Insight / Blog

Why Carriers Need To Act On Rising Merchant Return Rates

We predicted that this year would provide a reckoning for ecommerce. And no, it’s not just down to supply chain issues that have plagued retailers and headlines alike.

There’s another big problem affecting merchants: returns. For example, Boohoo had to issue a profit warning at the end of 2021, citing higher return rates impacting net sales growth and profits. Overnight, its market valuation fell by 15%. Combined with the supply chain challenges that many ecommerce businesses are facing, returns are becoming an obstacle to future growth. Some have turned to paid returns strategies, and it might not be long before even stubborn names like ASOS also start charging their customers.

The more returns impact merchants, the bigger knock-on effect it will have on carriers. If merchants are suffering from returns hurting their bottom line and inhibiting their growth, they’ll be more likely to squeeze on logistics costs, and fulfil less of their growth potential, resulting in reduced volume growth for carriers.

It’s not all doom and gloom though. If carriers can provide solutions to help merchants with returns and enable continued growth, they’ll be able to actively grow alongside them.

The growing problem of returns

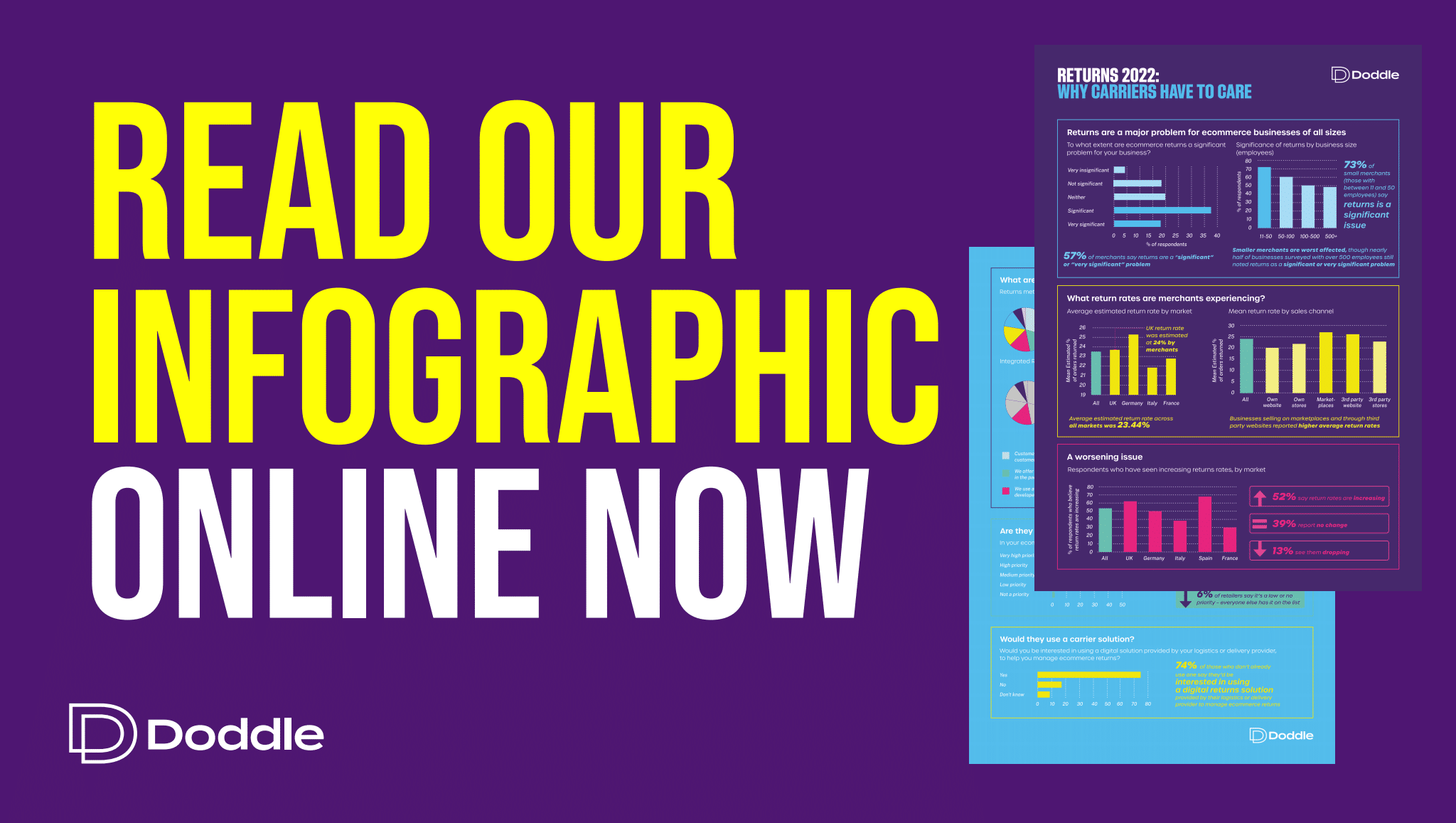

A survey of merchants conducted for Doddle reveals that 57% of merchants say returns are a significant problem for their business.

In America, ecommerce accounted for over 20% of the holiday spending in 2021, increasing from the pre-pandemic amount of 15% from 2019. Using estimates based on previous years, this would lead to $112-114 billion in returns goods. However, 61% of merchants expect an even higher return rate, raising that cost.

Doddle’s research also backed this up, with 52% of merchants stating that their return rate had increased over the last 12 months. On average, the reported return rate is 22%. In the UK and Germany, this figure rose to 24% and 25% respectively. Without intervention, this figure will continue to rise.

The role carriers must play in returns

If carriers want to secure their future growth, they need to offer solutions that enable their merchants to grow, and returns are a perfect example of where they can help. This doesn’t involve just handling the returns but providing a product that makes the whole process easier, from a consumer booking a return to when it arrives at a merchant processing centre.

An effective returns solution needs to satisfy requirements for:

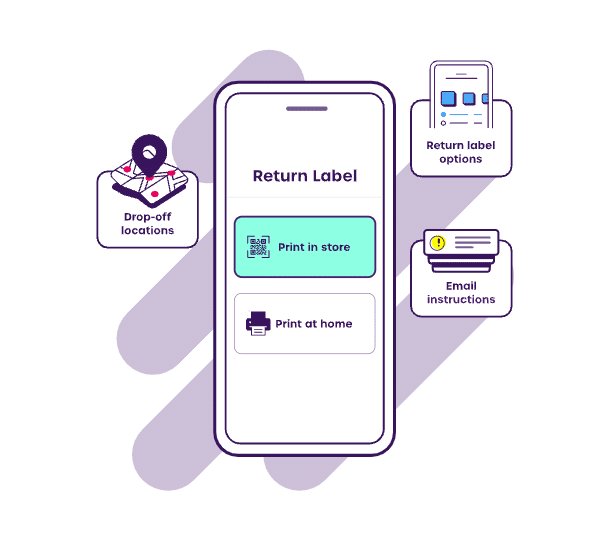

The end consumer, providing a seamless interface to book a return, with plenty of options for drop-off, including paperless returns.

The merchant, allowing them to manage and control the returns coming back and providing them with the data to reduce costs

The carrier, allowing this solution to feed into your own network for smooth pick-up and delivery.

An integrated returns portal offers a digital solution to meet all of these needs. Merchants can easily sign up and create their own branded experience within the portal, and all the volume is controlled by the carrier. Customers can access a convenient digital experience for booking a return, and merchants can automatically cross-check their order details to ensure any return booked is fully within policy, e.g. preventing returns after more than 30 days from an order, or preventing returns of non-eligible products like those on sale or swimwear.

Catching such returns before they are sent back for processing reduces costs for merchants – and can help reduce the amount of non-resalable items ending up in landfills.

Returns that are booked using this system are then handled by your network, and the merchant gains access to analytics and data to guide their returns strategy. By providing a returns solution for your merchants, you enable their ecommerce success, strengthen your relationships and ensure long-term growth with them.

Returns to become key to carrier growth

Returns shouldn’t just be seen as a problem for merchants. They should be seen as an opportunity for carriers to help merchants and secure growth on both sides.

Topics:

Related articles

7 tactics to drive self-service parcel drop-off adoption

Focusing on parcel kiosks, we explore 7 tactics to encourage customer adoption and drive volume into out-of-home (OOH) delivery networks.

Lessons from a decade in the first and last mile

A decade as Doddle taught us some lessons - and Blue Yonder helps us see what will matter in the next decade.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?