Insight / Blog

Can carriers sustain record growth?

Summary: The past two years have seen an incredible rise in parcel volume – but what will happen as the pandemic’s influence on ecommerce recedes?

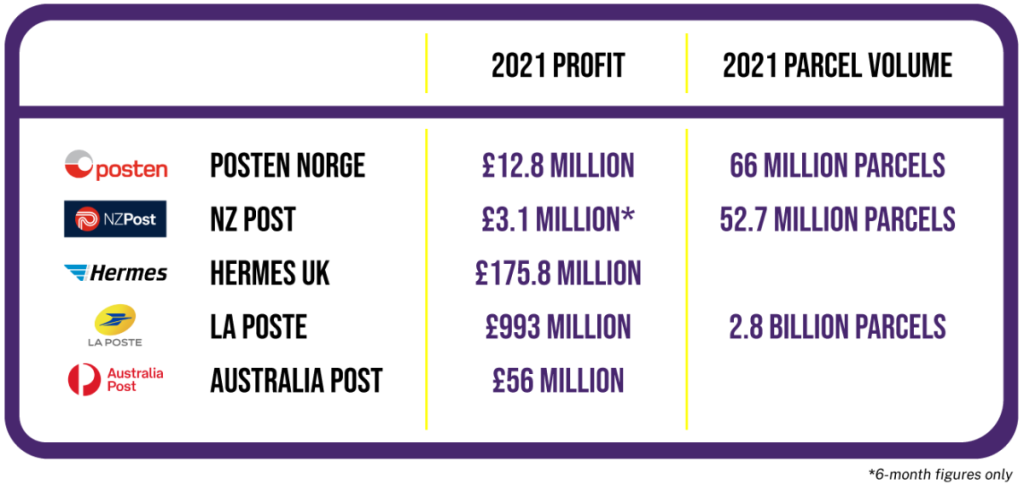

The challenges unique to scaling during a pandemic have not stopped many carriers worldwide from reporting record-breaking net profits for 2021, with incredible volume growth over the past two years outweighing operational pains.

But the question now has to be asked: what will happen as the pandemic’s influence on ecommerce recedes? Can parcel carriers and posts sustain their success?

The boom years

There’s been one consistent driving factor in carrier growth: the ecommerce boom. The pandemic drove many people to do much more online shopping, increasing ecommerce sales and generating more parcel volume for carriers.

In the UK alone, carriers shipped 4.1 billion parcels in 2020-2021, increasing over 1.3 billion from the previous year. La Poste’s carrier brands (DPD and Chronopost) sent 2.8 billion packages in 2021, up 10.7% on its already record-breaking 2020.

There’s now some evidence that the increased ecommerce participation that has driven these vast increases in volume is now falling back. According to ONS data, UK ecommerce sales in January 2022 are 20% down from the previous year, where a lockdown was in force. As pandemic restrictions continue to ease worldwide, we could see ecommerce sales losing steam against rejuvenated store retail and a challenging macro-economic climate. Some of the effects are already visible in the share prices of former ecommerce high-flyers, such as Boohoo, who are suffering because the market does not believe in their continued growth.

Whether ecommerce growth rates stabilise or sink to pre-pandemic levels, one fact remains true. Parcel carriers must look for ways to become more than passive riders of market forces. They need to actively secure their growth by providing competitive ecommerce solutions as the landscape changes around them again.

Return to offices to increase failed deliveries

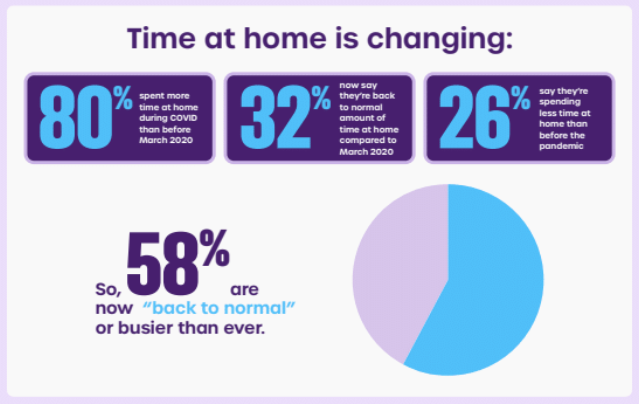

Our latest consumer behaviour report revealed that 58% of consumers are returning to pre-pandemic behaviours or are busier than ever before.

As consumers spend more time out of their homes, the number of failed deliveries will logically increase. Last year, just 6% of all online orders in the UK resulted in a failed delivery, but this is set to rise dramatically with a return to more time in the office. With each failed delivery costing an average of £11.60 per order which largely falls on the Carrier, this is a significant profitability challenge.

So how can Carriers tackle this?

The need for more flexible delivery options

If consumers are out of their homes more, they need access to more flexible delivery options and greater control of when and how their parcel is delivered. This presents a few possible solutions.

Firstly, more next-day delivery slots could be offered so that consumers can order to the address they know for sure they’ll be at, whether that’s at home or the office. However, this option is more difficult and costly to fulfil, and some consumers will prefer slower, less certain delivery slots if they are cheaper.

Secondly, carriers need to prioritise clear communication with consumers about when their parcel will be delivered and offer redirect/safe place options if they are not at home. DPD have shown that this can work well, but inflight redirects require enough time to implement the change of delivery destination, leaving consumers with relatively short windows to request changes and making routing more challenging for carriers.

Lastly, carriers can drive more traffic into their Out-of-home (OOH) networks for consumers to pick up at their leisure, whether at a parcel shop, a counter in a third-party store or from a locker. Increasing OOH volume also has major benefits for cost reduction and lower emissions. Most importantly for newly-busy shoppers in places with no pandemic restrictions, it’s ‘unattended’, meaning the consumer doesn’t need to be at home to accept delivery. They can pick up as and when they choose, giving them freedom over their order and reducing failed delivery rates.

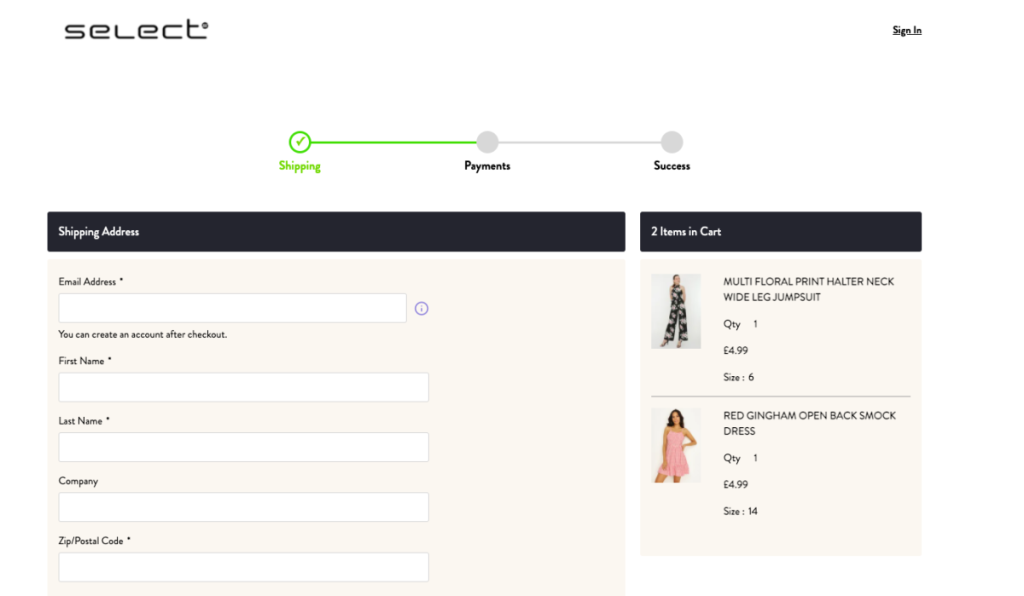

As our research has uncovered, 74% of shoppers plan to use Out-of-home in the future. The demand is there – but sadly, a huge number of checkout pages don’t offer OOH. Of those that do, the option is often buried until after the consumer has entered their home delivery information. Take Select as an example here. When a consumer clicks checkout, the first screen they’re presented with is a shipping address field. Collection in store is a shipping option for this retailer (and costs less than home delivery). But this option is located underneath the home address form, with no information above the fold that the form can be skipped in favour of collection.

If you compare that to the way the plethora of current payment options are surfaced, it’s chalk and cheese.

Rising returns also threaten ecommerce

Another area that could present a profitability challenge to Carriers is the growing levels of e-commerce returns. Returns are a major retail challenge. In our latest report, we discovered that 57% of merchants say returns are a significant problem – and that 94% of retailers are making better returns a priority for their business.

Returns are costing merchants, and current returns solutions aren’t doing enough to help. Regardless of the size, cost, or product type, most returns are all handled the same. This results in a heavy price for retailers, particularly when items cannot be resold.

When merchants suffer, carriers suffer. Without intelligent returns solutions, merchants will be more price-sensitive in contract negotiation and they’ll be limited in their growth.

Merchants need integrated solutions that look at what’s being returned at the start of the process. This way, the merchant can block returns outside the return window or for products that cannot be resold, meaning fewer resources are used manually checking and processing returns in warehouses.

By providing this software to merchants, carriers won’t just strengthen their merchant relationships. They’ll also help protect profitability, sustain growth and maintain their market share, particularly amongst a rise of 3rd party returns solution providers.

Carrier growth needs to be sustained through action

The tidal wave of growth that has swept carriers to success in ecommerce can’t last forever. Those who stay afloat in the long term will be those working closely with ecommerce merchants to help them succeed in ecommerce and harness mutual growth even in tougher market conditions. Succeeding in a more challenging market will differentiate winners, and they’ll be primed to capture the lion’s share of future ecommerce growth, as and when that comes.

Want to talk to our team about your strategy for Out-of-home or Returns? Get in touch today.

Related articles

How 3PLs Can Cut Costs, Reduce Waste and Boost Revenue With Smart Returns Management

3PLs should take advantage of returns to help reduce cost, efficiently manage warehouse resources, and aid growth.

Saving profits and the planet: 4 ways to sustainable & cost-effective returns

Returns drain profits and damage sustainability. Luckily, retailers can implement both cost-effective and sustainable returns using these 4 ways.

Speedy refunds: creating happy customers through fast & effective returns

Find out how speedy refunds can recapture revenue, increase customer loyalty and boost lifetime value.