Insight / Blog

Why paperless returns are just the tip of the ecommerce returns iceberg

If ‘convenience’ was a country, it would be the United States. It’s the home of all things easy, from Uber to Amazon to Google, and we are the global leader in obsessive customer experience improvement. Yet while sales appear to be nailed, there’s a really important part of the journey that has been lacking attention – returns. At present, only 2% of top US retailers are offering paperless ecommerce returns to their customers, meaning they have to print out a label and fill out a form, often even having to contact Customer Support to obtain a Return Authorisation.

In a land full of creative ways to serve customers better, this feels odd. It seems that up until now ecommerce returns have factored pretty low on the scale of priorities for retailers. This is particularly the case in long-established retail royalty, for whom brick and mortar has traditionally been their bread and butter. But that thinking is outdated and is already costing retailers more in the long run than it might seem to save in the short term.

When brick and mortar makes the rules

Many retailers have prioritised in-store returns as a primary channel for their ecommerce returns. That makes sense – stores are money-making machines designed to get your customers spending. If they’re there to make a return, they’re probably going to buy something else too. In-store purchasing makes ecommerce returns a great strategy for retailers to recover revenue.

The biggest issue for retailers is that the in-store returns experience is not replicated in other returns channels. Outside of the store, you need technology and investment to create a customer journey that can effectively process a return with minimum hassle to the consumer and minimal cost to the retailer and tempt the customer into spending with the retailer again.

Cost vs CX

Retailers have often applied a different logic to ecommerce. Here, returns are siloed and represent a cost centre, rather than an opportunity. That has forestalled investment, and indeed in some cases retailers will candidly admit that they are trying to discourage returns from ecommerce, rather than enabling a convenient process for customers.

However, the ecommerce tide was already slowly coming in when Covid-19 arrived, and it is swiftly becoming a tsunami. Retailers have seen online sales reaching levels usually reserved for Black Friday weekends, and with it, a higher volume of returns.

This has meant that many are seriously working to replicate the in-store sales-return-sales ecosystem in their ecommerce offering, erasing the mindset of returns being a logistics task and replacing it with connected thinking that builds the returns journey into marketing and CX.

Turning quiet costs into bottom line opportunities

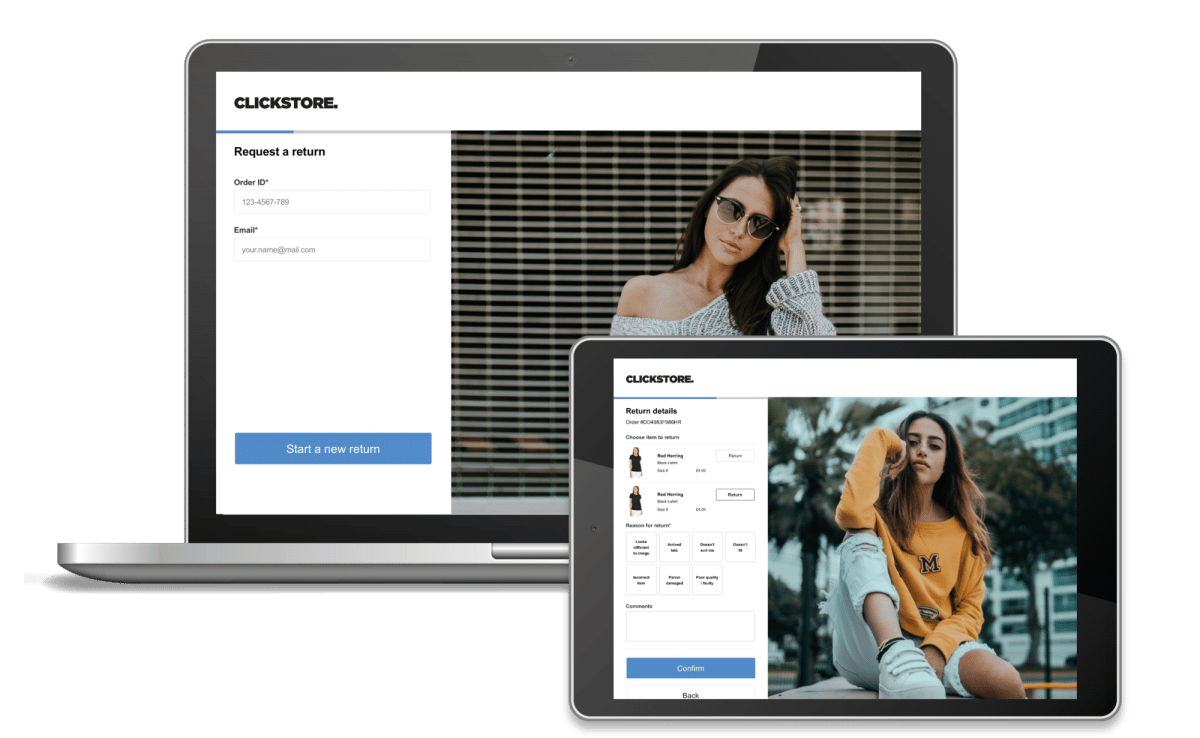

Going paperless is a relatively simple adjustment that makes a big difference to the convenience of an ecommerce return. Thanks to Amazon, customers are becoming used to this journey to the point of expecting it. Many shoppers evaluate two or three retailers simultaneously and base their final purchasing decisions on ease of return. Investing in this convenience can directly affect your sales and eliminate the cost of label printing for retailers who include returns labels in every package they ship.

Breaking down the silos between sales and returns isn’t just about replicating that valuable in-store upselling experience online. It’s also about retaining the resale value of the products they don’t want – getting them back into inventory and out into new customers’ hands as quickly as possible. Simply put, at volume, these kinds of previously unthought-of efficiencies directly impact a retailer’s bottom line.

Paperless returns and the automated future

Only a handful of retailers currently offer truly paperless returns, but given that this includes Amazon, that’s already a huge chunk of the ecommerce market. Even if a label isn’t included in the packaging, the onus is on the consumer to print it at home. In some ways, the rarity of paperless returns presents an opportunity for retailers to differentiate and stand out with a seamless customer journey – on another level, the share of the market held by retailers already using the system means that it’s becoming more of an expectation on the part of customers.

We live in a world where convenience is not just offered but expected, and the current state of ecommerce returns leaves it well behind the times. Most returns can be registered via a phone screen, but the experience is subpar, with many retailers urging consumers print labels at home or stand in long counter queues to hand in their parcels.

Making returns truly paperless is about optimising and automating the entire process, making returns faster, easier and more efficient. We already can see print in-store options becoming more and more commonplace. Still, we suspect this process will become increasingly automated in the next few years, to the point where we’ll see consumers complete completely paperless returns inside their favourite coffee store. Find out more about how returns can be automated with this look into the future of parcel drop-offs.

Topics:

Related articles

How 3PLs Can Cut Costs, Reduce Waste and Boost Revenue With Smart Returns Management

3PLs should take advantage of returns to help reduce cost, efficiently manage warehouse resources, and aid growth.

Saving profits and the planet: 4 ways to sustainable & cost-effective returns

Returns drain profits and damage sustainability. Luckily, retailers can implement both cost-effective and sustainable returns using these 4 ways.

Speedy refunds: creating happy customers through fast & effective returns

Find out how speedy refunds can recapture revenue, increase customer loyalty and boost lifetime value.