Insight / Blog

5 changes we predict in ecommerce delivery and returns in 2021

Last year we tried our hand at some predictions, and while we might have missed an historic pandemic and consequent disruptions, we otherwise felt the activity was worthwhile. Trying to forecast makes you dig deep into what you know about a market and evaluate all of the different trends that compete for attention, and that’s a handy exercise. In the spirit of accountability, however, let’s start by checking in on our naive selves 12 months ago, and figure out what we had right and wrong.

Grading our 2020 predictions

1. Delivery options get streamlined to make more sense for everyone

6/10. It’s hard to measure objectively across the retail space globally, so your mileage may vary, but our analysis of leading retail checkouts suggests that many have begun to offer fewer delivery options and a greater emphasis on order pick-up, whether at stores or via parcel shops and locker banks.

2. Increased consumer consciousness of delivery impact on sustainability

8/10. While it’s yet to massively shift behaviour, consumers are demonstrating ever-increasing awareness and concern about the impacts of delivery. That has continued throughout the pandemic, 70% of survey participants said they were more aware now than before COVID-19 that human activity threatens the climate.

3. The economics of the last mile continue to incentivise the use of PUDO

10/10. Paradoxically, while we are at home more of the time than ever before, the appetite for out-of-home delivery solutions continues to grow. That’s less contradictory than it might appear at first – skyrocketing ecommerce volumes around the world cranked up the pressure on parcel carriers, who rapidly recognised that their networks were simply not going to be able to cope with the new trend line. Whether it’s Yamato in Japan, Starlinks in Saudi Arabia or Amazon Hub pretty much everywhere, parcel carriers are developing and investing in PUDO networks to make their parcel deliveries more efficient and protect their margins. InPost is one of the world’s leading out-of-home delivery proponents, offering parcel locker installations in the UK and Poland, handling 310 million parcels in 2020. They just floated the stock in an IPO in Amsterdam and have come out with a market capitalisation of €8 billion – the biggest EMEA tech IPO ever at time of writing. Our 2021 prediction on this front is going to have to be a bit more spicy.

5 Predictions for 2021

1. PUDO reaches the mainstream

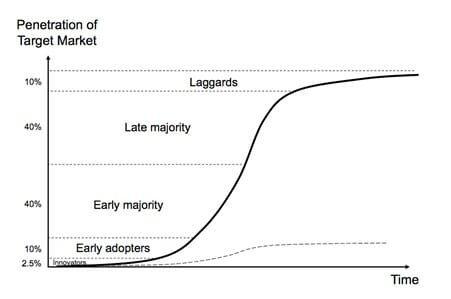

You’ve probably seen this chart before. Early adopters of PUDO have been around for a while, and they’ve illustrated how powerful it can be. 2020 really tipped the balance for a lot of leading posts and carriers. We talk to or work with a bunch of these businesses, and almost all see their PUDO strategy as a top priority in the next five years. It’s time to scale that adoption curve – the early adopters are already in, now it’s time for the majority to hop on board.

It’s hard to specifically forecast what form that takes. Consumer preference alone won’t drive the change from below, and carriers can’t just ask retail clients nicely if they could please change their checkouts to push PUDO. It probably comes down to the money, where carriers pass on some of the savings of consolidated deliveries onto their retail clients, who in turn can offer the same speed of delivery whilst promoting sustainability advantages and lower prices to consumers.

2. Networks start to open

The UK Post Office announced in December 2020 that it’s no longer maintaining an exclusive deal with Royal Mail, opening the door for it to work with other carriers in the UK market, potentially allowing shoppers to pick up any of their shopping from one of the 11,500 or so post offices in the nation. Collect+ is another network of PUDO locations which recently switched to a carrier-agnostic model and signed a deal with DPD – that would have been unimaginable a few years ago. What we’re seeing is the start of a trend towards models such as those found in Poland or China, where carrier-agnostic PUDO networks are huge parts of the overall delivery ecosystem. In China especially, HiveBox offers carriers a simple alternative to failed deliveries thanks to a huge network of 150,000 locker banks, which deliver 9 million parcels every day.

From a consumer perspective, it makes no sense to have to go to 3 different pickup points for 3 different retailers, so agnostic networks are clear winners with shoppers. The challenge is in getting an intensely competitive industry to engage collaboratively, and these recent announcements might be the early signs of a more collaborative future.

3. Planning and strategy make a welcome return

It would be wrong to say that nobody was been doing any planning or long-term thinking at posts and parcel carriers in 2020, but for 9 or so months, for most of the world, the unexpected flood of parcel volumes kept everyone on the defensive, making day-to-day decisions and keeping operational work at the forefront. If strategic work and thought was happening, it was in the background and in the margins.

In 2021, the historic lack of strategic planning and digital transformation will create a pretty obvious gap between the vision and the reality. We expect postal businesses in particular to invest heavily in digital capabilities as they play catch up. Some have been buoyed by a year of peak-level parcel volumes and revenues, others have seen their overall margins stressed by declining mail volume more than offsetting the benefits of rising parcel revenue. Those who can afford to will look to spend aggressively so that they can start to make parcels a more viable primary income stream, reducing the cost of delivery with digital implementations. Once embedded through its power to cut cost, digital transformation can start to take root in the organisation more widely.

4. Returns aren’t just a “retailer problem”

Returns are a retailer problem, in the sense that they most keenly affect the bottom line for retailers. But more than that, they are an industry problem for fulfilment. Carriers have typically not seen this as their responsibility, leading to an influx of tech businesses looking to provide value to retailers in reverse logistics – coming between carriers and their retail clients.

We expect to see carriers recognising that returns represents a huge problem that really motivates their customers, and begin to offer more tech-enabled solutions, rather than solely transportation solutions. Leading carriers will go beyond logistics and into deeper partnership with their retailers, making themselves more valuable and stickier by offering digital solutions to returns problems, enabling retailers to much more effectively manage a painful issue.

5. Giants from the payments sector take a keener interest in fulfilment

Online checkouts are about two things: (i) taking payment, and (ii) arranging delivery. In our view, the latter is a lot more interesting to consumers. Questions like ‘how quickly can I get it’, ‘do I need to be at home to receive it’, ‘can I return it if I need to’ are much more personal and intricate than ‘how should I pay’, but it is newcomers in the payments industry that are receiving remarkable investment and growth, and achieving massive market capitalisation.

And what’s universally true is that payments businesses thrive (and sell) on their ability to drive conversion. Our forecast in this blog piece from last year hasn’t quite come true yet, but the payments disruptors have continued their incredible tear. AfterPay’s market cap has gone from $1bn when we wrote the blog to $35bn (!), and their competitors Klarna and Affirm have also seen crazy growth.

Whether it’s a buy-now, pay-later business like AfterPay, Affirm or Klarna or a more established payment provider (Mastercard, Visa, Paypal et al), we see 2021 as a year where payment businesses will invest in delivery and returns to differentiate themselves in the very crowded payments space. If someone can own both key checkout phases of taking payment and arranging delivery, they’ll be reaping rewards for years to come. Not only will they be able to provide a genuine one-click purchase solution but they’ll also benefit from the delivery sector’s biggest secret: Engagement.

Consumers always put delivery and return factors as among their top factors in and online purchase decisions. Add to that the fact that consumers will check tracking data religiously – Pitney Bowes noted in a 2019 presentation that tracking events were checked 8 times per order – and you see that consumers care about delivery, and engage in all manner of ways with both delivery and returns services. For payment businesses who are trying to build more loyalty and develop deeper relationships with consumers, that wellspring of engagement is an untapped goldmine.

The dark horse to reach this true one-click-checkout position actually isn’t a payments giant at all – it’s Shopify. Amazon already has all the visibility of customer behaviour both as a payment provider and as a carrier, but would retailers ever give over their entire checkout to Amazon? Probably not. Shopify ticks a lot of boxes here: it already has the payment tech, it’s building out the logistics capacity to offer to its retailers, it has a huge customer base already, it has the market cap to deliver on an ambitious project like this, and crucially, it is not the biggest scariest competitor in online retail.

If you’re interested in how Doddle can help your business navigate the tumultuous parcel market in 2021 (or perhaps you just absolutely disagree with our predictions), get in touch today.

Topics:

Related articles

Return fees or free returns: why not both?

Debates between return fees or free returns miss the bigger picture: how to address the root issues of returns.

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?