have their parcels delivered to a locker rather than their home address, which will allow them to collect their parcels at a time that is convenient for them.

In the future, we could see Royal Mail doubling down on this strategy, particularly if its USO is relaxed. In Denmark, where letter volumes have rapidly declined, the government has abolished the USO for Post Danmark. And with regulator Ofcom calling for a loosened USO with fewer letter delivery days, change may be on the horizon.

InPost

InPost has reached a milestone of 6,000 lockers in the UK. Initially, the InPost strategy relied exclusively on lockers, focusing growth on the key cities of London, Manchester, and Birmingham. But to help aid nationwide growth, the company has changed its strategy from exclusively using lockers to a mix of lockers and PUDO. Recent financial reports show that the company has almost as many PUDO locations as lockers across Europe (aided by its acquisition of Mondial Relay). For the UK+Italy, InPost report 5,825 PUDO locations, a growth of 95% from the previous year.

One of the primary reasons for InPost to shift its strategy is the high cost of achieving the scale required to become the largest OOH operator in the UK with lockers alone. Currently, InPost has approximately 6,000 lockers in the UK, and to beat Amazon’s current OOH network size, it would need at least 12,000 new automated parcel machines (APMs), which would cost over £100m.Expanding with pick-up and drop-off (PUDO) partners is a more cost-effective way for InPost to achieve denser network coverage.

Partnerships such as Vinted have proven exceptionally useful for InPost. For example, since launching a locker-to-locker service for sellers to drop items off at an InPost locker using a QR code, demand across the InPost network has more than doubled quarter by quarter, growing by a further 31% between Q4 2022 and Q1 2023. In Q4, InPost delivered 17.2 million parcels, showing a 169% YoY and +29% QoQ growth. Leveraging this partnership, InPost has also launched its PUDO network on the Vinted platform, allowing consumers to collect parcels from InPost Shops. Michael Rouse, CEO of InPost International, said that the service “enables us to accelerate our network capacity to capture further demand for InPost’s services. Furthermore, in some areas where APM installation is tricky due to space constraints, we can still add a collection point for our growing two million user base. This marks an important milestone in our mission to become the UK’s largest OOH provider”.

Amazon

Amazon initially invested in lockers to provide customers with a convenient way to collect their parcels. However, to achieve rapid scale, the company partnered with a host of high street brands and locations to quickly build a PUDO network from as many as locations as possible. These partnerships (as well as its continued investment into lockers) has allowed Amazon to have one of the largest collection point networks in the UK, with approximately 17,500 out-of-home (OOH) locations, of which 8,000 are lockers, according to Last Mile Experts 2023 European OOH report.

Amazon has the resources and means to build and expand its network rapidly. However, unlike other carriers, its unique position as both retailer and logistics provider has also allowed Amazon to actively encourage consumer adoption of its network on the checkout, including running promotions where consumers can get £5 (later £4) off their order if they choose to collect at an OOH point.

Unless carriers can convince retailers of the benefits of adding OOH options at checkout, they will struggle to match this scale of consumer adoption and OOH volume. However, on the bright side, once consumers use OOH options and discover the benefits for themselves, they are more likely to use it again. So, some consumers that Amazon convert into OOH users may drive future volume into other carrier networks. But it’s never a good strategy to rely on a competitor to build your audience for you.

DHL UK

DHL UK has approximately 3,500 Service Point locations which they have run for many years as a bedrock of the DHL Express business. The company has built its network through long-standing partnerships with retailers such as Ryman, Safestore, WHSmith, and Robert Dyas, as well as independent stores.

While DHL UK has not built its own locker network, the company announced a partnership with Quadient in September 2022 to offer smart lockers for parcel pick-up throughout the UK. We’ll come back to Quadient’s network in its own section below.

Evri

Evri has built a UK network of over 8,500 parcel shops and lockers, assisted through its small-format kiosk, which reduces the workload for store staff when accepting returns and C2C parcel sends across its drop-off points. The Print In ParcelShop devices were developed to remove barriers for those without home printers, provide consumers an easier journey, and help the carrier expand its PUDO network into more independent businesses and fuel stations. In addition to contributing to Evri’s network expansion, the devices have boosted parcel volumes for the courier. In 2020, the devices were reported to lift parcel volumes by an average of 15%.

Alongside its ParcelShop locations, Evri has over 1,500 lockers across the UK, each available 24/7 outside local shops and supermarkets. The lockers are split between InPost and Evri lockers, although it is unclear how many of the lockers are entirely Evri-owned.

Evri is also a partner of the Quadient open locker network, becoming the first carrier to offer the Drop Box and Printer capability to its customers, again relying on technology to help its network expansion.

DPD

The Last Mile Experts 2023 European OOH report reports that DPD has 6,567 PUDO locations and 206 automated parcel machines in the UK, partnering with the Post Office, Sainsbury’s, Homebase, Argos, Morrisons, Go Outdoors, Matalan and the Coop as well as a network of Collect+ stores.

The network is most densely populated in London, with DPD claiming one of its DPD shops can be reached within a 10-minute drive of 93% of the population, while London residents can reach one in just a 5-minute walk. DPD was the first carrier to partner with the Quadient open locker network, joined later by Evri and DHL.

Elaine Kerr, DPD UK CEO, commented: “Parcel recipients always tell us they also want choice and control over their deliveries. Many households have become more reliant on deliveries post-pandemic, but not everyone is at home all the time now. So, it is important that we continue to develop new smart, safe and secure delivery options. It is really exciting to think about the kind of locations that could be most convenient for people, going forward such as libraries or maybe even pubs.”

Quadient

Quadient, a French postal and parcel technology company, is building an agnostic locker network in the UK. It launched in 2022 with a plan to get to 5,000 locations “in the coming years”. Roll-out appears to be slower than initially planned, with only 1,100 lockers in operation (which we believe also includes their residential network).

Quadient has had some great success in launching partnerships with DPD, Evri, and DHL UK to create a carrier-agnostic network offering customers greater flexibility and convenience in parcel delivery and collection – without making those carriers take on the risk of fully financing and implementing the locker network themselves.

The ambition to build a carrier-agnostic network is admirable, especially in a competitive and fragmented UK market. However, despite its rollout plans, Quadient remains a small player in the market, and may find it difficult to source suitable locker locations – particularly with other operators like Amazon and InPost already staking their claim. It remains to be seen how much actual volume and usage the network can drive, and how it will handle the challenges of agnostic network management, if and when that volume starts to increase significantly. This is particularly true considering InPost’s recent bout of embarrassing PR, where orders had gotten mixed up as its locker volume increased.

To make carrier-agnostic lockers work, you need to implement either parcel management software that interfaces with carrier software in real time to manage availability, or you need to flood the market with so many locker compartments that you never have to worry about volume exceeding capacity, like Hive Box’s 300,000 strong network in China. Quadient’s planned 5,000 rollout isn’t anywhere near the level of saturation that the latter strategy requires, so it needs to focus on the technology and management of the network to reach success.

UPS, FedEx and emerging locker companies

UPS and FedEx are other key players in the UK OOH market, with a respective 4,900 and 3,700 PUDO locations. Neither of these companies have currently invested in their own locker networks within the UK, although UPS is partnered with both OOHpod, which covers locations across Ireland, and Lockars, which have eco-friendly lockers in London and ambitions to deploy over 10,000 locations over Europe.

For locker companies like OOHpod, Lockars and YEEP!, having carrier partners on board is a great way to expand volume into their networks. But, in that lies a catch-22 situation. Driving volume requires a decent scale and density across the UK, so that carriers see you as a useful partner to expand their networks. However, reaching that scale and density is very expensive and hard to justify without carrier customers already on board.

It’s why, despite each of these locker companies having ambitious plans to rollout thousands (or 10,000 in Lockar’s case!) of lockers across the UK, they only have a combined total of 380 for the time being.

UK OOH network set for continued expansion

OOH networks in the UK are expanding, with most carriers using a heavily PUDO-oriented network as a base to increase density, partnering with retailers, shops or supermarkets around the country. However, it is worth noting that carriers are also moving towards print-in-store solutions within PUDO networks to also offer a better customer experience, such as Drop-Off Kiosks or Counter-Top Kiosks. As Evri shows, having a kiosk offers carriers a unique selling point, providing both and improved customer journey while reducing staff demand, thus making host partnerships more attractive.

The exception here is InPost, which started with a locker-first network. However, InPost has recently changed its strategy to increase density and scale to help compete with the network size of Amazon.

Bar Royal Mail, which is about to try its first deployment of lockers, many of the top carriers aren’t investing in lockers directly, but are partnering with Quadient to enter this field. DPD was the first to recognise the opportunity and added consumer benefits the partnership might provide when added to its own offerings, with other carriers such as Evri and DHL UK following its lead. Although truly carrier-agnostic lockers haven’t traditionally been successful, having a partnership model is a great way for carriers to lessen the risk of investing in new units while potentially helping drive demand and volume. However, they are also incredibly difficult to get right – so only time will tell if the partnership will pay off for these carriers.

Topics:

Related articles

Lessons from a decade in the first and last mile

A decade as Doddle taught us some lessons - and Blue Yonder helps us see what will matter in the next decade.

Parcel lockers vs parcel kiosks: which is best for parcel drop-off?

We explore the benefits and drawbacks of parcel lockers and kiosks to help decide the best self-service solutions.

4 ways that C2C commerce is transforming the last mile

As consumers adopt recommerce, out-of-home networks are having to adapt to increased demand.