Insight / Blog

The impact of adding OOH to merchant checkouts

Summary: 77% of European merchants offer OOH delivery and are reaping the benefits, including increased KPIs of conversion, NPS and AOV.

Out-of-home (OOH) delivery offers posts and parcel carriers a way to reduce delivery costs and emissions by consolidating deliveries into local collection points that consumers can visit at a convenient time.

For carriers to realise these benefits, they need to direct more volume through out-of-home deliveries. But to drive awareness and adoption of OOH as an option to consumers, it needs to be made available on an online merchant’s checkout – if merchants don’t offer OOH as a delivery option, consumers can’t choose it. But to convince merchants to change their checkout – the critical aspect of the online buying journey – is not easy. So carriers need credible and compelling evidence that making such a change will improve their business.

To that end, we recently conducted research into European Out-of-Home Delivery Options, surveying retailers across the UK, France, Germany, Spain and Italy to learn which merchants are offering out-of-home (OOH) delivery; how they’re making it happen; whether it’s working for them; and what carrier partners need to provide to merchants to make their ecommerce checkouts more effective at converting and retaining customers.

We learned that out-of-home delivery comes with some major benefits to merchants, which carriers can and should be investigating and reporting on, to convince more of their customers to offer out-of-home delivery and drive more volume through this cost-effective and sustainable channel.

OOH integration across Europe

77% of our survey respondents offered out-of-home delivery at the checkout. This figure is great, and much higher than we’d expected – but if we’re to move on and increase OOH usage, it’s essential to understand the effect that offering OOH had on key performance indicators like conversion rate, average order value and net promoter score.

These are the key questions for any ecommerce merchant. At what rate do website visitors convert into shoppers, how much do they buy when they do convert, and would they recommend a friend to do the same? If OOH delivery can make an incremental improvement at these stages, more merchants who don’t offer OOH can be persuaded to do so, and those merchants who do offer it can be convinced to promote it.

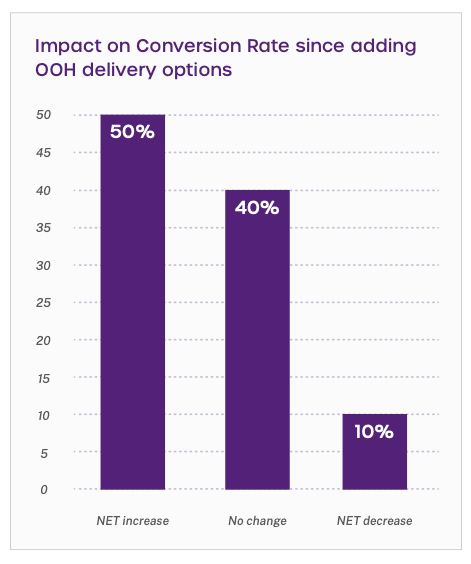

We asked merchants what change they had seen in these key performance indicators since adding out-of-home delivery to checkouts. This is what we found out.

50% of merchants increased conversion rate

50% of our merchant respondents said that they saw an increase in conversion rate since adding the out-of-home delivery options, with 20% saying they saw a significant increase. Just 10% said they saw a decrease, while 40% saw no change.

Insufficient delivery options are a leading contributor to basket abandonment, so it makes sense for the opposite to be true – i.e additional options will increase conversion (to a point, obviously). Beyond that, out-of-home deliveries cater to an important demographic of shoppers who cannot guarantee they’ll be at home to accept deliveries, particularly during the working day when many will be at their workplace. Giving them the confidence that they won’t miss their delivery should make them more likely to purchase in the first place.

However, with 10% of merchants seeing a decrease, it’s possible that a clunky integration of out-of-home options can clutter a checkout journey and / or confuse shoppers. Making sure that the integrations in no way obstruct a seamless customer journey is essential.

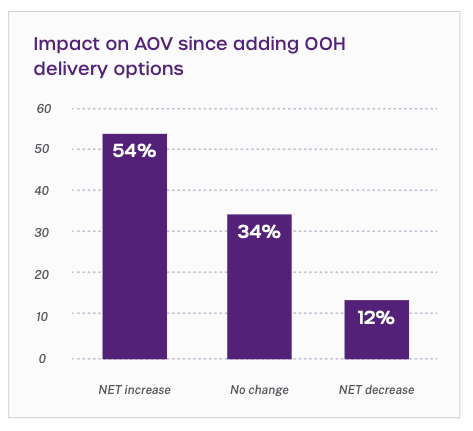

55% of merchants increased average order value

55% of merchants saw an increase in average order value since adding out-of-home delivery options to their checkouts. 12% saw a decrease, with 34% experiencing no change.

The impact on average order value appears to be slightly greater than for conversion rate, with most merchants experiencing an increase. The underlying logic is like the increased conversion rate – customers who are confident that their delivery will be available at a convenient time and place are liable to spend more.

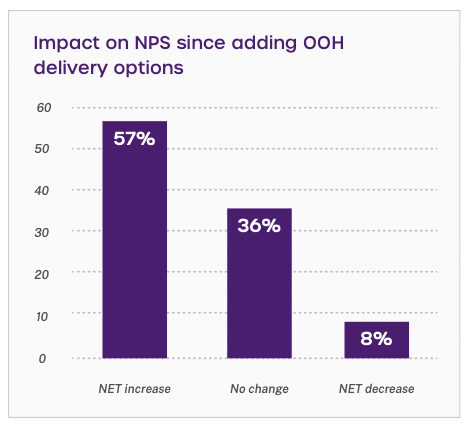

57% of merchants improved NPS scores

Net Promoter Scores (NPS) was the factor most likely to improve and least likely to be negatively affected following the introduction of out-of-home delivery options. 57% saw an improvement, and just 7% experienced a decline.

Full coverage on customer experience

Delivery is an underrated aspect of customer experience. That might sound strange given that a business like Amazon has made the delivery promise a cornerstone of its growth strategy. Still, delivery is an operational, functional part of the journey for many merchants. Thinking of it as the culmination of the shopping experience requires us to understand the impacts of failed deliveries, late deliveries, negative experiences, et cetera.

One of the most potent benefits of out-of-home delivery is that it escapes the familiar unpleasantries of a bad home delivery experience. There can be challenges (queueing at a post office or shop counter for a parcel isn’t ideal) but in working with customers, we’ve repeatedly seen out-of-home delivery achieving the highest Net Promoter Score of any delivery type. The psychological benefit of controlling when to pick up a parcel encourages customers to feel positive about the merchant.

We’ve witnessed this in action through our partnership with Australia Post. Since retailer OZ Hair & Beauty implemented OOH delivery options in its checkout, OZ’s overall NPS score has increased by an impressive 8%. Moreover, OOH delivery options provided the highest score compared to other delivery services and achieved a perfect 100 NPS score in July 2021.

Find more insights about out-of-home delivery and merchant checkouts in our research report: European Out-of-Home Delivery Options – An eCommerce Merchant Survey.

Want to discuss how we can bring your OOH network onto merchant checkouts? Talk to us.

Related articles

7 tactics to drive self-service parcel drop-off adoption

Focusing on parcel kiosks, we explore 7 tactics to encourage customer adoption and drive volume into out-of-home (OOH) delivery networks.

Convenient and sustainable: developing an out-of-home delivery strategy

Sustainability has become a key decision factor for retailers - here's how carriers can stay ahead with an out-of-home delivery strategy that’s both sustainable and convenient for consumers

5 Changes We Predict in eCommerce Delivery & Returns in 2024

Our predictions for 2024 in ecommerce delivery and returns, plus a roundup of our 2023 predictions.