Insight / Blog

Grocery ecommerce demand has spiked, and Walmart is mobilising an army

Whether it’s panic buying, stockpiling or simply a general surge in demand for groceries, the last fortnight has seen grocers struggling to keep the shelves stocked in stores and huge pressure on their grocery pickup offerings.

Walmart’s EVP of corporate affairs, Dan Bartlett, told reporters that their curbside pickup service has been “slammed”, and the supply chain was robust but “catching its breath”. He added that the retailer was still unsure of whether this level of spend would continue.

“We’re trying to find where the new normal is. We’re not sure we’ve hit it yet.”

Helping Walmart deal with the new normal? A massive 150,000-worker hiring drive. The majority of these new temporary roles will be assigned to stores and warehouses. This comes within days of Amazon announcing a similar target to hire 100,000 new employees, albeit these Amazon staff will work almost entirely in fulfilment centres.

Moving up the adoption curve

Whatever the new normal is, grocery ecommerce is going to play a bigger role than ever before. The ability to shop in isolation and have a no-contact pickup experience is going to be crucial to maintaining social distancing. Once people start using ecommerce to order groceries, they tend to pick up the habit – that means that this boost to adoption is likely to have longer-run implications for grocers, who may need to invest in offering more slots for pickups and devote more resource to picking online orders.

In 2018, just 3% of grocery spend occurred online, and only 25% of consumers had shopped online for groceries in the last 12 months (Bain) – even then, just 10% of consumers do so regularly. In comparison, the UK saw approximately 7% of grocery sales occurring online in 2018.

However, what happened in the last few weeks has almost certainly pushed that percentage of ecommerce users in the US significantly higher. In essence, the pandemic has changed the long-term curve of grocery ecommerce adoption in a way that the industry simply has not experienced before. That means it is all the more essential for grocers and other retailers to find a way to serve this demand profitably and sustainably.

Buy online, pickup at the curbside

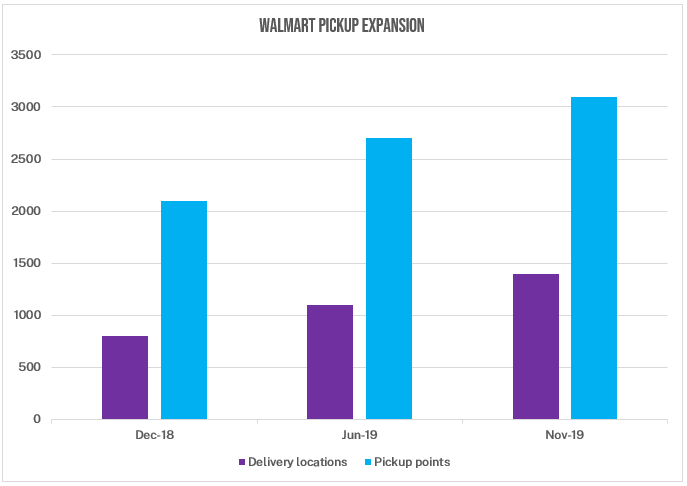

Walmart has been expanding its pickup offering in recent years, giving it a point of differentiation against Amazon, which until 2019 was the leading ecommerce grocer.

Home delivery is significantly more costly for retailers to offer – to put it simply, bringing orders to customers is a lot easier if the customer has come to the store already. That makes pickup orders more profitable, and with the massive store estate Walmart has, it can offer pickup points within easy reach of a massive share of American shoppers.

Lockers

Order pickup can also be offered as a self-served experience using autonomous locker banks. Staff load up orders into lockers and customers collect them from the parking lot. The main reason this hasn’t had more widespread adoption before is that grocery lockers need to be quite technologically advanced – with ambient, chilled and frozen sections. However, lockers combine the benefits of order pickup with maximum efficiency for store staff, and provide an extra layer of distance to reduce the likelihood of infection.

Grocery lockers may well have a role to play in a retail world where we need to think about our shopping and delivery choices in terms of our wider social responsibilities, and where grocery retailers are keen to grow their ecommerce share without diverting too much staff resource away from the shop floor.

Topics:

Related articles

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?