Insight / Blog

5 changes we predict in ecommerce delivery & returns 2023

Summary: We check last year's predictions and forecast more changes in the first and last mile for 2023.

Watch our FREE webinar on changing consumer behaviour

As is tradition here at Doddle, we’re ringing in the new year by forecasting what the future holds for last mile delivery and returns. True to form, we’re also going to review what we wrote last year and grade our powers of prediction. Hindsight may be 20:20, but it turns out foresight is closer to 50:50.

Marking 2022’s predictions

1. 2022 provides a reckoning for eCommerce – 9/10

Expect to see many more ecommerce retailers suffering bad quarters, halves or years – and a few more rescues or acquisitions before the end of ’22. Returns will be a big factor in the apparel space especially.

At some point, ecommerce businesses are going to have to become sustainable without a boom market buoying them up. This could be that year.

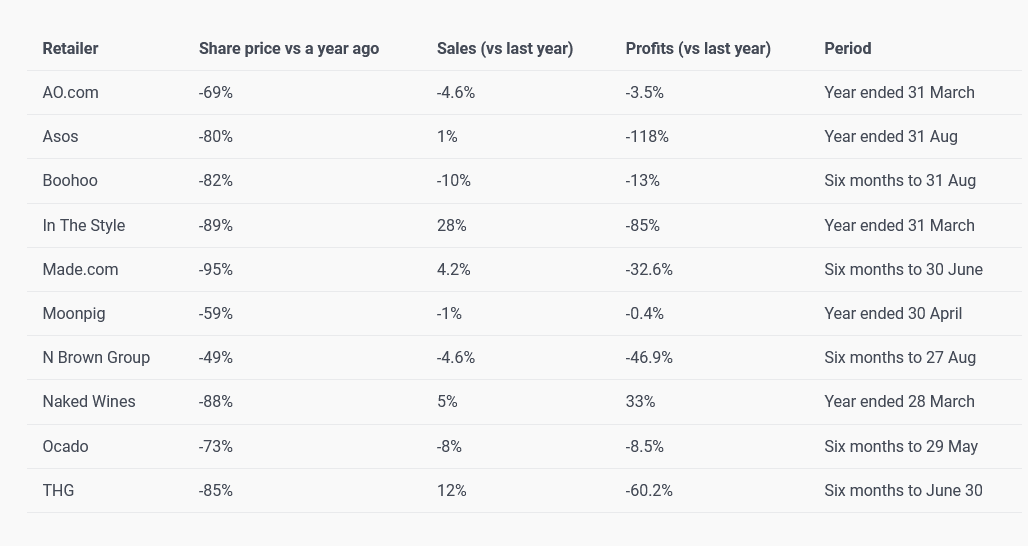

Reading this today, it doesn’t feel like a wildly bold prediction, but it is worth calling out that the ecommerce players were having the time of their lives at the end of 2021. The like of Zalando and Amazon had their all-time share price highs in November 2021. For their 2022 State of Fashion report, McKinsey surveyed fashion business leaders and found that “91 percent of executives predicted market conditions [for that year] would improve or remain the same” heading into 2022. But then Icarus got a bit close to the sun. Share prices crashed, sales wavered, and profits fell off a cliff.

(Table from Charged Retail)

One thing we didn’t predict was that it was inflation that dominated the headlines around retail challenges. Regardless, supply chain issues remained hugely prevalent, and the reckoning of ecommerce has certainly kicked off.

2. Green new wheels, and the mountain they must climb – 8/10

We expect to see two major sustainability trends pick up pace. The first is reporting to have a clear picture of where emissions and environmental harm is coming from, the second is fleet electrification. The future of delivery vehicles is clearly electric, and by 2023 more carriers will have localised electric-only fleets, a la DPD’s London depot, to meet urbanites’ desire for eco-friendly deliveries.

You couldn’t move in 2022 for announcements about new electric vehicle purchases, or about new depots opening up to serve cities staffed exclusively with electric vans. Whether it’s DPD serving 10 UK cities with electric fleets, bpost using electric vehicles in ecozones in Mechelen and Leuven, USPS committing to 40% of its new fleet being electric, Royal Mail scaling from 100 vans to 5,000 EVs; it’s clear that this was the tipping point for EV expansion.

As regards reporting, UK carrier Evri chose 2022 as the first year to produce an ESG report, and more carriers than ever are releasing dedicated sustainability reports. The quality of these reports varies significantly, and ultimately many carriers are still marking their own homework. Picking two different carriers still often reveals two different approaches to emissions measurements.

Why the last mile is less sustainable than ever, and what we can do about it

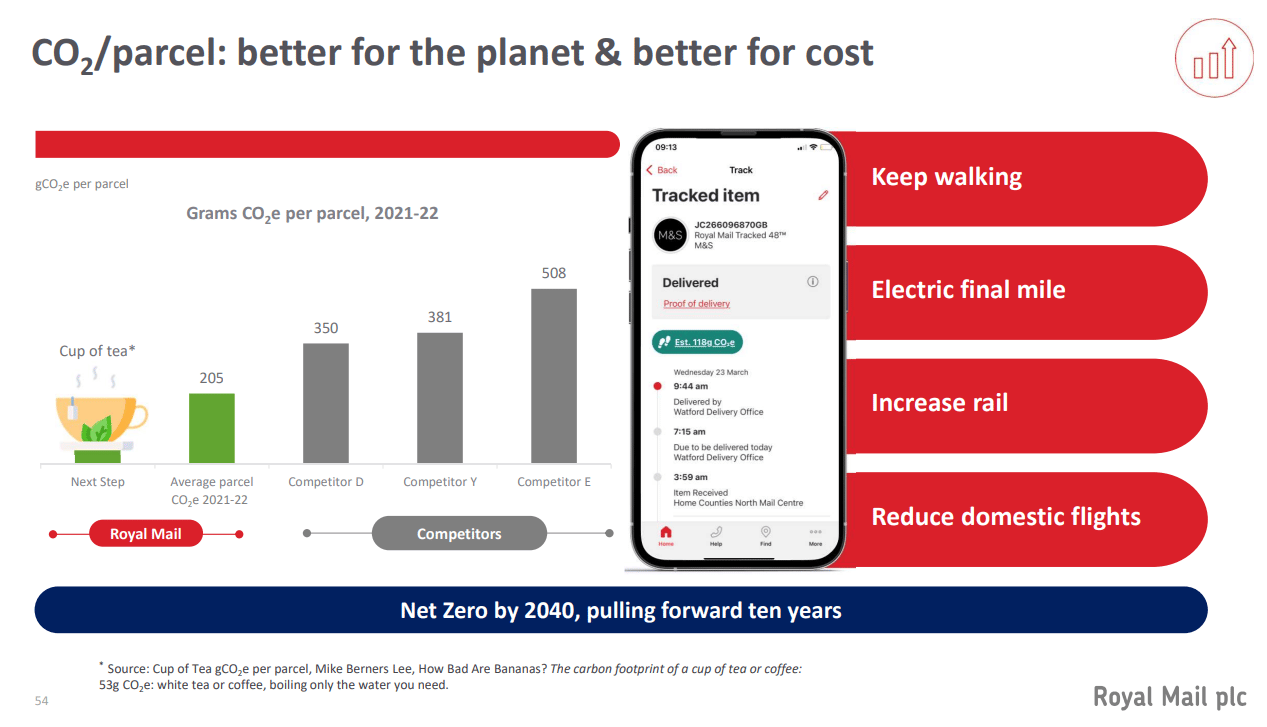

In some cases, carriers even grade each other’s emissions footprint, as in this tastefully anonymised example from Royal Mail. While there are no prizes for guessing the identities of D, Y or E, it would be interesting to know what data Royal Mail is using to assign these emissions values to its competitors, because these figures don’t match the publicly available sustainability reports of those businesses.

Evri, for example, says that it’s “the best dedicated parcel carrier in the industry” when it comes to gCO2e per parcel – neatly excluding Royal Mail from the comparison – and refers to “Scope 1 and 2” emissions to make that case. With a lot of reporting comes a lot of massaging the numbers.

3. Out of home, sweet home – 3/10

We believe in 2022, carriers will for the first time exert industry-wide pressure on retailers and shoppers to try to divert more volume through their OOH networks. They’ll aim to reach consumers by emphasising the increased flexibility of OOH and the opportunity to avoid missed deliveries – especially as spring and summer bring a little relief from the pandemic once more. They’ll target retailers to promote OOH at the checkout, improving conversion with a wider array of delivery options, and potentially incentivising them with pricing discounts too.

This trend is more like an oil tanker changing direction than a car doing a handbrake turn.

And for the most part, we’ll fall on the sword of wishful predictions, again. Our research and others (Australia Post, InPost, bpost) has been building a better case than ever for doing just this, showing that merchants can seriously benefit from offering OOH on their checkouts and drive better consumer experiences. Sadly it has yet to become a mainstream drive.

The biggest changes we saw in the UK came from Evri, who in 2022 started adding sustainability-focused messaging promoting OOH delivery into their customer comms, and bpost, who put out some great ads promoting their out-of-home delivery options.

4. Recommerce establishes new delivery and return behaviour – 7/10

Carriers will start catering to “micro-merchant” needs in their OOH offerings with label printing and send support.

Consumer-to-consumer ecommerce has seemed impervious to the challenges which plagued the B2C model, and several carriers with a major focus on OOH delivery and returns have recognised how important PUDOs and post offices are to this segment.

That has led to businesses like InPost launching locker-to-locker delivery options for C2C sends, which proved immensely popular: within 2 months of launch, 45% of users had already repeated their usage, and 25% had used the service three times or more. This uptake is likely increased by InPost’s existing partnerships with Vinted and eBay, but the demand was unexpectedly strong, causing the carrier to impose a volume cap to maintain service levels.

Other carriers have adapted their OOH setups to better serve C2C sends – for example, Evri PUDO locations now almost all offer self-service label printing, and it has partnered with the Post Office to offer parcel sends across the UK, the first non-Royal Mail carrier to offer such a service in the Post Office network in nearly 500 years!

5. And just for fun – Another bite, this time from the Apple – 0/10

We predict Apple will incorporate multiple shipping addresses and delivery options into Apple Pay, allowing retailers who integrate it into their checkouts to offer a one-tap buy button on mobile.

While both Apple Pay and Shop Pay (as called out in predictions gone by) are very prevalent on ecommerce checkouts, neither have yet been convinced that massive value exists in adding in delivery options beyond home delivery. Nor have they looked to build an intelligent system of delivery preferences based on previous delivery and purchase data, an opportunity that few businesses have, and which (we think) could be hugely valuable.

In the world of checkouts, retailers still want consumers doing as little thinking as possible, because they believe it leads to higher conversion, even if a little more thought and a few more options might improve their experience and lifetime value.

2023 Predictions

1. Logistics giants reach down to the consumer

Whilst 2022 was a challenging year in ecommerce, to say the least, one sector seemed the weather the storm better than most – the freight sector. Maersk, CEVA, Kuehne & Nagel, CMA-CGM and other mega-multinationals in this space all seemed to thrive in a world where the term ‘supply chain’ was once again on everyone’s lips.

We believe that’s set to continue in 2023 with the biggest shipping, transport, freight, and general logistics businesses in the world moving ever closer to their raison d’être: the consumer. As part of this, we‘ll see many more acquisitions in the space, with these behemoths snapping up both last-mile carriers and growth tech companies at bargain prices in a market where equity is harder to come by. That will enable some to become truly end-to-end, from factory floor to doorstep, around the world.

2. Cities take control

In Paris and in cities across Belgium, we’ve now seen how local regulation and focused activity on a city-by-city basis can transform last mile delivery, and it feels like there is an emerging blueprint for success. With advisory groups like the Centre for London also recently publishing reports on the subject, we see 2023 as a year when many cities around the world look to transform their infrastructure, forcing carriers to adapt and collaborate with authorities to get parcels into the hands of consumers.

This February, Barcelona will vote on a proposal to tax 1.25% of merchant profit for those with revenue of more than €1 million in the city who “use public space to deliver products purchased online”, citing congestion and pollution concerns. Crucially, deliveries to collection points will not be made to pay this fee. In effect, the city council is pricing back in the negative externalities of home deliveries. It will be fascinating to watch whether or not this change is passed on to consumers, how merchants respond, and how carriers are forced to adapt.

Elsewhere, look for the creation or extension of low or no-emissions zones, congestion charges, time-based restrictions on deliveries, and other disruptive impacts against carriers’ default practices.

3. Returns get rationalised

Whilst returns have long been talked about in ecommerce, their fundamental impact on the overall viability of the ecommerce delivery model in sectors like fast fashion has oft been overlooked, with people focusing instead on the shiny lights of growth. In 2022, that growth stalled or fully reversed, and the focus on returns has really intensified.

That shows little sign of letting up in 2023, with consumers likely to be tighter with how they spend their money in many countries, which will lead to increased propensity to return online purchases they don’t deem worth the expenditure.

To help combat the impact of returns on merchants in an inflationary market where growth is harder to come by, we expect to see more carriers offer a consolidated returns service in 2023. The idea of ‘consolidated returns’ is that merchants pay a lower fee to get slower returns in bulk, rather than paying a per parcel rate, which is traditionally the case. Amazon has been quietly pioneering this model for many years, and FedEx announced a new consolidated returns offer in December 2022. We expect ‘consolidated returns’ to become much more commonplace in 2023.

On the merchant front, more and more retailers are implementing returns charges and fees as the turn away from free returns continues. One holdout has been ASOS, which as late as Q2 2022 insisted it would not charge for returns as a matter of principle. By the end of the year, we think ASOS will be charging for at least some of its returns, by some of its customers, some of the time. A smart, truly digital business with a great capacity to understand its customer’s behaviour, ASOS will recognise that not only can it afford to charge for some returns – it actually might not be good business sense to make every return for ever customer free forever.

4. Delivery management becomes a consumer product

Carrier management systems are now commonplace for ecommerce merchants who just want the best rate for any given delivery. In 2023, we expect to see more consumer-focused solutions land in the market to help frequent ecommerce buyers navigate the maze of email confirmations and tracking pages to find when that thing they bought the other day will arrive.

This has started already – Klarna’s app can now scrape Outlook and Gmail accounts for confirmation emails to consolidate delivery information in one place. Google is working on a similar feature for Gmail, and Shopify’s imaginatively named “Shop” app does the same for Shopify-based orders.

Now that interest rates are well above zero and the flood of venture capital has consequently slowed to a trickle, those businesses who’ve raised at aggressive valuations in the past couple of years are challenged to justify the numbers. We expect consolidation in the post-purchase/returns/consumer-facing order management space, with mergers and acquisitions, including potentially a major carrier acquiring a provider to accelerate their own digital transformation.

For those carriers who don’t buy or partner for a solution, the impetus will be to build one quickly or risk losing the consumer relationship entirely.

5. The pre-eminent locker business leans into PUDO in the UK

In the UK, InPost is very much a returns and consumer sends business right now – you don’t typically see the option to deliver to its lockers on a merchant checkout. That goes against the incredibly successful blueprint it has followed in Poland, where the majority of volume is outbound delivery. To transform its model in the UK and achieve the attractive margins the Polish business churns out year after year, InPost needs to capture more of the (much larger) outbound shipping market. To do this, it will need 2 things: national coverage, and end-to-end logistics. We predict a big move on both fronts.

Watch our full webinar below to learn what drives consumer behaviour.

We’ll be back again at the start of next year to see how well or poorly this round of predictions ages, but if you’re interested in reading or watching more from Doddle, you can sign up for our newsletter at the bottom of this page – it’s a monthly roundup of our most interesting work, and the most insightful logistics and ecommerce stories from the web.

You can also get in touch with us if you’d like to let us know what you think of our predictive capabilities, or if you’re looking for technology and expertise to help you with last-mile delivery and returns.

Related articles

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?