Insight / Blog

Payments vs Delivery

In ecommerce, one checkout is much like another. You add products to a bag, view your bag, enter payment details, enter an address, and confirm the order.

Today, two huge industries are furiously competing in this space – Payment and Delivery. They’re in the same space, part of the same area of the customer journey, and have many of the same fundamental benefits to retailers – and yet they are vastly different industries. The problem is that while payments is sexier, better funded and louder in the market, delivery makes the bigger difference to customers.

On a simple level, payment providers offer customers the ability to pay for goods online, and delivery companies offer retailers ways to get those products to their customers.

Note the phrasing. Payment providers focus as much if not more of their marketing on the end consumer, using consumer demand to pull retailers to accept their payment method or adopt their payment gateway. By contrast, delivery businesses focus much more on the retailer and winning the right to deliver their parcels.

For many payments businesses this ability to talk to consumers is a core part of the offering. For example, Afterpay – a market leader in the buy now, pay later space – lead much of their marketing on their ability to re-engage customers.

Delivery companies, however, tend not to talk much about their ability and opportunity to engage customers – in spite of the fact that customers check their tracking updates an average of 8 times (Source: Pitney Bowes – email me if you want the stat).

Payments is also a hotter industry right now, with funding for fintech hitting sky-high levels and new disruptive entrants finding plenty of capital. Klarna and AfterPay are the biggest proponents of the buy now, pay later proposition. This is a relatively new concept which allows customers to order items and only pay once they’ve received them and decided to keep them – but both businesses are valued at well over $5bn. Meanwhile delivery languishes somewhat in the functional, less sexy business area of ‘operations’ – moving stuff around and making sure everything is in its right place.

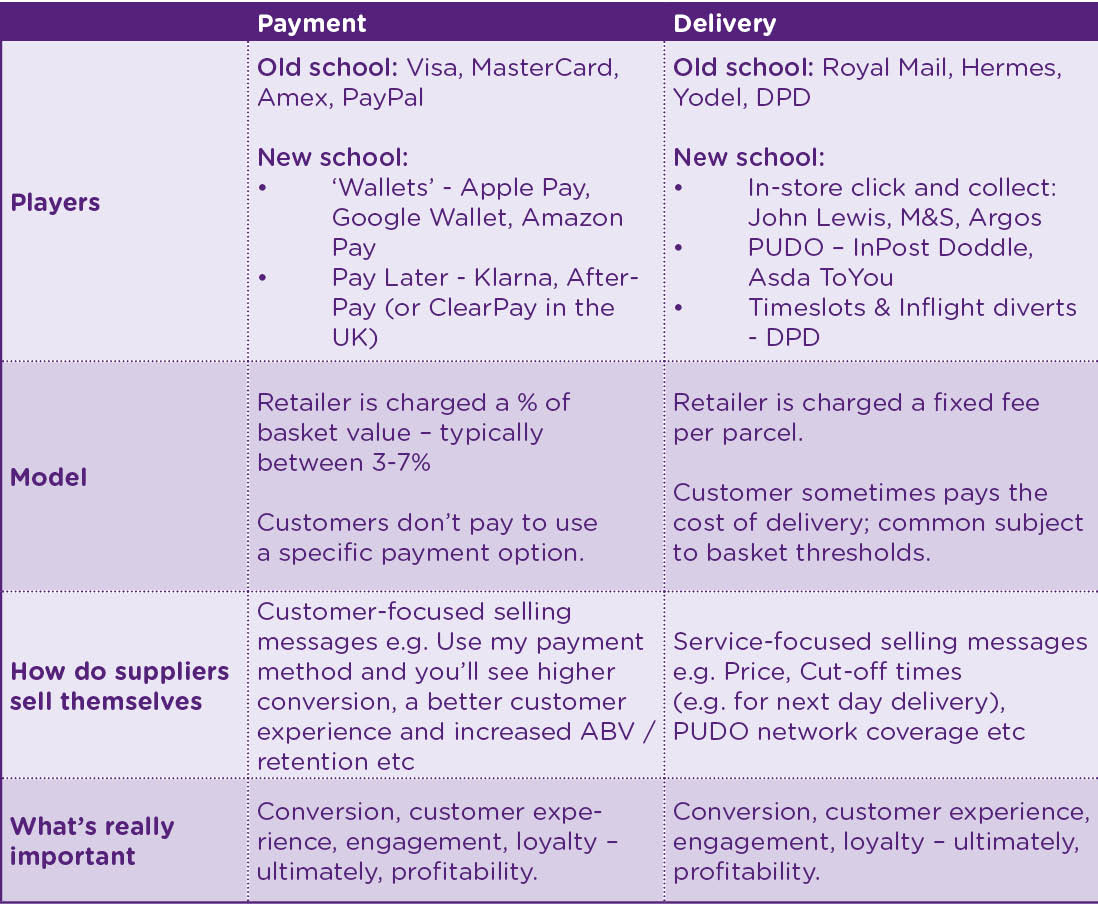

Here’s a high-level summary of the contrasting landscapes of payment and delivery, industries which work in parallel, in the same space with the same end users and business customers, but which remain so different.

The point of the table above is that whilst from the outside these 2 industries appear very different, they share a very similar set of characteristics and impact on retailers’ businesses. The success of their respective business depends, ultimately, on the impact they have on customers. And when you dig into the actual data, it’s delivery that appears to have a bigger impact in customer decision making.

Take a look at what an authoritative global consumer survey has to say about the factors which really impact conversion at the checkout.

(Chart from UPS Pulse of the Online Shopper 2019 – check out the run-down on the survey here).

Top reasons for cart abandonment:

I’ve taken the liberty of highlighting factors which are directly about delivery in purple, and the payment factor is in blue. Putting it bluntly, delivery cost and speed matters more than payment options when it comes to getting that final click of confirmation from shoppers – yet it’s the payment companies trading at sky-high multiples of revenue.

The reasons are many, but the takeaway for retailers has to be that while payments businesses will enjoy a massive share of voice thanks to their funding and the % they skim off each transaction, customers will be the ones making the calls which affect profitability, and delivery remains an unbelievably powerful and immediate driver of loyalty.

Within the delivery industry there also needs to be a conversation about how we can better convey the extremely tangible and higher-level profitability benefits of great delivery experiences, moving from a conversation about minimising per-parcel costs towards one about long-term profitability and the representation of the brand in the final touchpoint.

And if delivery companies don’t do this, what are the odds on Visa or Klarna spending some of their marketing millions on 15,000 click and collect lockers in the UK and becoming a serious delivery proposition overnight? They see much the same data that the delivery companies do, after all, and they serve the same wider purpose. Could we see a future where delivery and payment businesses connect more closely to facilitate the best possible experience before and after a shopper clicks that order button?

Topics:

Related articles

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?