Insight / Blog

The importance of trust to peak performance

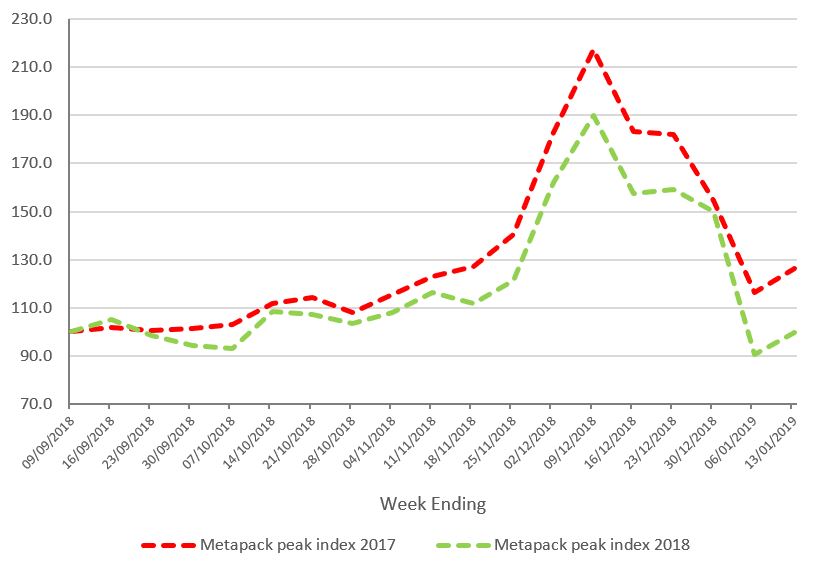

The recently released Metapack 2018 peak figures reveal a couple of interesting trends.

The first is one we pretty much know already: 2018 peak figures were disappointing across the board. When you compare peak 2018 volumes against the same period the year before, it looks as though volumes were at times 20-30% down on a relative basis. The two lines run almost parallel, with the only week in which volumes achieved the same relative performance being the final week before Christmas – widely reported as being very strong in 2018.

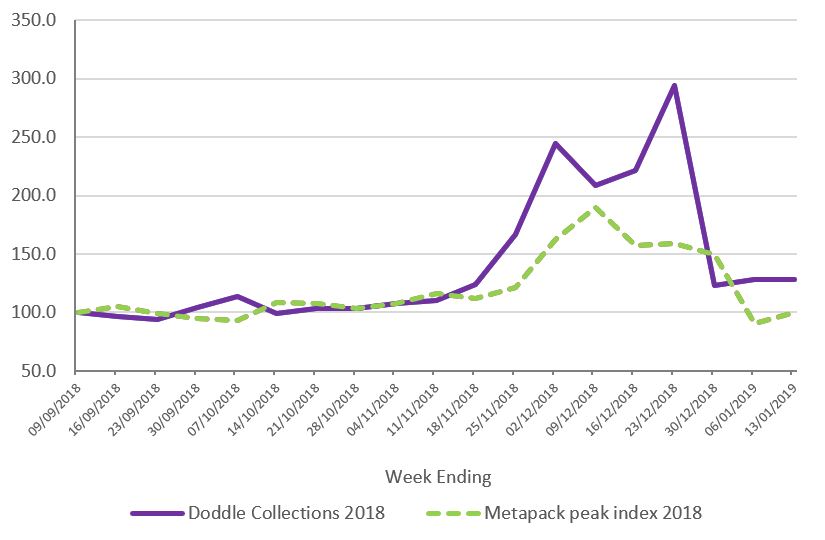

The second, for me, is the more insightful. It’s the fact that click & collect significantly prolongs and deepens the impact of peak. The below chart compares Doddle’s click & collect performance against that of the Metapack index.

As you’ll see, Doddle volumes broadly track those of Metapack until the week of 18th November, when our volumes start to out-perform. That trend then grows materially over the Black Friday weekend and the December trading period, until in Doddle’s peak week, we were trading at 3 times the volumes in the first week in September, while the wider sector traded at only 1.5 times September figures.

Why?

Our hypothesis – supported by consumer insight work we’ve recently commissioned with YouGov – is that it comes down to trust. The significant majority of consumers use both home delivery and click & collect services throughout the year – and that makes sense. I certainly interchange between the two regularly.

The consumer decision making process in choosing home delivery or click & collect can broadly be categorised into:

-

Functional – price of service, speed, types of services offered etc

-

Emotional – how valuable is this item to me, what happens if I miss this delivery, what do I need this item for, am I likely to return this item etc

At peak times, Emotional factors take over. People ‘need’ to get their Christmas presents, cannot take the frustration of hanging around at home all day to accept a parcel and cannot ‘afford’ the risk of someone opening a gift delivered to home.

Most of these Emotional factors point to the same underlying logic – click & collect offers increased trust and certainty over home delivery. Recent YouGov research we commissioned reveals that over a third (34%) of online shoppers don’t trust couriers to always deliver successfully with that figure rising to nearly half (47%) of 18-24 year olds.

How does that play out longer term? Well, there’s an argument that what happens in peak is a bellwether for what’s to come in future. People who only bought their Christmas shopping online in 2012 now buy things online throughout the year.

Our gut – borne out in industry predictions – is that home delivery will always be around as a delivery option, but that it’s status as a habitual choice is being eroded. Whilst it’s anticipated that the volume of home deliveries will increase by 51% by 2022, it’s expected that the volume of click & collect orders will increase by almost double that – 95% (IMRG Metapack Delivery Index).

So click & collect is fast becoming a mainstream delivery option that consumers expect to see in amongst a portfolio of delivery choices. What Metapack’s most recent peak figures also show is that it’s rapidly becoming an option that retailers ignore at their peril – one that offers consumers the trust they can’t live without at crunch points and one with the capacity to extend the potential peak sales window by ‘make or break’ days and even weeks.

Topics:

Related articles

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?

5 Changes We Predict in eCommerce Delivery & Returns in 2024

Our predictions for 2024 in ecommerce delivery and returns, plus a roundup of our 2023 predictions.