Insight / Blog

Our 9 key takeaways from WMX Miami 2022

Summary: Discover the key insights from over 30 speakers and experts in the post and parcel world in our exclusive roundup.

Note: This blog has the insights from WMX in Miami 22. For WMX in Dubai, click here.

We recently attended the World Mail & Express (WMX) Americas Conference, which brought together industry leaders from the Americas and around the world – there are worse place to go than Miami in February!

Lots of focus fell on the pandemic and its influence on the post and parcel world, but there was also plenty of discussion on facilitating crossborder trade and how to become a truly sustainable industry. If you didn’t make it over to Miami, or if you did and just didn’t catch all of the 30+ speakers within the two days of the event, here’s our top takeaways from this year’s event.

1. USPS investing billions in EVs and post offices

Firstly, we heard from Mary P. Anderson, Executive Director, International Postal Affairs of USPS. Her talk, ‘USPS What’s Next?’ outlined the ‘Delivering for America’ transformation plan that USPS is carrying out.

What stood out most from this plan was the vast $19 billion investment in new delivery vehicles and post office upgrades. 10% of the current order of vehicles will be electric, in line with aims to reduce USPS’s carbon footprint.

The investment into their post offices and retail spaces is equally eye-catching. If post offices can become attractive locations for consumers to collect and send parcels, out-of-home delivery and returns could massively accelerate in the US. USPS has by far the largest American network of staffed parcel and mail service locations through its Post Offices – over 30,000 locations. Investing in this crucial point of difference makes strategic sense.

2. PUDOs and lockers are still on the rise

Afterwards, we heard from Floriano Peixoto Vieira Neto, Correios’ President. In his talk ‘Thriving in challenging times’, Floriano noted that the Brazilian post was now handling over 14 million items daily, including 2 million parcels.

Notably, in order to handle expanding parcel volumes and become more sustainable, Correios are planning to significantly invest in parcel lockers and pickup and drop-off (PUDO) locations. Expanding out-of-home (OOH) networks like this has several advantages for parcel carriers, allowing for increased drop density, fewer failed deliveries a lower carbon footprint for each parcel.

It also gives more choice to their customers, in line with Correios’ goal of keeping ‘customers as our focus’.

3. Australian ecommerce has been growing insanely fast

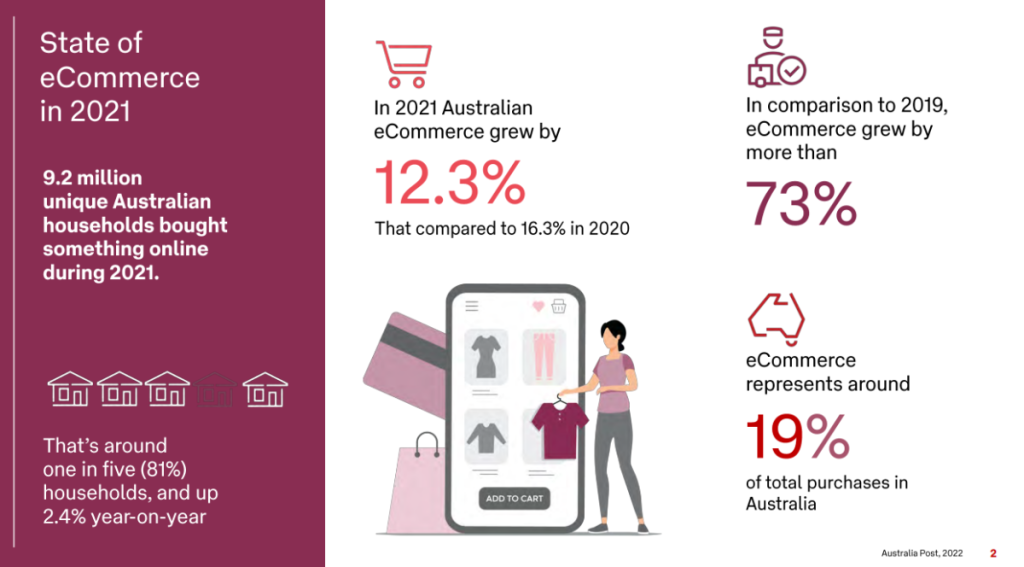

Michael Cope, General Manager International Services at Australia Post, gave a great talk on the staggering rate of ecommerce growth in Australia. In his speech, Michael shared some incredible stats, for instance highlighting that ecommerce has grown more than 73% in just two years from 2019 to 2021.

Interestingly, despite some gloomier outlooks from markets like the UK and US seeing ecommerce growth fall back to pre-pandemic levels or below, there’s optimism that thanks to its slightly later adoption of ecommerce, Australia may well have some real headroom still to grow into.

In addition, Michael shared how important the international carrier lines are to Australia Post, fuelling growth through ‘lanes’ of New Zealand, the USA, the UK and Canada.

4. Community mailboxes cut delivery vehicles by 80% for CPost

Thomas Roggendorf, CEO of CPost International, gave a brilliant case study of delivery in the Caribbean Island of Curacao. His talk ‘Community mailboxes: challenges and opportunities’ detailed how CPost had revolutionised the delivery model in Curacao to a Community Mailbox model, similar to the approach used in some regions by Canada Post.

These community mailboxes are a set of lockable mailboxes in an accessible outdoor location near to residents’ homes. Every household in the community has their own box and a key to this mailbox. The upshot is that delivery is now to one set of mailboxes rather than to hundreds of doors, enabling consolidation on a huge scale.

To prove the point, CPost has taken its delivery points from 80,000 addresses to just 150 locations by implementing community mailboxes in Curacao. What’s more, this decrease has reduced the need for delivery vehicles by 80% on the island, massively improving the company’s carbon footprint and sustainability.

5. Technology underpins post and carrier growth

Escher CEO Brody Buhler gave an excellent presentation on ‘The new postal reality’, discussing how the role has changed and is now underpinned by the parcel business. For posts to succeed, they need to follow the four key strategies to meet evolving consumer needs.

Realise delivery and retail network synergies, as a large, more integrated retail network enable posts to delivery more parcels and sustain growth.

Invest in ecommerce as the primary driver of parcel volume.

Automate and optimise delivery processes and journeys, using technology to increase efficiency.

Reimagine the delivery depot and move towards micro fulfilment.

We’ve been talking for years about how posts should be maximising their retail estates as a key point of difference to specialist CEP carriers, and about the role of posts and carriers in enabling ecommerce, so it was gratifying to hear someone else talking about it for a change!

Investing in ecommerce can look like many things, but one way for carriers and posts to focus their efforts is by looking at the challenges their ecommerce merchant clients have and aiming to address them. For example, rising return rates can affect carrier volume – carriers who implement digital returns solutions will be better able to sustain ecommerce growth for their customer and themselves.

6. UAE aims to be a gateway to the Middle East for crossborder ecommerce

Peter Somers, Chief Executive Officer of Emirates Post, shared some fascinating stats in his talk ‘Transforming Emirates Post for the ecommerce market’.

-

91% of residents in the Middle East are “digital converts”

-

eCommerce spend per capita in the Middle East is £1,649

-

eCommerce CAGR is 32.9%

Peter’s talk also discussed Emirates Post’s desire to become a gateway to the Middle East, reaching this online population via Dubai and other Emirati ports of entry.

7. We need to do more to be sustainable

As sustainability was one of the critical themes of the events, there were many great talks on building a sustainable future in ecommerce. Some of the highlight speakers in this area include Emily Phillips, VP of Advanced Solutions at XPO Logistics, Infinium Logistics CEO Paul McCormack and Elena Fernandez-Rodríguez, the Deputy Director for International Affairs and Sustainability at Correos.

A commonality among these talks was how hard it was to be genuinely sustainable in ecommerce. As Elena put it, we need to do less self-congratulatory backslapping and instead look long and hard at how our industry is not doing enough. This is especially true when Transport emissions are now the largest contributor of US GHG emissions at 29%, as Emily noted.

This is a point we’ve raised in our annual predictions – reducing carbon emissions per parcel by ~6% is good, but if the market grows by 40% in two years (as it has done for much of the world since 2019), we’re still emitting a lot more carbon than we were two years ago.

However, it wasn’t all doom and gloom. As well as the reality check, Elena also shared some interesting stats on the number of deliveries made on foot by Correos. As part of their last-mile sustainability model, their 11,000 ‘on foot’ employees have travelled a total of 12.4 million km. This once again highlights the ability of a post with excellent infrastructure coverage to stand out on sustainability and types of service other carriers may not be able to directly replicate.

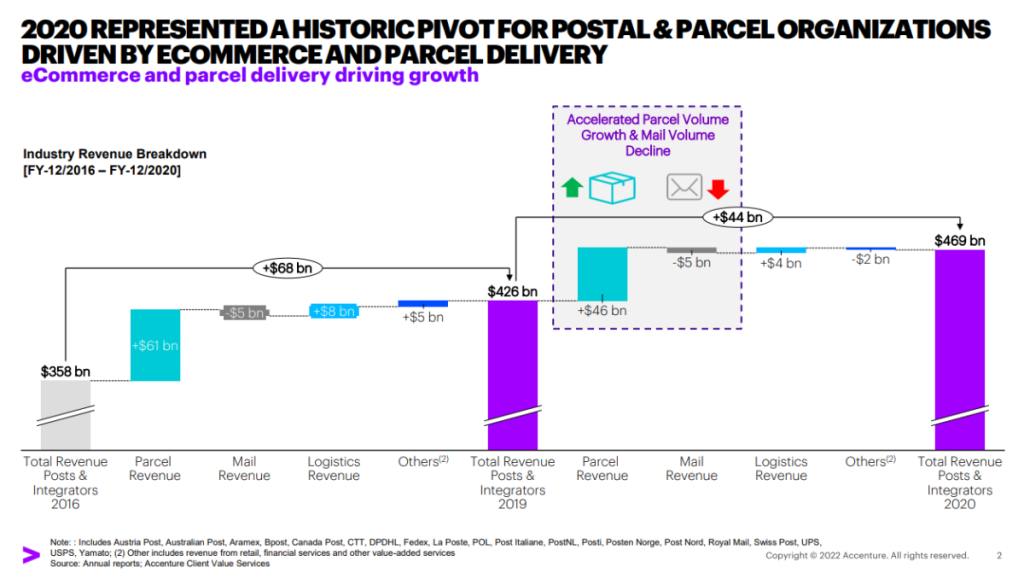

8. Parcel continues to grow as mail declines

Many talks at WMX explored global ecommerce and parcel growth among carriers and posts. But the ‘Innovation to transform’ talk by Andre Pharand, Managing Director at Accenture, highlighted how the pandemic accelerated the decline of mail within the postal sector.

With mail in long-term structural decline, postal operators are transitioning their businesses to focus more on parcels. An under-represented aspect to this transition is that posts have unique advantages in the battle for a share of ecommerce parcel volume.

We’ve previously explored how Parcel Collect can turn Royal Mail into a returns leader, and this talk was a great reminder of how postal companies can leverage their position to offer unique propositions to consumers and merchants, which can help them take the lead in an ecommerce-first landscape.

Andre also noted how much the pandemic accelerated the long-term trends of mail decline and parcel growth, as illustrated here.

9. Carriers have a lot to consider amidst the post-pandemic ecommerce boom

And finally, I got the chance to get on the soapbox, to talk about how some of the key trends we’ve seen happening during COVID-19. In the talk, I focused on how we’re seeing competitive threats and opportunities for carriers in 3 key stages of the online buying experience – the checkout, the post-purchase experience and in returns.

In the checkout, we’re seeing a mass of activity from payments businesses, platforms and aggregators, and our feeling is that carriers are being left behind. One of the key trends we’ve noticed is how payment is increasingly prioritised over delivery. One-click payment methods such as PayPal Checkout or Apple Pay often effectively default to home delivery, taking consumers’ options and agency away. Carriers need take a lesson from the payments industry to focus on innovative checkout solutions which drive consumers into their networks and create better experiences from the start.

Secondly, there’s the world of communication, or ‘post-purchase experience’ as the sector of the industry has christened itself. Technology businesses are active in this space, offering to aggregate carrier events and tracking information, and present a seamless communication experience to online consumers. This is a threat to carriers – I believe that communication with the customer is a key part of the value chain for carriers, and they need to make those communications clear and direct for a better experience, and to avoid disintermediation.

Finally, we spoke about rising rates of returns and the knock-on effect this has on carriers. We’ve talked about why carriers need to act on returns before. The bottom line is that carriers need to partner with merchants to deliver smart returns solutions that limit costs by pre-approving returns before they’re sent and enabling intelligent returns management, not the one-size-fits-all approach we have today.

Want more information on these topics?

Our team are always happy to help. Get in touch with us today.

Related articles

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?