Insight / Blog

2023 report reveals 11% YoY increase in merchants struggling with returns

Summary: We explore how the returns market, and merchant perceptions, have changed in the last year.

Our latest returns report analyses the European ecommerce returns market by size and region to understand the size of the opportunity, merchants’ current returns proposition and solution usage, and ultimately what they’re looking for from logistics partners.

As 2023’s survey questions remained the same as the 2022 edition, we now have a clear picture of how the returns market, and merchant perceptions, have changed in the last year.

63% of merchants say returns are a significant problem — up from 57% in 2022

One of the headline stats is that 63% of merchants said that returns are a significant or very significant problem, up 6 percentage points from 57% the previous year.

Breaking this down by merchant size, large merchants (those with between 100 and 500 employees) were most likely to be affected by returns issues, with 80% of large merchants stating that returns are a significant problem. This figure has risen sharply since the previous year, growing from 50% to 80%.

Among smaller retailers, the number of merchants who say returns are a significant problem has fallen slightly, going from 73% to 67% for businesses with 11–50 employees and from 61% to 59% for businesses with 50–100 employees. Similarly, the share of the biggest merchants (with 500+ employees) who reported returns as a significant or very significant problem was down from 48% in 2022 to 45% in 2023.

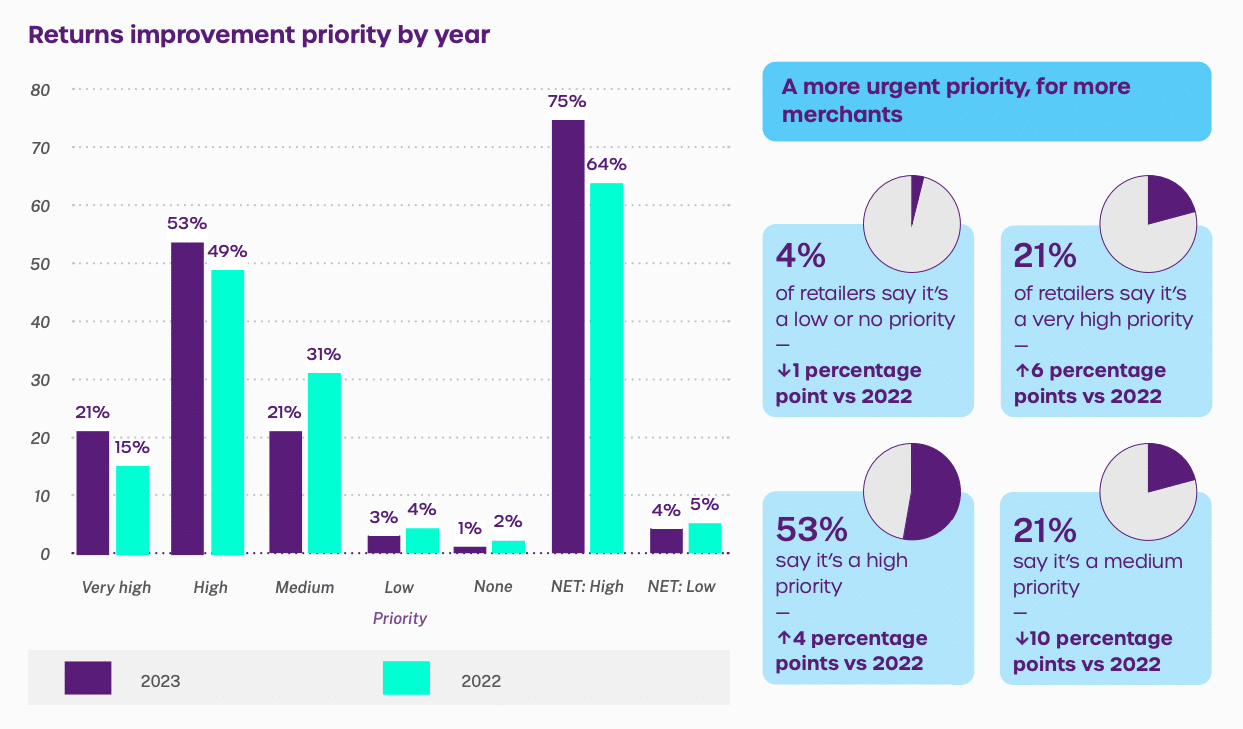

From last year, the merchants who said that returns were a ‘medium’ priority in 2022 have ramped up the urgency, with this segment dropping from nearly a third of merchants in 2022 (31%) to only a fifth (21%) in 2023. At the same time, the share of those rating returns as a ‘Very High’ or ‘High’ priority increased by 10%. The increasing return rates affecting bottom lines and growing concern over consumer spending habits and economic forecasts is likely to have had a big impact on this figure.

The past year has also seen major retailers move away from growth-oriented returns strategies into profitability models, with retailers increasing free shipping thresholds, moving away from free returns and driving more volume into in-store returns to recapture lost revenue.

Average return rates are up 5.5 pp since 2022

The average estimated return rate across all markets is 28.9%, up from 23.44% in 2022. This figure is backed up by two thirds (66%) of respondents reporting that the rate of returns they experience had increased in the last 12 months. In 2022, that figure was just over half (51%). This rise in the rate of returns might explain the increase in merchants identifying returns as a problem area, as well as the increase in priority given to improving returns.

The share of small (11-50 employees) merchants now seeing increased return rates has jumped from 53% to 79% since 2022. Mid–to–large retailers also saw a jump in the share of merchants experiencing growing returns problems, from 54% to 74%.

The largest merchants were the least affected by increasing return rates. These retailers may have borne the brunt of initial post-pandemic rises in return rates, which is now filtering down to impact smaller retailers as well. This strengthens the need for smaller retailers to implement returns tactics like targeting problematic returners by using consumer data, item type, and return reasons to calculate when consumers need to pay for returns, similar to what retail giants like Amazon have already begun.

More merchants are using integrated returns – but not enough

When asked what returns solutions merchants use, 39% said they are using integrated returns portals, up from 36% in 2022.

Integrated returns are digital returns portals that require customers to input an order number, tying the return to a record of purchase. This allows retailers to capture data about the return and associate it with shopper and purchase data, giving them more control and insight on returns. In addition, these portals enable increased profits through automatic rules, which can get in-demand items back in stock quicker, issue return-less refunds for low-value items, or prevent return policies from being abused (i.e. accepting returns outside of policy windows).

Although the number of merchants using integrated returns portals is on the rise, nearly two-thirds (64%) rely on returns systems that don’t offer the level of control or cost-savings that merchants need to tackle returns issues. The most common returns initiation method is to contact customer service, which is an expensive and time-consuming option for the retailer to offer, requiring manual support, and it’s a hassle for customers to boot.

For smaller retailers with limited resources to develop their own solutions, but with an existing relationship with a parcel carrier, a carrier-provided digital returns solution would seem an appropriate fit to help them solve their returns issues. Although the number of merchants using solutions provided by carriers has risen from 24% to 26%, it’s clear that carriers have not yet made significant inroads in this market.

Over a fifth (21%) of our merchants reported that their carrier/logistics provider didn’t offer any digital returns solution, and another 7% didn’t know. That means more than a quarter of the market is unaware of carrier solutions, whether because they’re not provided at all, or not being correctly marketed to merchants.

Last year, we emphasised the opportunity for carriers in this area by providing and promoting digital returns solutions to customers. In 2023, this opportunity has only become larger and more important.

77% of merchants are interested in carrier solutions

77% of merchants who don’t already use one say they’d be interested in using a digital returns solution provided by their logistics or delivery provider to manage ecommerce returns, up from 74% the previous year.

As the 2023 returns data shows, most merchants see returns as a significant problem for their business and are actively interested in carrier-provided solutions. By providing returns management solutions, carriers can secure growth, drive parcel volume and increase customer loyalty in one fell swoop.

Topics:

Related articles

How 3PLs Can Cut Costs, Reduce Waste and Boost Revenue With Smart Returns Management

3PLs should take advantage of returns to help reduce cost, efficiently manage warehouse resources, and aid growth.

Saving profits and the planet: 4 ways to sustainable & cost-effective returns

Returns drain profits and damage sustainability. Luckily, retailers can implement both cost-effective and sustainable returns using these 4 ways.

Speedy refunds: creating happy customers through fast & effective returns

Find out how speedy refunds can recapture revenue, increase customer loyalty and boost lifetime value.