Insight / Blog

2023 ecommerce heads towards optimisation of returns and delivery

Summary: 2023 has seen small adjustments to delivery & returns - driving a major shift in the ecommerce business model from growth to profitability.

After a non-stop boom in ecommerce growth since the Global Financial Crisis in 2008, we suggested that ecommerce may be in for a rude awakening last year. Although the Covid crisis gave ecommerce a shot of adrenalin that held off the inevitable, the reckoning is truly underway in 2023. It’s being felt across the spectrum – from ecommerce pioneers like ASOS, Boohoo or THG, to newer challenger businesses like Revolution Beauty, Everything5pounds, and I Saw It First.

Our belief – that unlimited free delivery and returns is not sustainable – has been proven right this year. Many of the major players in ecommerce have woken up to how pivotal their last mile & returns strategies are to overall profitability.

Despite the staggering share price declines – ASOS is now 423p per share, from an all-time high of over 7,000p – and the disappearance of some popular brands, we are optimistic about the future. Hidden behind the headlines is a sense of progress, a recognition of the realities of ecommerce. In our world, this progress is most visible in a massive acceleration of the changes that retailers are making to their delivery & returns propositions.

This is not new, but 2023 has seen a step change in constant optimisations to things like dynamic delivery pricing, basket thresholds, and returns options. These are small adjustments and tweaks to the overall propositions that each, in themselves, don’t have a huge impact. But cumulatively, over time, they will add up to major shifts in the unit economics that drive the long-term sustainability of the overall ecommerce business model.

Let’s look at some examples of those optimisations:

2023 so far…

We’d love to list every update over the first half of 2023, but that would be a long and dull list. Instead, we’ve looked at the evidence, connected the dots and collated them into small snapshot views of the market for you.

These are the main ways that optimisations in delivery and returns have manifested in 2023 so far.

Free shipping thresholds have increased

One of the most obvious examples of an optimisation is to increase free shipping thresholds. As reported by Wall Street Journal, Macy’s, Saks Fifth Avenue, Neiman Marcus and Abercrombie & Fitch are among the leading US retailers that have increased free shipping thresholds during 2023. On average, the minimum order threshold for retailers to offer free shipping rose to $64 this year from $52 in 2019, based on a sample set of 48 retailers.

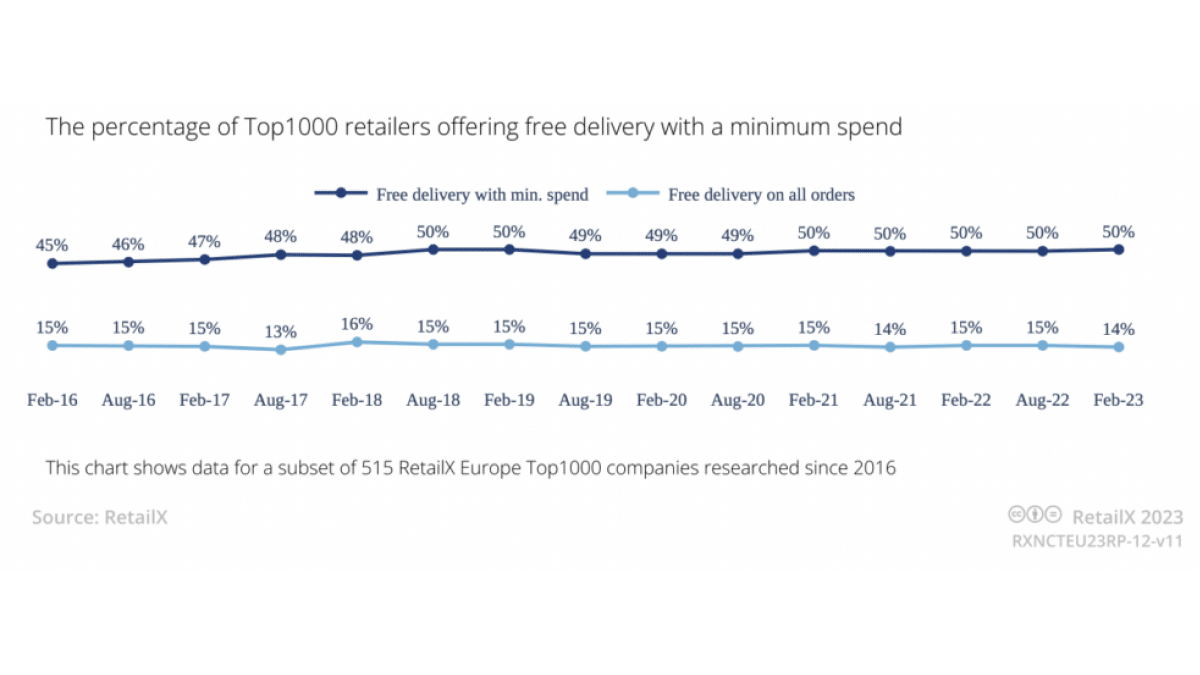

Whilst this 23% change (from $52 to $64) might not seem ‘seismic’, it should be compared against a backdrop of inertia and activity in this space. In the below study by RetailX you can see how little focus and attention has been placed on optimisation in delivery thresholds historically:

Elsewhere, ASOS also increased its minimum spend from £10 to £15 for its Premier members to unlock free delivery (we’ve predicted that changes to its returns policy will follow) and a European study of the top 1000 retailers also found that the average spend to qualify for free delivery has increased by 98c to €72.30 since last year.

More nails in the free returns coffin

Late last year, Zara and Boohoo made headlines by charging for returns. This year, more retailers are following suit, including THG (which owns brands including Lookfantasic, MyProtein and Glossybox) as well as H&M, J. Crew, Kohl’s, Uniqlo, Anthropologie & Neiman Marcus in the US.

Historically, charging for returns would have been seen as sacrilege. The gospel rule was that returns must be free to attract and retain consumers. In a 2021 survey, Klarna posted that 84% of online shoppers agree they’re more likely to buy from and 86% are more likely to come back to online merchants who offer free returns, and 75% said that they would buy more over time if free returns were offered.

Paid returns could act as a deterrent to growth. Yet, research by ZigZag shows that consumers are still buying (and returning) from these retailers. Compared to last year, paid returns increased by 122%, making over one-third (35%) of all returns made. CEO Al Gerrie states:

“To see that paid returns have not hampered retail sales is also a positive sign and I expect to see more retailers looking to introduce paid returns and free returns to be used as an incentive or loyalty offer.”

As the year goes on, we’re likely to see more retailers implementing paid returns in some capacity. Preferably, retailers won’t just implement a blanket cost for returns, but instead implement smarter rules that target problematic returners by using consumer data, item type, and return reasons to calculate when consumers need to pay for returns, similar to Amazon.

Retailers getting smarter on in-store returns

New Look is trialling a £1.99 return fee on online orders for postal returns, with returns in-store remaining free. It’s the same tactic used by Next, which we covered in more detail last year when they proposed to keep 195 profit-loss-making stores open to fulfil ecommerce demand. As a result, 80% of Next’s returns are handled in-store, despite 65% of its sales being digital.

This seems like a total no-brainer for merchants. It reduces shipping costs and allows them to either re-stock items in-store or use a consolidated shipping option to return items to a distribution centre. But more importantly, this omnichannel strategy helps to channel consumers in-store, where they are most likely to buy another item – creating an opportunity to recapture lost revenue.

Final sale items are on the rise

Final sale items (sold without a possibility of return and usually associated with clearance stock) have increased in the US. The second-hand clothing website Poshmark reported a 61% rise in garments marked “new with tags” and featuring the words “final sale” in the description since 2022.

Other online retailers have followed suit, such as AYR, which has created a dedicated final sale section within the main header of its website. It’s certainly one way to limit returns, but something that cannot be replicated across Europe due to EU regulations, which state that a 14-day period for returns must be offered for all items sold online.

Alternative delivery options continue to grow

Home deliveries are relatively expensive for retailers and their logistics partners, compared to the reduced costs of consolidated deliveries in OOH locations. Where those cost savings are passed on to retailers, we’re seeing increased adoption and prioritisation of out-of-home (OOH) delivery options.

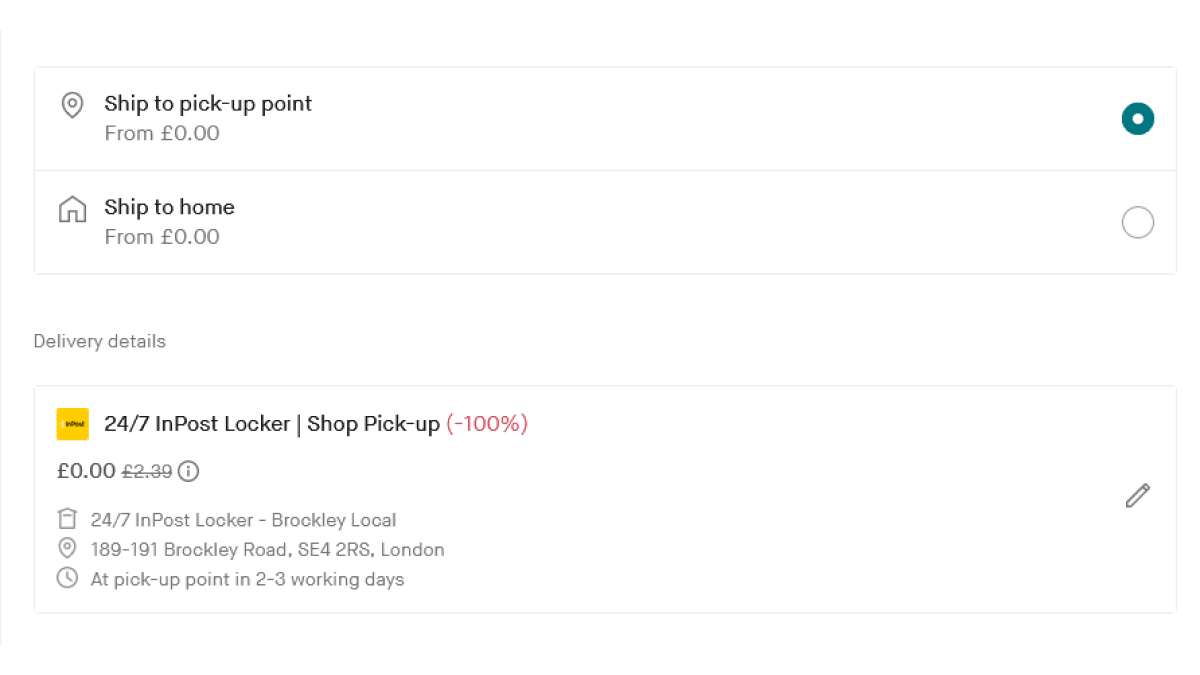

One major example is Vinted, the recommerce site operating across 16 markets in Europe. At the beginning of August, Vinted announced an expansion to its InPost partnership, allowing members to collect parcels over the counter via participating InPost shops. This comes after the company launched VintedGo in 2022, which after a successful Paris trial saw over 200 locker locations to facilitate sends and collections from the Vinted platform.

Vinted has also been optimising its checkout and product pages to incentivise consumers to select out-of-home delivery options, offering promotional free delivery for new customers (only on OOH deliveries). Pickup point deliveries are also pre-selected on the checkout as the default option. With a relatively simple set of nudges like these, Vinted says that 73% of its customers now have their items delivered to a pickup point.

Small actions, big strategic changes

The above optimisations are small nudges and actions. But the constant stream of these tweaks to delivery and returns shows a big shift in ecommerce thinking and strategy.

Previously customers free delivery and returns were seen as prerequisites, dogmatically adhered to. To grow and attract consumers, you had to offer fast, free home delivery and free returns – all at incredible cost to the retailer. As ecommerce switches from a focus on growth to a profitability-first approach, retailers are rethinking these ‘foundations’. They’re changing the rules, or removing them altogether.

The defining characteristics of ecommerce profitability are rooted in delivery and returns. It’s about how you charge for delivery, how you get the parcel to the customer, whether they return it and how returns are processed. In all these aspects, carriers have a key role in shaping and providing solutions.

For example, carriers can provide easy checkout integrations highlighting OOH delivery options, or digital returns solutions that identify and target consumers who are costing retailers the most with problematic returns behaviours, such as serial or fraudulent returning. And, more importantly, to help retailers implement strategies to tackle the problem, including automatic rules that:

-

Charge certain consumers for returns if based on past returns or reason code

-

Prohibit returns outside of warranty or outside the returns window

-

Issue return-less refunds for items that cannot be sold or cost too much to ship back into stock.

By helping retailers become more profitable, carriers become more valuable ecommerce partners, boosting loyalty and retention, and ultimately increasing parcel volume.

Related articles

Lessons from a decade in the first and last mile

A decade as Doddle taught us some lessons - and Blue Yonder helps us see what will matter in the next decade.

Parcel lockers vs parcel kiosks: which is best for parcel drop-off?

We explore the benefits and drawbacks of parcel lockers and kiosks to help decide the best self-service solutions.

What do out-of-home networks look like in the UK?

We dive into the biggest logistics operators and their current OOH networks in the UK