Insight / Blog

Parcel lockers vs parcel kiosks: which is best for parcel drop-off?

Summary: We explore the benefits and drawbacks of parcel lockers and kiosks to help decide the best self-service solutions.

Self-service solutions have become a priority for parcel carriers looking to improve efficiency and customer experience in out-of-home locations. Automated journeys deliver a great customer experience while reducing staff dependency. Additionally, these solutions allow carriers to expand their out-of-home networks into new locations such as coffee shops or gyms.

As the first and last mile becomes more automated, parcel lockers have become increasingly popular, with many carriers and posts introducing them as a collection and drop-off option. Smaller-format self-service kiosk options are also gaining popularity, particularly as they can be more easily deployed inside owned locations such as post offices, as well as in third-party out-of-home locations like convenience stores.

Focusing specifically on the consumer parcel shipping and ecommerce returns journeys, we’re exploring the benefits and drawbacks of both models, helping carriers to make informed decisions about the best self-service solutions.

Contents

What’s the difference between parcel lockers and kiosks?

Parcel lockers are a set of automatically opening and locking compartments, through which users can collect or securely drop off parcels. These are typically controlled by a touch screen interface and/or a barcode scanner, which is used to read collection or drop-off barcodes on labels or from users’ phones.

Parcel kiosks are designed to focus on parcel sends and returns – they don’t enable users to collect a delivered parcel. Several types of kiosks are available, including small and flexible Counter-Top Kiosks, simple drop-box models, POS (point-of-sale) Kiosks, and Through-The-Wall kiosks.

The benefits of parcel lockers

Parcel lockers have become increasingly popular among carriers, providing consumers with an automated journey for both parcel sends and collections. When placed in public outdoor locations, lockers offer 24/7 access, allowing customers to drop off their parcel at a time that is convenient for them, without relying on store opening times.

In terms of sizing, lockers can provide some flexibility as carriers can upscale or downsize their locker installation to fit the expected volume and the available space, within limits.

For carriers, lockers offer greater delivery efficiency through consolidation, reducing failed deliveries and saving costs. Additionally, if lockers are accessed by foot or as part of an existing trip, such as train stations, supermarkets, or office buildings, they can increase sustainability compared to home delivery.

Why the last mile is less sustainable than ever, and what we can do about it

Consolidation is also an important factor on the reverse logistics and consumer shipping journey and a motivating factor in logistics operators adopting parcel lockers – although this is something that both lockers and drop-off kiosks provide.

New locker units can also help to drive brand awareness for carriers. Customised in carrier branding, lockers can function as billboards in high-traffic areas, combining delivery and advertisement. This is one of the reasons why lockers seem to have more popularity and media coverage than traditional pick-up and drop-off (PUDO) locations, despite carriers having far more PUDO locations than locker banks.

What are the downsides of parcel lockers?

One of the main drawbacks to parcel lockers is the cost. Lockers require significant capital investment, with average prices ranging from $6,000-$20,000 depending on size and features. Additionally, lockers incur ongoing operating costs such as power, maintenance, and license fees, which can run up to 10% of the locker costs.

Another big downside to parcel lockers is the difficulty of siting each locker to create a dense and convenient network. This is particularly challenging if other carriers have already developed a network in the area. Sourcing locker locations requires a dedicated team focused on establishing partnerships and finding the right locations in a given area. In addition, forming partnerships with host locations like convenience stores might also be harder, as many lockers won’t fit inside smaller stores, and lockers installed on the pavement in front of a store might be harder to sell as a driver of footfall for those stores.

In addition, locker adoption is not guaranteed. Just because carriers have built a locker network, it doesn’t mean that consumers will use them. Carriers must also invest in building consumer awareness and adoption to drive volume into locker networks, a cost which comes on top of the initial capital investment.

Finally, parcel locker capacity is limited by the number of compartments available. Without emptying, it can be easy for lockers to reach this limit and thus be unusable until the carrier collects outgoing parcels and consumers collect incoming deliveries. Because of this, lockers also require technology to see accurate real-time locker availability. If lockers are at capacity, it can be a frustrating experience and a wasted trip for the consumer if they arrive at a full locker and can’t send their parcel.

The benefits of parcel kiosks

One of the main advantages of kiosks is their greater location variety and flexibility. Kiosks can be installed inside key locations like convenience stores and petrol stations, and can even open up totally new kinds of location for parcel drop-off, such as coffee shops, gyms, and or even fast-food restaurants.

Additionally, kiosks are easier to install, with many formats able to be plugged in, switched on and used almost immediately. They can also be moved if the host location wants to change its layout, reducing installation and maintenance costs. The only exception is Through-The-Wall Kiosks, which must be installed into a fixed wall.

Like parcel lockers, kiosks can offer additional services on top of the physical drop-off, like label printing or allowing customers to purchase postage for their drop-off. They are also user-friendly and intuitive, enhancing the customer experience. For example, our Drop-Off Kiosk journey can be completed in as little as 60 seconds, and our Counter-Top Kiosk in as little as 30.

Despite their much smaller size, in the right circumstances kiosks can handle a greater volume of parcels than a typical parcel locker bank. Of course, this depends on fill rate and how frequently parcels are collected from a locker by consumers and added in or taken away by couriers. However, because kiosks only deal with drop-offs and operate inside host locations, staff are on hand to empty them when they fill up, so they can be filled and emptied many more times per day than a locker is likely to be. That can result in amazing throughput, even with small devices. Our Drop-Off Kiosks have handled over 10 million returns (and counting!), with individual kiosks able to process over 400 parcels per day in peak periods.

In addition, parcel kiosks can also increase footfall to host locations and increase spend in-store, bringing host locations more revenue, while reducing staff workloads compared to non-automated PUDO. Because consumers don’t need to queue at the counter with their parcels, kiosks can also help reduce queueing in stores.. The benefits for host locations make kiosks a more attractive offer for carriers when finding new partners to scale and expand their networks. It’s the same tactic Evri used with its Print-In-Store devices, which has helped it to expand its ParcelShop network across the UK.

What are the downsides of parcel kiosks?

The main drawback of parcel kiosks is that they can only be used for parcel sends and returns. Even with parcel kiosks installed, consumers will need to rely on over-the-counter services or lockers for parcel collection.

In addition, the features and functionality of kiosks vastly differ depending on the model used. This means that carriers will need to carefully consider which model is best suited for their specific needs and customers. For example, all indoor models will have limited access depending on host store opening times, while Through-The-Wall Kiosks and outdoor models will have the same 24/7 access as parcel lockers.

Parcel kiosks also rely, to a limited degree, on staff interaction to empty the kiosks when full or accept parcels from a countertop device. Although they are a more attractive host offer than traditional PUDO methods and are likely to drive more store traffic than externally placed parcel lockers, they still require a certain degree of host staff management to ensure the kiosks are used effectively and efficiently.

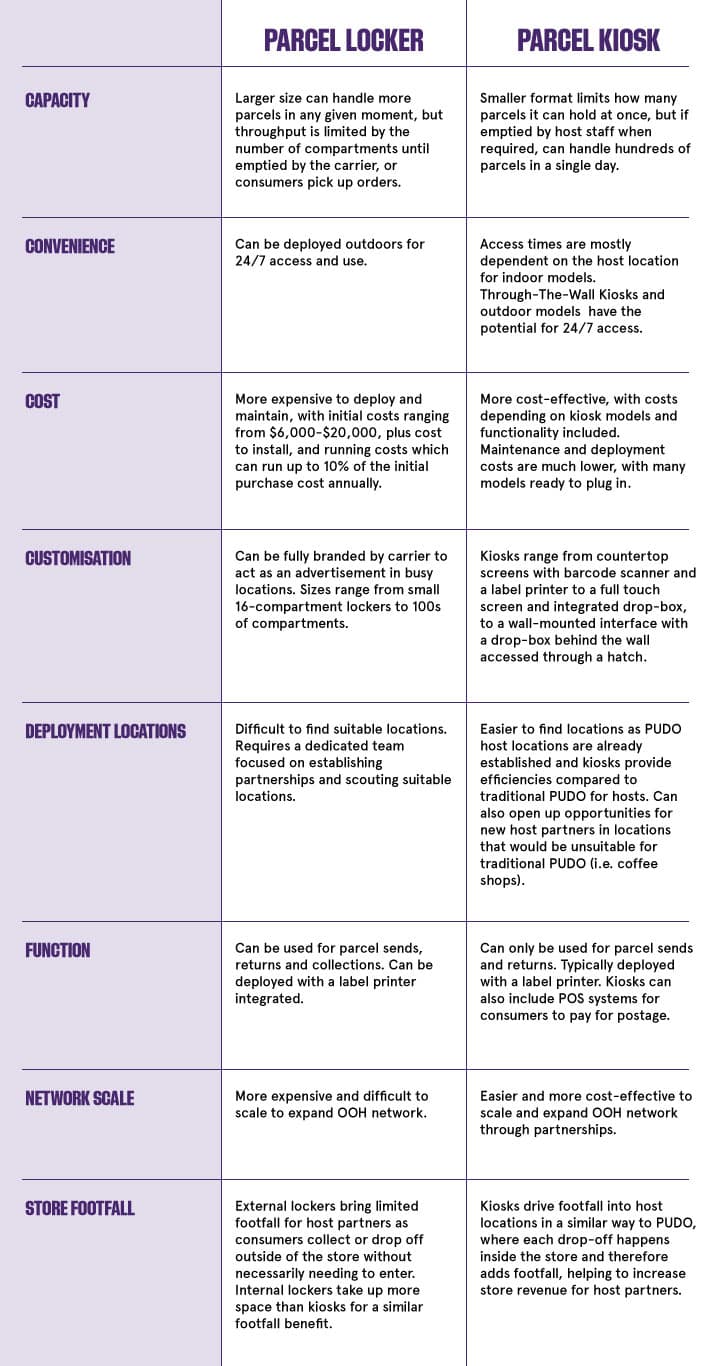

Parcel lockers vs parcel kiosks

After reviewing both parcel lockers and kiosks individually, it’s time to explore how they measure up to each other for parcel sends and returns.

Should carriers invest in parcel lockers or kiosks to manage parcel drop-offs?

Parcel lockers and kiosks have a range of benefits and drawbacks to carriers. Both are great ways to expand network density, drive efficiency, and improve consumer experience. While parcel lockers serve a dual purpose in automating both delivery and returns, when it comes to the drop-off experience specifically, kiosks are custom-built to meet the needs of carriers, consumers and host locations, with much greater flexibility and significantly lower costs to deploy.

Overall, the best networks will use a combination of both parcel lockers and kiosks, giving consumers a variety of options to choose from. Lockers are expensive but valuable, so adding in PUDO locations and maximising their efficiency with kiosk technology will be the more cost-effective and faster way to scale an effective out-of-home network.

Topics:

Related articles

Lessons from a decade in the first and last mile

A decade as Doddle taught us some lessons - and Blue Yonder helps us see what will matter in the next decade.

What do out-of-home networks look like in the UK?

We dive into the biggest logistics operators and their current OOH networks in the UK

4 ways that C2C commerce is transforming the last mile

As consumers adopt recommerce, out-of-home networks are having to adapt to increased demand.