Insight / Blog

What 3PLs can learn about returns following GXO’s acquisition of Clipper

Summary: GXO holds a powerful position against its 3PL competition to offer end-to-end services to address the retail returns crisis.

Third-party logistics (3PL) business GXO has recently agreed to a cash and share acquisition of Clipper for $1.3 billion. This is an intelligent investment for GXO, which is able to take advantage of Clipper’s home and store delivery services to a range of high-profile retail clients, including ASOS, John Lewis and H&M.

The acquisition, therefore, gives GXO instant access to a physical fleet to expand its value proposition, increases its warehousing capacity, and grants it a greater share of the UK 3PL market.

Those are great benefits of the service, but a key part of the acquisition allows GXO to gain access to Clipper’s returns management system to facilitate reverse logistics at an advanced and detailed level. In the not-too-distant future, this frees GXO from relying on other carriers to provide the consumer-facing returns portal and services and places the company in an incredibly powerful position against its 3PL competition to offer intuitive end-to-end services during the current retailer return crisis.

Retailers are facing a rising returns problem

Rising return rates are hitting retailers hard, reaching 40% for certain fashion retailers. In a survey for Doddle, 52% of European retailers said returns were increasing. From recent headlines, such as Boohoo’s profits sinking by 94% to £7.8 million as consumers return clothes at a faster rate than before the pandemic, or Missguided falling into administration before being rescued and bought by Frasers Group, it’s clear to see that returns are at a crisis point for retailers.

Amongst the returns crisis, Zara has implemented a £1.95 charge for returns (unless returned in-store). This has sparked debate amongst retailers, with some considering taking the same path. However, ASOS has taken a firm stance against charged returns, stating: “Free returns are a core part of the ASOS offer, and there are no plans to change this approach.” However, it may only be a matter of time before ASOS start charging for returns…

ASOS hasn’t been immune to the damage caused by returns, as the company’s share price dropped by 15% to a twelve-year-low of 987.5p, despite the huge growth in sales over the last few years. Despite this, the fashion giant continues to emphasise the value of free returns to consumers, as recent research shows that 78% of customers are more likely to purchase from a brand offering free returns.

Free returns make retailers more compelling to shoppers, but that comes at a cost which many can’t afford forever as the volume of returns continues to rise. The solution isn’t to issue a blanket charge for all consumers but to analyse returns on an individual basis, based on the item type, reason for returning and the individual customer themselves. It’s the model that Amazon operates, and like much of their ecommerce strategy, it’s paying off.

This is where 3PLs have an opportunity to step in: retailers need solutions that can analyse and process returns individually but don’t have the technical resources, time, or expertise available to build them.

3PLs stand to profit from smarter returns

The 3PL market has exploded over the last few years, particularly within the UK, where they have been named the leading occupier of warehouses after an astounding growth rate of 42% over the previous six years.

For 3PLs, reverse logistics represents a path for continuing this growth by making return solutions easier for retailers. With the right solutions, 3PLs will be able to improve efficiency, reduce cost per return and secure better deals with retailers by addressing one of their top priorities: the impact of ecommerce returns.

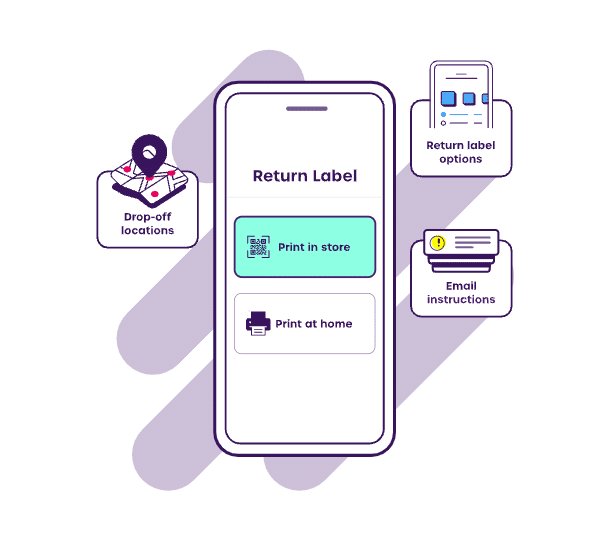

One key to addressing the returns crisis is data collection. Digital returns portals, where consumers select which items to return and pick a reason for why they’re doing so, are the mechanism through which reverse logistics providers can capture pre-sort data. This gives the provider more accurate insights about what is being returned and why before it arrives at the sortation centre, improving efficiency and reducing the cost of returns processing.

Those insights are immensely helpful to the retailer too, who can use them to start reducing returns at source, for example by altering designs to prevent common flaws, or by adding better product information to their sites. It’s the move that the market-leading parcel carriers are now taking, and where our partnerships with Australia Post, Yamato and Inmar Intelligence are really starting to add value to their retail customers.

Clipper’s platform, therefore, represents a massive benefit to GXO, which now does not need to build that consumer-facing digital portal itself. However, to really make gains in reverse logistics, the next step for GXO is to develop or acquire an intelligence engine that can automate processing decisions based on rules configurable by the retailer.

For example, retailers could decide that:

-

Damaged or faulty items are sent to Warehouse A to test and repair.

-

Items available for reselling are sent directly to stores for restocking or repackaged for consumers.

-

Consumers who return most items could be charged for certain returns.

-

Items outside return windows or regulations are rejected.

-

Consumers can be issued refunds for low-value items without shipping the item back, where it would not be profitable to do so.

These rules are designed to save on shipping costs by introducing re-routing and supply chain management through crucial pre-sort data. Rather than delivering all returns into a sortation centre, an intelligent rules engine will give 3PLs more control over their returns process and increase their ability to acquire retailers with a significantly reduced cost per returned item.

Returns data is key

The key to tackling the returns crisis is through data which enables retailers and their logistics providers to reduce the amount of returns but also the (currently) unavoidable operational costs associated with every returned item. Getting that data requires retailers to use a digital consumer portal to understand what is being returned, why and by whom. An intelligent returns solution can then take over to route returns to the right locations and charge (or not charge) consumers, using a configurable set of rules around item value, item type (e.g. a 2-man collection) and reason for return to make that decision.

GXO’s acquisition of Clipper allowed the company to access and implement a part of this solution (the returns booking portal) for retailers, without having to build it internally. That puts them one step ahead of the competition and sets the bar for other 3PLs looking to compete in the reverse logistics market. The next step will be for a 3PL to move towards the intelligent and adaptable solution described above, which will unlock even more value for their current (and future) retailers who are facing a crisis in ecommerce returns.

Want to talk more about a digital reverse logistics solution which solves the operational nightmare of ecommerce returns? Get in touch with our team today.

Related articles

How 3PLs Can Cut Costs, Reduce Waste and Boost Revenue With Smart Returns Management

3PLs should take advantage of returns to help reduce cost, efficiently manage warehouse resources, and aid growth.

Saving profits and the planet: 4 ways to sustainable & cost-effective returns

Returns drain profits and damage sustainability. Luckily, retailers can implement both cost-effective and sustainable returns using these 4 ways.

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.