Insight / Blog

The top 3 insights from WMX Asia

Summary: Our key takeaways from three days of speeches, discussions and brainstorming with leading regional and global carriers.

We were lucky enough to attend the World Mail & Express (WMX) conference in Bangkok last week, which provided three days of speeches, discussions and brainstorming with some of the world’s top posts and carriers. This year’s Asia conference brought out some major players: Ariya Thongbai, Sr Executive VP of Thailand Post; Charles Brewer, CEO of POS Malaysia; and Shreya Bose, Regional Head of SEA Crossborder Sales at Ninja Van, to name a few.

The agenda took aim at topics like crossborder growth, emerging technologies, disruption and new market entrants, changing consumer demands and the future of ecommerce. We’ve picked our top three insights from the three days to share.

Returns are still a major concern for retailers and carriers

At Doddle, we’re strong believers in the importance of carriers acting on rising return rates, so it was encouraging to see returns emerge as a focus throughout the presentations on offer. In Escher CEO Brody Buhler’s presentation, ‘The Postal Digital Transformation Imperative’, he called out returns as a force reshaping the postal landscape, revealing:

-

2x growth in online returns in 2021 from the previous year

-

79% of consumers expect free returns

-

A total of $218 billion of revenue was lost in 2021 due to returns

-

62% of consumers will buy more online if they can return items to a physical store

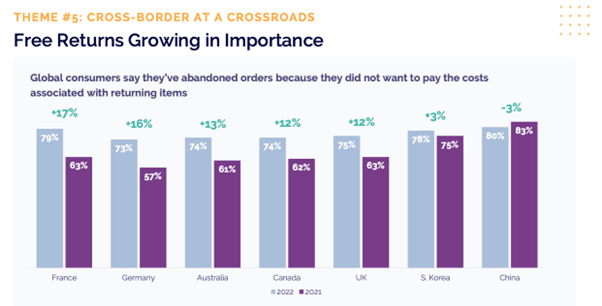

The returns problem becomes even more pronounced in cross-border ecommerce, as shoppers from countries around the world abandoned orders because they don’t want to pay the costs of returning items. In every market bar China and South Korea, the average abandonment rate has increased by at least 12% since 2021.

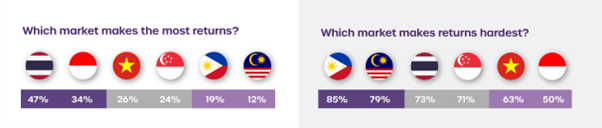

The Head of GeoPost SEA, Mark Tan, also shared insights on returns during his presentation ‘Shaping the Future of Ecommerce: Perspectives from the Last Mile’, revealing that 1 in 4 SEA consumers returned their last online purchase. What’s more, 2 in 3 considered the return experience to be difficult.

One of the most interesting points from this presentation is that the markets with the highest difficulty returning items have the lowest return rates. That might seem positive for retailers in these markets, but research consistently shows that making returns a painful experience results in reduced customer loyalty and incentivises them to shop with a retailer who can make that journey easier and less painful. In effect, while the challenge might suppress some returns, it is likely also suppressing a lot of valuable orders too.

Returns are a vital part of the ecommerce experience across all markets. To encourage more volume and future orders, carriers need to offer retailers better returns solutions with key data and insights to improve efficiencies and customer satisfaction.

Consumer delivery preferences are evolving

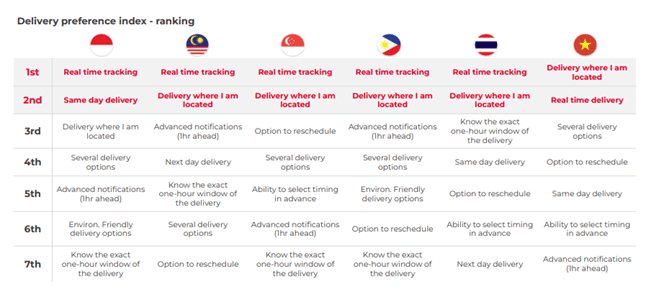

Mark Tan’s presentation also delved into changing consumer delivery preferences across south-east Asia, showing that real-time tracking was voted the number one delivery preference across all countries, bar Singapore where it was ranked 2nd.

Other key delivery preferences include several or advanced delivery options, with the ability to reschedule deliveries or have advanced tracking with one-hour windows. These responses paint a clear picture of demand, with consumers wanting to know precisely when and where their parcel will be delivered.

That reflects an emphasis on convenience and immediacy, especially with the importance several markets place on “delivery where I am located”. Addressing that demand will be challenging for carriers if they’re reliant on home deliveries, given that for many, home will not be “where I am located” for much of their time. One of the ways carriers might look to address this could be through the use of PUDO networks, since these will allow them to deliver items closer to their customers, without relying on their customers being close to home.

As Mark Tan also shared in his presentation, between 71-89% consumers prefer to have their parcel delivered to a home address. That might seem an oxymoron, given that consumers also say they want delivery directly to wherever they are. Part of the problem for South-East Asian carriers is relatively low adoption rates of PUDO, leading to this contradictory expectation. Consumer preferences in surveys like these often reflect existing habits more than evaluations of after having tried all the available options – i.e. shoppers will always “prefer” the service they’ve used over the option they haven’t, even if the latter would actually better address their needs.

We know from our time building a UK PUDO network that the more a consumer uses PUDO, the more it becomes routine, and the more it becomes their delivery preference. The average user who came back after trying PUDO once at Doddle then used it 13 more times. That’s why Amazon initially offered £5 off their PUDO delivery orders to encourage first-time usage – a very generous discount on the first use is paid back by the repeat usage.

It’s ultimately up to carriers to promote the benefits of OOH and incentivise customers to try it, to drive longer-term and more widespread behaviour change, getting customers to pick the service that addresses their own changing needs and desires.

Carriers are facing new challenges on many fronts

Since the pandemic, a lingering feeling of uncertainty has been plaguing carriers. So, it was only natural that part of the conference centred on what actions carriers have taken since the pandemic and the new challenges they are now up against. After the explosive growth during 2020 and 2021, parcel carriers are now finding that there are new headwinds to consider.

Some of these challenges included cross-border taxation, the ever-present questions about sustainability, and how new start-ups are disrupting the market. In Thailand, for example, the second-biggest delivery operator is just 5 years old, and elsewhere in South-East Asia, new entrants are disrupting national parcel markets with low-cost offerings that make competition difficult for incumbents. To find out more, read our blog on out-of-home delivery in the Asia Pacific.

Lionel Berthe’s presentation, ‘Asendia’s Latest Options in the Global Disruption Challenges’, stated that 60% of global business leaders claim the number one challenge in 2022 is supply chain disruptions. That feels like it was true at the start of the year, looking back at 2021 – but specifically for carriers, and specifically now, it would probably not rank as the top challenge they’re facing, with global economic headwinds growing and questions about the balance of power in both global spending and regional market shares.

Whatever their main challenges, it seems an opportune moment for carriers to review their strategy and offering. We’ve spoken recently about how carriers and posts should employ a practical approach to digital transformation, and there’s no better time to invest in transformational technology to increase value for merchants and improve efficiencies, ready for all the uncertainty and hardships that lie ahead.

To find out how Doddle can help carriers in South-East Asia thrive amidst changing consumer behaviour and growing returns challenges, get in touch today.

Related articles

How 3PLs Can Cut Costs, Reduce Waste and Boost Revenue With Smart Returns Management

3PLs should take advantage of returns to help reduce cost, efficiently manage warehouse resources, and aid growth.

Saving profits and the planet: 4 ways to sustainable & cost-effective returns

Returns drain profits and damage sustainability. Luckily, retailers can implement both cost-effective and sustainable returns using these 4 ways.

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.