Insight / Blog

Black Friday might fall flat for store-based retailers

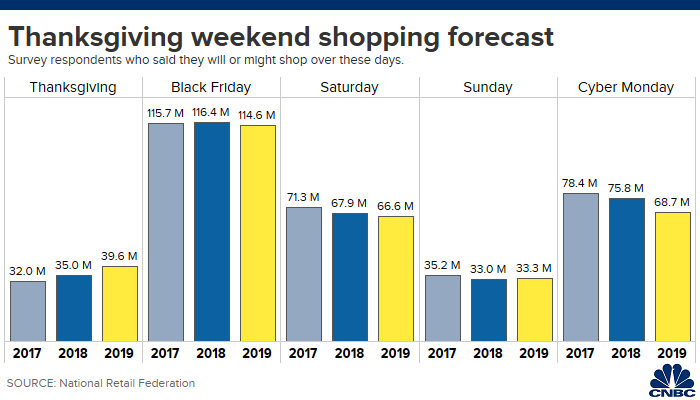

Data from the National Retail Federation predict a decline in shopping on Black Friday and Cyber Monday, with only slight improvement on Thanksgiving day (year on year).

Analysts identify the depth and breadth of online sales in the days and weeks leading up to Black Friday as a key reason for the drop in shopper interest and consequent flat foot traffic predictions.

Of course, this is troubling news for retailers who generate a significant proportion of their annual revenue through the peak, with CNBC citing figures which suggest Black Friday 2018 was responsible for between 6 and 7% of quarterly sales for mall-based and big box stores.

However, it’s not a foregone conclusion that Black Friday 2019 will be a let down for retail, with eMarketer forecasting the first ever trillion dollar holiday season, a rise of 3.8% on last year, with online sales growing by 13.2% year on year.

There are also retailers who are choosing to harness a more mindful attitude to shopping that is increasingly common in consumers – for example Everlane is making a donation to clean plastic from beaches for all sales during the Black Friday period, rather than offering deep discounts. On a similar note, makeup and skincare brand Deciem is closing shops and shuttering its site on Friday to eliminate the panic and FOMO shoppers sometimes experience during Black Friday – it will instead extend its sale into December.

Topics:

Related articles

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?