Insight / Blog

Out-of-home delivery in Asia-Pacific markets – a snapshot

Summary: Quick pictures of out-of-home delivery across a handful of markets in the APAC region, including Japan, China & Australia.

Last-mile delivery is a fantastically complex and varied set of systems, which work in different ways in different parts of the world. At Doddle, a lot of our analysis is derived from our experience working in more mature ecommerce markets, like the UK and the United States. While those markets are far from homogeneous, with important differences between them, it’s good to cast our net out more broadly, and offer some perspective on what’s happening elsewhere in the world too. Having teams in Australia and Japan, it felt sensible to start in the Asia-Pacific region.

To that end, we’re talking today about the nature of last-mile delivery, particularly out-of-home delivery, across a handful of key markets in the APAC region. There are broad trends which crop up in many markets, notably the general predominance of home delivery and the increasing influence of Chinese carriers and investment, but each market has its own specific challenges and opportunities for change, and it’s those singular elements that this article is all about.

Singapore

-

Population: 5,453,600

-

Population density: 7,804/km2

-

Key players: SingPost, Ninja Van, J&T, Pick

Last year, we completed an in-depth report on the Singapore market.

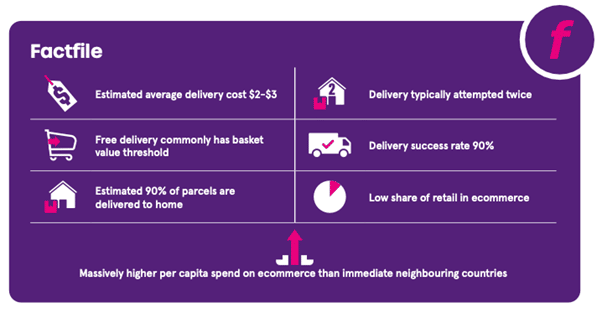

Singapore is densely populated, with 70% of its total population living in high-rise accommodation. At first glance, this might sound like a dream for carriers with one location for hundreds of recipients. However, the reality is very different as the majority of these Housing Development Buildings (HDBs) don’t accommodate common parcel storage space, meaning carriers must travel to each door to make deliveries.

Typically, failed deliveries result in two or more attempts at redelivery, making this a highly costly and time-consuming operation when nobody is home to answer the door, with carriers having to spend time moving up and down in buildings, only to leave with the parcel still undelivered. To address this inefficiency, carriers need ways of delivering reliably first-time, without inconveniencing customers, and ideally without spending time unloading and delivering parcels throughout entire HDBs. To this end, the Singaporean government has stepped in to build 1,000 carrier-agnostic lockers (under the Pick brand) which are freely accessible to all delivery service providers.

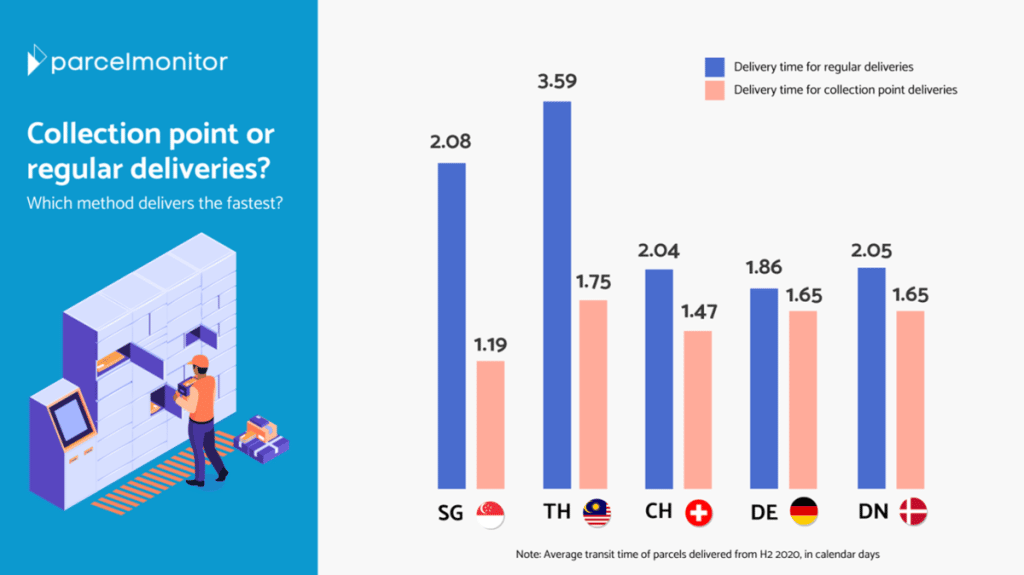

Since they’re government-owned, no carrier can claim a competitive advantage, but all players in the market should benefit. Early data suggest that lockers are expected to reduce the distance travelled by carriers by 44% daily, massively improving efficiency. Implementing these lockers doesn’t just help carriers and posts in Singapore, but also provides a better user experience for consumers. Lockers mean that no parcel will be missed while they are out, allowing them to collect as and when it suits them – usually from a locker bank within or within the immediate vicinity of the high-rise accommodation they live in. In a survey, most Singapore residents believe that the lockers increase convenience, and that they will be making use of them.

“The majority of residents, or 96 per cent of about 10,000 residents surveyed, said the lockers will bring them convenience and that they will use the locker stations in their neighbourhood”

Sim Ann, Minister of State for Communications and Information

This is a relatively unusual (for now) example of a government directly paving the way for more widespread OOH delivery adoption – it’s now up to carriers to continue this path in Singapore. Whether other nations take notice of this intervention and look to follow the same model will be interesting, though obviously few have quite the same set of challenges as the city-state.

China

-

Population: 1,412,600,000

-

Population density: 145[10]/km2

-

Key players: China Post, SF Express, Cainiao Logistics, ZTO Express

China accounts for 59% of all parcels delivered in the world. With massive demand and volume increasing, it’s perhaps surprising that per-parcel delivery rates are relatively cheap compared to other markets, and declining yearly.

In 2021, the average price per parcel was $1.82, down from $4.38 in 2007 – showing an average decrease of 8.4% year-on-year. To put this into context, China handles over three times the parcel volume of the USA, where the average cost per parcel is $10.50. These figures show just how fierce last mile competition in China has become.

What’s more, 60% of parcels are currently delivered same-day using micro-fulfilment centres in cities across the country to keep up with consumer expectations, which have been driven up by high-profile retailers like JD and Alibaba. The cost of building and maintaining these facilities has squeezed already-tight profit margins to an extreme. Thus, carriers must find ways to claw back cost savings – which is why OOH delivery plays a key role in this market.

China has the biggest OOH delivery market in the world, with hundreds of thousands of locker locations, growing at a rate of 25% per year. However, consumers don’t always get a choice about their delivery location. The general rule is that carriers must call for consent before locker diversions, giving consumers power over this choice. However, with such high parcel volume and delivery speed being essential for their tight profit margins, parcels are often rerouted to OOH locations as a default, sometimes without the consent of shoppers.

Currently, approximately 40% of all deliveries are to OOH locations. This arrangement has been enthusiastically backed by the Chinese government, particularly after the outbreak of the pandemic, where the government emphasised the role of lockers to reduce contact between delivery drivers and consumers. At the same time, the State Post Office has said it will seek to “actively promote” parcel lockers as a delivery option. On the surface, China is a poster child for OOH adoption and usage. But not all consumers are happy with how this delivery method is implemented, providing Chinese carriers with a unique challenge to solve.

In April 2020, Hive Box, the leading locker supplier in China, announced it would stop free collection from its lockers unless consumers paid a monthly membership fee. If home deliveries were rerouted to a Hive Box locker without consent, consumers would have had to face an extra charge on top of their delivery fee. That’s obviously frustrating as a consumer, but the level of frustration might come as a surprise, with some residents going as far as cutting power supplies to lockers in their area. After the backlash, Hive Box introduced an 18-hour grace period. For every 12 hours a parcel is left in the locker after this period, a charge of 0.5 yuan is now added to a maximum of 3 yuan.

Now, Chinese carriers must try to walk a tightrope whereby they offer the same speedy, cheap deliveries consumers are addicted to, whilst encouraging them to keep allowing deliveries to be made to lockers and other OOH locations, without triggering too much backlash. Ultimately, the choice of delivery destination belongs to the consumer, and carriers will have to do more to encourage OOH adoption from the start of the user journey, rather than relying on redirects.

Watch our FREE webinar on changing consumer behaviour

Australia

-

Population: 25,991,100

-

Population density: 3.4/km2

-

Key players: Australia Post, Aramex, ParcelPoint, Omni Parcel

Australia is the 11th largest ecommerce market in the world, with revenue expected to reach USD 32.3 billion by 2024. In 2021, ecommerce made up 19.3% of total retail sales, with online spending growing at a rate of 24% year on year.

As ecommerce sales grow, so does parcel volume, putting strain on carriers and posts to keep up with demand. What’s more, Australia has a unique geography in which 86% of its population is urban, located in cities and towns on the outer edges of the country. Although only a small percentage of its overall population lives in outside communities, the vast expanse of the country and wide distances between them increases delivery costs and make it harder to offer nationwide same-day delivery services.

Currently, around 90% of parcels are delivered to consumers’ homes. But with rising parcel volumes and challenging geography, this level of growth is hard to sustain. In addition, consumers are becoming increasingly impatient, as a survey from the Australian Bureau of Statistics revealed that Australians are feeling more time-poor than ever, with 45% of women and 36% of men feeling “always” or “often” rushed or “pressed for time”. Where time is in limited supply, convenience is key.

In a market where consumers are after speed and convenience, and parcel volumes are growing yearly, OOH is key to sustaining growth through consolidated deliveries that consumers can collect when it suits them. This is an opportunity that Australia Post recognised. They partnered with Doddle to launch the Collect & Return PUDO network, covering over 5,000 locations such as Post Offices, 24/7 Parcel Lockers and retail partner locations, with new locations being added every week. This network was vital for Australia Post to increase capacity while meeting increasing customer expectations of reliability, flexibility and convenience.

In a country that favours home delivery, the biggest challenge for Australia Post was to increase visibility and use of this network, starting with how the option is presented at the point of purchase:

“The success rate of the Collect service depends on how well it’s presented at the checkout. We’ve found that retailers who implement this well usually see an immediate uptake of 4–6% for this service. We expect this to grow over time as customers get more familiar with the service.”

Abdul Rehman, Product Manager of Collect at Australia Post

Australia Post’s checkout integration is powered by Doddle, which seamlessly integrates into their merchant’s shopping carts as a widget, API or Shopify plug-in, showing available collect locations to consumers on a map. Going beyond a simple list, this integration also shows customers important information such as opening times for PUDO, distance from their home address and drive time for added convenience.

Overall, this integration wasn’t just successful in driving OOH volume for Australia Post but also provided merchants with additional benefits by improving the wider consumer journey. For example, retailer Oz Hair and Beauty saw NPS rise by 8% since offering the collect service on checkout.

See our case study for more information on our work with Australia Post.

Japan

-

Population: 125,502,000

-

Population density: 332/km2

-

Key players: Yamato, Sagawa Express, Japan Post

Japan has an incredibly strong service culture, and in the last mile, that centres around home delivery. Something approaching 99% of all parcels are delivered to homes, with as many as four redelivery attempts. With a failed delivery rate of 20%, this comes at a high cost to carriers – a cost which is only expected to increase as parcel volumes rise.

The WEF forecasts that ecommerce volumes in central Tokyo’s 23 wards will rise by 85% by 2030. In turn, this is projected to increase the number of delivery vehicles required by 71%, and require them to each travel 25% further, substantially increasing traffic and carbon emissions. Suburban areas will also be hit by this increase, with delivery fleets expected to expand by 51% to meet the demand. Paired with a declining birth rate and an ageing population, Japan will have fewer working-age drivers to fill open roles, and may struggle to meet increasing demand for home deliveries.

Unusually, Japan has a vast out-of-home delivery network already in place. For example, Yamato, the largest parcel carrier, has over 250,000 TA-Q-BIN collection points in desirable and convenient locations. In Tokyo, 95% of residents can reach a Yamato locker within a 5-minute walk.

However, these points are predominantly used for outgoing C2C parcels. Japanese residents don’t just use this service to send parcels to others but also send themselves parcels for easier travel. For example, a consumer may ship their luggage for a trip directly to a hotel or even ship golf clubs to the course the day before their visit, to avoid travelling with these items.

Until recently, all of these collection and sending points still relied entirely on paper-based manual processes, making it a time-consuming and frustrating experience for the consumer. Now, Yamato has recognised the opportunity to digitalise this experience and utilise its impressive network more fully, in line with its Next100 plan.

To make that happen, Yamato partnered with Doddle and licenses our PUDO application to digitise and speed up the in-store process, offering features such as label printing, parcel organisation for storage, quick collection, and digital receipts. This service will be rolled out to 8,000 stores and features heavily in Yamato’s Next100 plan to increase volume into OOH, provide a high-quality customer experience across all of ecommerce and reduce the strain on home delivery.

Thailand

-

Population: 66,171,429

-

Population density: 132.1/km2

-

Key players: Thailand Post,Skootar, SCG Express, Flash Express

The most important characteristic of Thailand’s delivery market is that it is oversaturated with excess capacity. Part of this is due to the ecommerce boom during COVID-19, in which Thailand added nine million new digital users and achieved 68% growth in ecommerce from 2020 to 2021.

Strong ecommerce growth promised a very lucrative market and opportunity for carriers to share a piece of this success. However, many businesses jumping in to grab a slice of the ecommerce pie brought about an oversupply – meaning that each delivery provider has more capacity than required to deliver the existing parcel volume.

That has created an ultra-competitive market in Thailand. To appeal to retailers and earn market share, carriers are lowering prices at unprecedented rates, with the cost per parcel declining as much as 30-50%. This problem has also been exacerbated by Chinese operators entering the Thai market, hoping to take a slice of the $30 billion ecommerce market.

In a low-price, cut-throat parcel market, consolidation is not a high priority; it’s all about increasing volume. The intense competition also puts consumers in a position of power. If carriers compete to deliver, consumers can make more requests for speedy, next-day or guaranteed delivery at their homes, reducing some of the consumer-facing benefits of using out-of-home delivery.

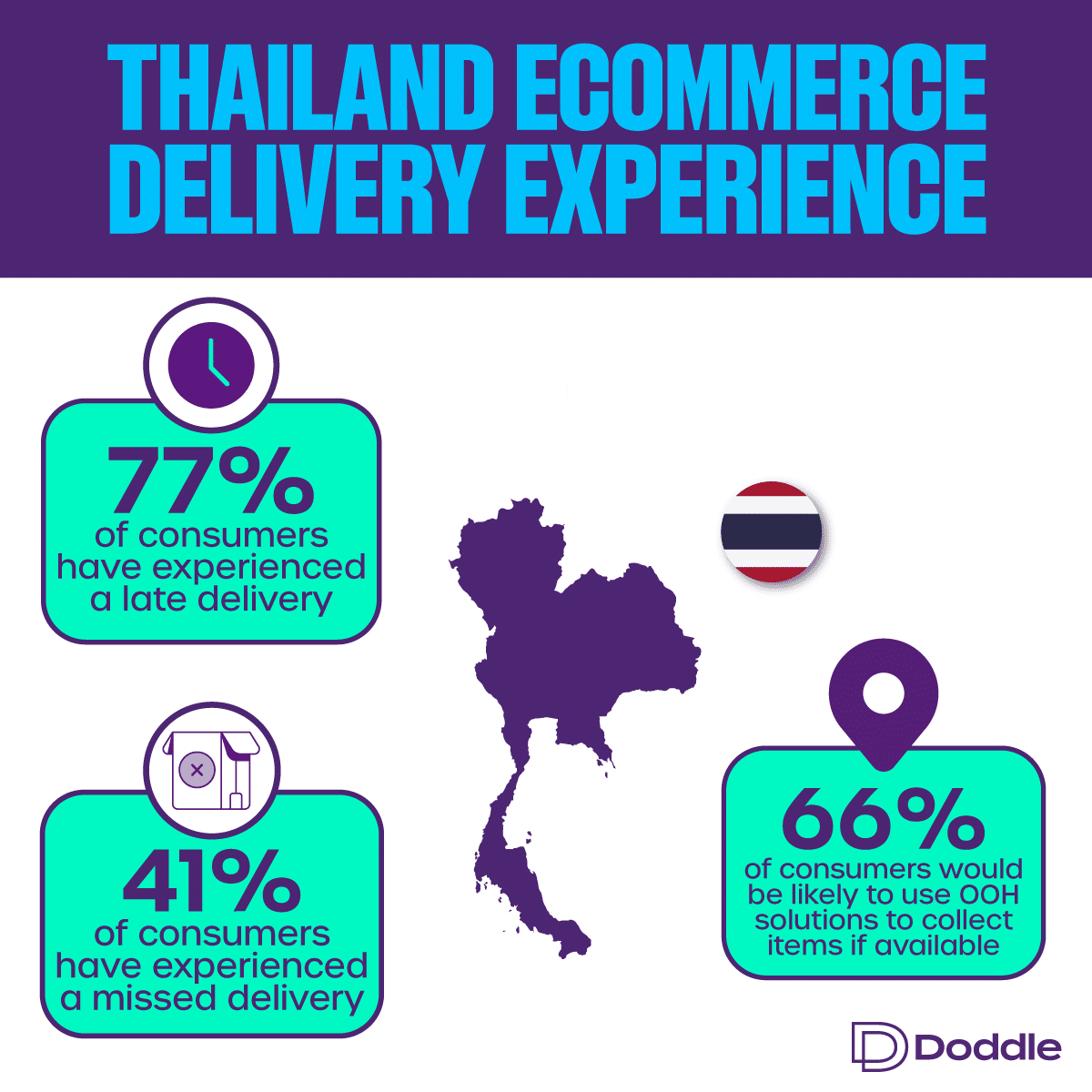

Overall, Thailand has one of the lowest OOH delivery ratios in the region, with just over half of Thais surveyed saying they did not use collection points for ecommerce deliveries in the past year.

Although OOH is not widely used in Thailand right now, as its ecommerce market continues to grow, so will the opportunity for carriers to own these networks and realise a competitive advantage. In 2020, Thai Post announced plans to implement smart locker pick-up boxes in 2021, stating they would roll out 30,000 over the next three years.

Sadly, these smart lockers haven’t yet been deployed (or at least, not publicly announced), perhaps due to the excess capacity in the market.

Discover more detail about the Thailand market, as well as how Thai consumers shop online, what delivery problems they are facing and where carriers can capitalise on the market’s rapid growth in our latest report.

South Korea

-

Population: 51,709,098

-

Population density: 507/km2

-

Key players: Korea Post, CJ Logistics, Hanjin Express, Lotte

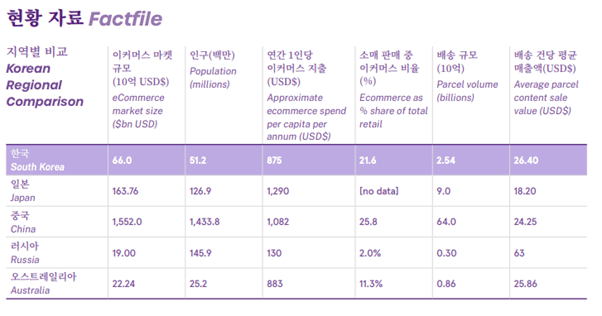

We completed a report on the South Korean market that you can download here, highlighting how the market is performing compared to nearby countries and the unique challenges and opportunities on offer here.

Overall, OOH is not a widely used delivery option in South Korea. Between 95-99% of orders are delivered to the home. If a resident is out, the parcel is left on their doorstep as stolen packages are almost non-existent in South Korea, so failed delivery or redeliveries aren’t a concern for carriers and posts.

However, there still exists a massive opportunity for OOH in South Korea through PUDO locations. Most residents live within easy reach of a physical outlet and are often more inclined to purchase locally through these outlets than order online. However, if the item cannot be purchased locally, or if online offers more convenience, they will make a purchase online.

Turning these stores into PUDO points would increase carriers’ efficiency through consolidation and allow consumers to collect orders while already shopping. But comparing this to home delivery, where parcels will be waiting on their doorstep when they get home, consumers do not have much incentive to switch to OOH based on convenience alone.

One academic paper in the Journal of International Logistics and Trade examined the benefits of installing more parcel lockers, concluding that lockers would benefit communities and provide long-term economic value. Amongst the key benefits was consolidation in urban areas where traffic congestion, accessibility, and pollution are serious problems. By delivering parcels to OOH points, delivery companies will spend less time on the road, easing congestion and providing consumers with a greener delivery method.

In addition, the paper highlighted security issues for residents that live in small townhouses and detached houses without security systems and guards, which have received increasing attention from the government and society. Although ‘porch piracy’ is relatively uncommon in South Korea, lockers would provide increased protection and privacy for those living in shared accommodation, providing extra incentives for adoption.

APAC adoption of out-of-home is slow but growing

OOH is happening at varying rates across different markets across the APAC region. China leads with the highest adoption rates, while Thailand and South Korea have some of the lowest rates.

But change is happening, with critical investments in building networks, developing existing networks to improve customer experience, and driving volume into these networks through better integrations. As return rates and parcel volumes increase with ecommerce growth, OOH will prove a key asset for many carriers and posts to scale and sustain demand.

The benefits offered by OOH will prove an asset for many markets, particularly countries like Singapore and Thailand, which have achieved a 40% faster delivery time using OOH collection points.

Learn more about building and driving volume into an out-of-home delivery network with our experts.

Related articles

7 tactics to drive self-service parcel drop-off adoption

Focusing on parcel kiosks, we explore 7 tactics to encourage customer adoption and drive volume into out-of-home (OOH) delivery networks.

What are the different types of self-service parcel kiosks?

We explore the different types of self-service kiosk, outlining the pros, cons and best use cases for each.

What consumers think about parcel lockers and how carriers can encourage adoption

Parcel lockers offer carriers automation, consolidation and increased efficiency. But what do consumers really think about them?