Insight / Blog

Why ASOS might start charging for returns, and what that means

Summary: ASOS increased the minimum spend for next-day delivery for its Premier subscribers - are returns next?

UK fast-fashion ecommerce leader ASOS recently announced plans to alter the terms of its Premier next-day delivery subscription by increasing the minimum spend for eligibility from £10 to £15. Premier subscribers will still receive standard delivery for free, no matter the basket size, but for orders under £15, shoppers will need to pay an additional £5.95 charge for next-day delivery.

At the start of the year, we predicted that ASOS would make some changes to its return policy, moving away from the ‘free for everyone’ promise it publicly made and charging for at least some of its returns.

We see this change to the Premier delivery offering as a perfect exemplifier of a broader strategic shift from ASOS that makes us even more confident our prediction will come true.

ASOS’s changing philosophy

Premier delivery is a great proposition for ASOS shoppers. For a minimal yearly payment – £11.95 in the UK – customers can order as much as they want and get next-day delivery for free, incentivising them to spend more with ASOS throughout the year.

For ASOS, the cost of free next-day delivery is recuperated (and more) through higher average basket values (ABV) and the increased purchase frequency of Premier subscribers. And in general, this model has worked for the retailer, with its annual report stating that Premier customers shop 3.5x more than an average ASOS customer.

ASOS“Our Premier offer is key to driving loyalty and engagement among our customer base as well as increasing our average customer value over time.”

However, with the economy forecast to shrink, inflation rising and real wages falling, it’s now very apparent that consumers are spending less. In the UK, ASOS reports that ABV is down by 3% YoY. That’s put pressure on the retailer to cut cost and become more efficient in a lower-demand environment.

ASOS wants to retain the attraction of the Premier proposition that leads consumers to sign up and purchase more frequently – but, in a shift to the heady growth days of 2017-20, focus these days at ASOS is on the bottom line as much as it is on the top line. By raising the minimum basket value, ASOS can target a specific behaviour that can never be profitable: low-value baskets receiving free next-day delivery.

It’s not the first time ASOS has tweaked the conditions for Premier eligibility. Only last year, the company implemented the £10 minimum spend, which was met with criticism from users who threatened to cancel. Since then, the price for Premier has also nudged up from £9.95 to £11.95 per year. Interestingly, despite these changes, ASOS achieved a 12% YOY growth in Premier subscribers, suggesting the backlash to the £10 minimum might have been overblown by publications looking for a click-bait headline – and presumably has emboldened ASOS to feel confident that upping the minimum this year wouldn’t stop shoppers from signing up.

Increasing the minimum basket to £15 makes financial sense for ASOS. It’s a way to keep the original proposition of unlimited next-day delivery for a minimal yearly cost at the core of their offer. There’s just an added asterisk to remove edge cases and make the model more economically valuable.

In our view, the same logic will soon apply to returns.

Free returns, just not for everyone all the time

As recently as June 2022, ASOS said “free returns are a core part of the ASOS offer and there are no plans to change this approach”.

However, returns remain a fundamental issue for online retailers as a result of (in)direct costs of having items shipped back and the associated returns reprocessing costs, and (ii) the reduced value of items being returned in a world of seasonal & fast-moving fashion cycles. Whilst online growth was booming, retailers were happy to accept this cost of returns as part of the online model, but as growth has slowed, we’ve seen big names like Boohoo or Zara introduce a charge for online returns for the first time within the last year.

The other factor worth bearing in mind is that in a cost-conscious environment, returns rates typically creep up, something ASOS itself has acknowledged, stating that return rates ‘have increased from May 2022 to levels close to pre-pandemic’ in its annual report. Despite the rise in return rates, ASOS has stood behind the statement that returns will remain free, for everyone. But as we’ve seen with Premier delivery and the added asterisk of minimum order value, there’s room in ASOS’ philosophy to adapt its stance on returns to tackle edge cases that impact profitability.

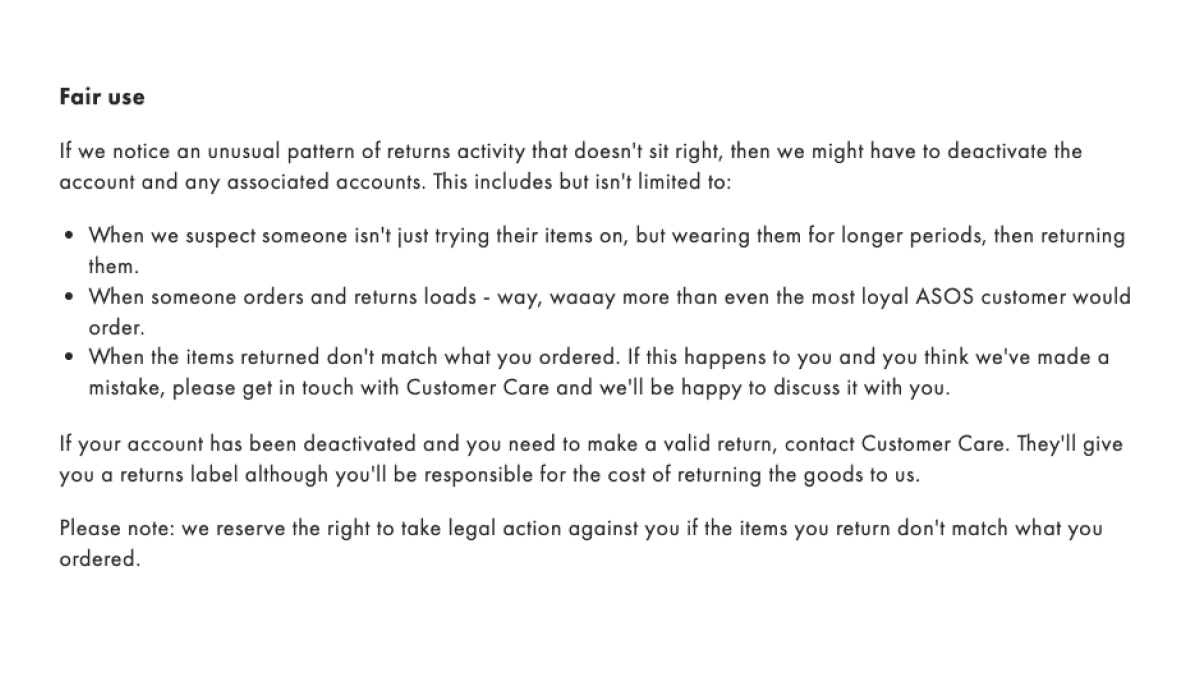

A few years ago, ASOS took some steps to close a loophole in its returns policy: ‘wardrobing’, where shoppers buy and wear clothes for a short period of use, then return them for a full refund. In this situation, ASOS threatened to deactivate user accounts and changed the terms of its returns policy to ensure that returned items were unworn and in original packaging.

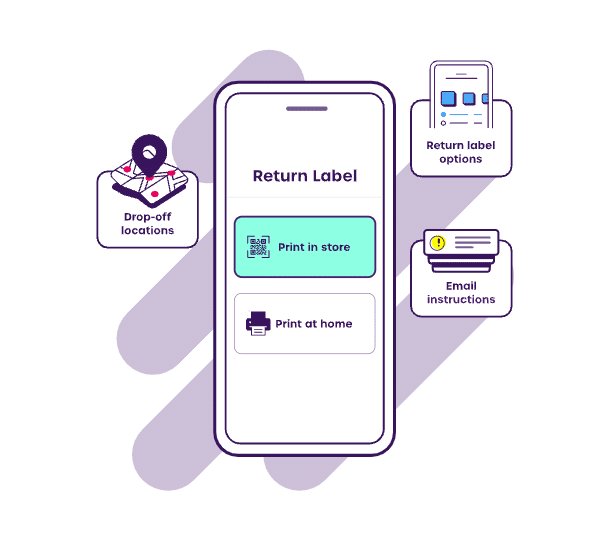

But there’s still far more that ASOS could do to cut down on other types of unprofitable returns. By using its returns portal data, ASOS can look at other returns behaviours, such as those who ‘bracket’ order and return items (i.e. buying multiple sizes or styles of a single item with the intention of only keeping one), or ‘bumpers’ who routinely add items to hit the minimum threshold for free delivery, only to return the added item.

By identifying the most frequent or costly returns behaviours and comparing them against the profile of customers who frequently generate such returns, ASOS can smartly target returns charges, or add terms and conditions that limit margin erosion from such returns, increasing overall profitability. In the case of the ‘bracketer’ perhaps the shopper is offered free returns for the first 7 days, but pays for returns from day 8 to 28 of the returns window, to encourage speedy returns. In the case of the ‘bumper’ perhaps the frequency of this behaviour results in the shopper being charged a small fee for returns until the shopper’s return rate drops back to a normalised level.

Overall, the position might change from 100% of returns being free to allowing 95% of returns to be sent back for free – asking shoppers to contribute to the cost of their return in specific cases.

No matter which rules ASOS chooses to use, implementing data-driven returns rules and charges would allow it to eliminate or recover some of the cost of the least profitable returns in just the same way that it has removed free next-day delivery from low-value baskets. By carefully targeting the ‘low-hanging fruit’, i.e. the worst 5% of returns, introducing charges would still allow most consumers to continue to benefit from the security of its free returns proposition.

ASOS’s impact on other retailers

By publicly declaring its stance on returns, ASOS has become a figurehead for free ecommerce returns. If its policy changes from ‘free for everyone, every time’ to ‘free, except for…’, ASOS will likely inspire more retailers to also place restrictions around their returns.

But creating returns rules won’t be as straightforward for other retailers, who don’t have the same resources or access to returns data. Many ecommerce merchants are still blindly putting return labels in outbound orders and lack a basic digital returns portal required to collect simple returns data at scale. But collecting the data necessary to implement intelligent returns rules and charges requires more than just a returns portal – it needs a fully integrated solution that incorporates order information to better track what is being returned, by whom, and why. Only then can retailers identify their edge cases and make smart rules based on these results.

Intelligent returns rules can also be useful for more than just deciding when to charge for a return. For example, by identifying the item type and date, a fully integrated returns solution can restrict items from specific categories, e.g. underwear, from being returned – or reject items returned after a set return window. In addition, retailers can configure rules to change the shipping location for specific items, to charge for certain categories of returns, to allow for damaged items to automatically be directed straight to a repair centre or for fast-selling items to be sent back for restock and resale immediately.

For small and mid-size retailers to get smarter about returns and increase their profitability, they need access to an integrated returns solution. This is where carriers have a major opportunity.

The returns opportunity for carriers

Solving the returns crisis isn’t about deciding between free or paid returns. It’s about controlling costs and putting more intelligence in place to recover costs for the most inefficient cases, without negatively impacting the vast majority of shoppers. To achieve this, merchants need returns solutions that capture data and allow them to make rules to control their unprofitable edge cases and reduce returns costs.

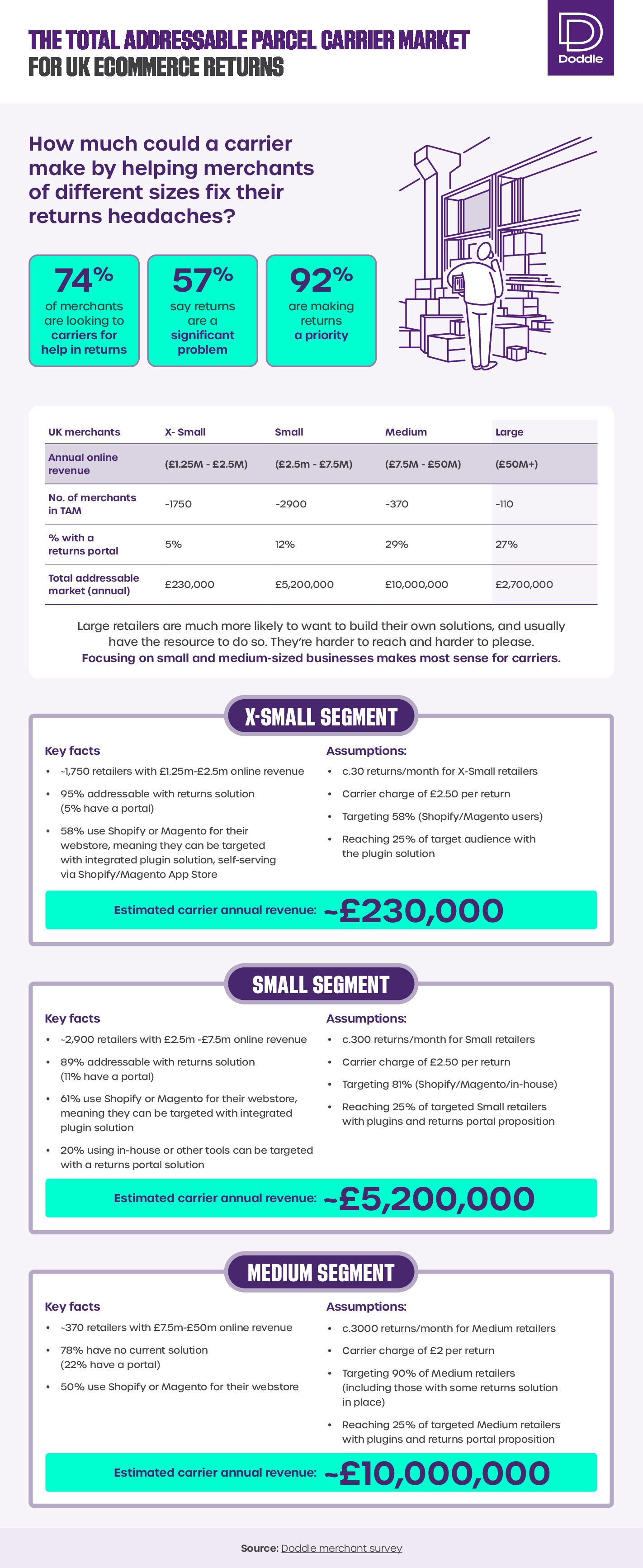

Doddle research from 2022 indicated that 74% of retailers without a returns solution would consider using one if their parcel carrier offered them one. So, if carriers can provide their customers a digital returns offering, they stand to strengthen their overall value proposition and form stronger partnerships with existing retail partners. At the same time, carriers will also capture a greater share of small and mid-size ecommerce merchants’ returns volumes, potentially adding millions in parcel revenue – as our infographic below highlights.

The best part? Carriers don’t even need to spend the time and resources developing a merchant-oriented returns proposition internally. At Doddle, we’ve built, tested and deployed a proven solution used by thousands of retailers worldwide through our partnerships with leading carriers and postal operators. Get in touch to learn more.

Related articles

How 3PLs Can Cut Costs, Reduce Waste and Boost Revenue With Smart Returns Management

3PLs should take advantage of returns to help reduce cost, efficiently manage warehouse resources, and aid growth.

Saving profits and the planet: 4 ways to sustainable & cost-effective returns

Returns drain profits and damage sustainability. Luckily, retailers can implement both cost-effective and sustainable returns using these 4 ways.

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.