Insight / Blog

Real-life or fantasy: a realistic look at achievable automation in the last mile

Summary: The future isn’t all drones and robots. We take a realistic look at automation in the last mile, and what the next few years could bring.

Discussions of automation in the last mile are usually dominated by wishful thinking and adventurous predictions of self-delivering robots, drone takeovers or other technological advancements resembling science fiction films.

Radical predictions of the future are something humans have done for centuries. But very few are right. Even Back to the Future thought we’d have flying cars by 2015, powered by garbage. In reality, we’re battling for electric vehicles and self-driving technology.

There’s no harm in looking at what the future might hold. In fact, we predict what the next year will bring in ecommerce delivery and returns every January. But there’s a difference between realistic predictions to inform strategy and out-there theories just for fun. The reality is that automation is happening in the last mile, but it’s about improving the efficiency of current processes, cutting costs, and boosting profits rather than creating a futuristic utopia.

So, what is on the horizon for the last mile, and how can carriers use automation to inform their strategy? To answer this, we will evaluate current automation solutions and thinking in the last mile, analyse their effectiveness and determine what (realistic) future developments we could expect to see in the next few years.

Parcel lockers continue to automate OOH delivery – but not take over

Parcel lockers are an automated alternative to traditional PUDO points, providing an immediate range of benefits.

-

They’re (usually) available 24/7, allowing consumers to collect at their convenience.

-

They’re self-service, saving time having to queue at the counter.

-

They’re designed to handle collections and drop-offs, satisfying an increased demand in returns and C2C sends.

-

They provide parcel consolidation for carriers, increasing route efficiency and long-term sustainability.

InPost’s annual reports tell us their lockers receive an average NPS (Net Promoter Score) of 75. Given that the existing PUDO counters in Mondial Relay, the French PUDO business InPost acquired, scored 64 on the same metric, lockers appear to deliver a slightly improved customer experience.

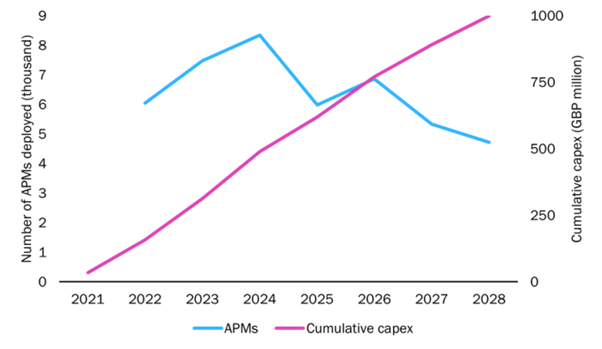

You will have undoubtedly seen countless headlines about locker growth around the globe, with carriers unveiling plans to pilot lockers or expand their existing networks. In the UK, Analysys Mason and LME predict the deployment of over 50,000 APMs (Automated Parcel Machines) before 2030, with a cumulative investment of £1 billion.

Although lockers are certainly popular, they won’t take over traditional PUDO, with the future providing both a mixture of lockers and PUDO points making up carriers’ OOH networks.

There are several reasons for this. Firstly, lockers come at a much larger expense than traditional PUDO locations, which tend to be in useful, high-traffic locations like convenience stores and have minimal costs compared to siting, installing and maintaining a large hardware device like a locker. If carriers want to increase network density, the easier and cheaper option will generally be to add new PUDO locations.

The overall cost of a locker network will also depend on whether the network is carrier-specific or agnostic, as achieving a fully carrier-agnostic network requires more work and cost to make operational. This is because you need to develop a dynamic parcel management software that works in real-time to show the amount of availability for carriers. Or, you could flood the market with so many locker compartments that you never have to worry about volume exceeding capacity, like the approach HiveBox has taken in China. In the UK, Quadient is also moving into the carrier-agnostic space, but time will ultimately tell whether the approach will be viable for other carriers in this market.

Why agnostic parcel lockers aren’t everywhere

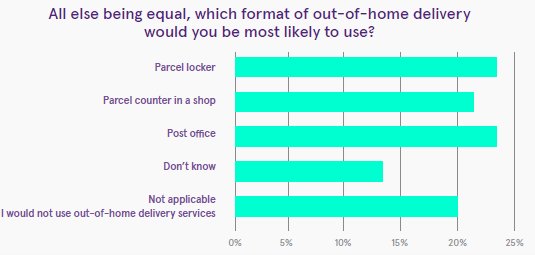

In our Post-Covid report, when we asked which OOH options customers would most likely use, preferences were almost completely even between the three formats of parcel lockers, parcel counters and post offices. Some customers prefer parcel lockers, but not all. To deliver the best customer experience, a mixture of different PUDO options must be available for customers to choose from.

It’s not just a preference: functionality is also a key element in choosing a drop-off or collection point. This is particularly true for returns or consumer sends, where customers typically print a label at home or in a drop-off location, attach it to the parcel and then hand it over. That print-in-store journey naturally favours PUDOs and post offices as a drop-off location.

Some lockers offer label-printing functionality, and some locker providers actually leave it to the courier collecting parcels from the locker to print labels, meaning the consumer can drop it off without any label attached. But adoption of such solutions requires more trust from consumers that the carrier will label everything correctly, which may take time. Over the next years, we might see more print-at-locker options to assist consumers in the drop-off journey. However, we anticipate much of the innovation and automation will be in kiosks, not lockers. More lightweight and adaptable than lockers, kiosks can fit into places that would have been seemingly off-limits to carriers, such as coffee shops, gyms, restaurants and more.

Route planning is the backbone of last mile automation

Route planning is an essential aspect of last mile automation, asbetter routes equate to more parcel deliveries in fewer miles. That means better efficiency, lower costs and fewer CO2 emissions for long-term sustainability.

The next step for automation in this area is calculating the likelihood of delivery success for each stop and factoring in real-time updates to divert to OOH. To achieve this, carriers need smarter access to consumer behaviour, revealing insights about when they are in (i.e. through customer-selected preferences), what times of deliveries have failed before and what times have been successful in increasing the chances of particular route-making successful delivery. In addition, if a stop is predicted to fail (or a consumer opts to re-route), the technology behind this must be able to incorporate OOH stops, increasing the overall success rate and efficiency.

Many elements must be overcome to achieve this level of automation, including collecting and harnessing consumer data and having real-time views of OOH availability. But with the efficiency savings on offer and a long-standing focus on route planning, we can see some variation of this coming to fruition in the next few years.

Customer communications to get more advanced

Keeping consumers in the loop helps to provide a great delivery experience. Automation already plays a key role here, with many carriers using automated systems that send out branded communications when the parcel has been received or is out for delivery.

A space for automation and efficiency here is to get smarter about how these communications are sent – and the other systems they connect to. For example, if a parcel is on the way, these communications could be used to set up redirects to OOH from the consumer, which ties into the route planning system. Although this exists for some carriers before parcels are on route (like Amazon pushing OOH redirections on the day of delivery), it doesn’t happen in real-time. The opportunity is lost if consumers don’t re-direct before the route starts.

As well as real-time tracking, carriers can use data to send out more personalised communications. For example, if a consumer consistently uses a particular locker station for sends, and space is available there, why not notify them to help encourage more volume?

Robotic deliveries aren’t on the horizon

We couldn’t talk about automation in the last mile without bringing up automated delivery robots, such as the like of Starship. At Leaders in Logistics, Thierry Golliard, Director of Open Innovation and Venturing at Swiss Post, talked about the robots used during very specific use cases, like hospitals using them to deliver medicine to patients while staff are busy elsewhere.

The reality here is that these robots will likely not find broader last-mile use cases. This is partly due to their small capacity (Starship models “can carry up to three bags of groceries”), which in most last-mile use cases would limit them to a very small number of deliveries per journey. Having one autonomous delivery vehicle to deliver a handful of parcels is the exact opposite of carrier efficiency.

In addition, these robots can only be used when consumers are guaranteed to be in to accept delivery. If the consumer isn’t there, it’s a failed journey, and the robot must travel back as no method of unattended delivery can be achieved. The robot can’t remove the package by itself and can’t wait hours for the consumer to return. It’s a total loss of time, resources and money.

Finally, these robots are expensive for carriers to purchase, maintain, and replace if people steal or damage them. Comparing all those factors to the cost of a delivery man with a van, who can deliver more parcels in last time and at lower cost, there’s one clear winner for carriers.

Drones will struggle to get off the ground

Drones is another popular topic that keeps coming around for last-mile innovation. Every few years, you’ll see a headline about how drones will become the next big thing in delivery, how Amazon has filed for yet another patent, and how most parcels will be delivered by drone. This McKinsey article from earlier this year is a great example.

Yet… If Amazon hasn’t started using drones for everyday deliveries in earnest, there are good reasons.

Drones aren’t practical for last-mile delivery. They’re weather dependent, they require safe spaces to land, they require regulatory approval, and in the case of autonomous or semi-autonomous drones, they need expensive and buggy self-piloting tech.

Even if you remove most of these headaches, it comes back to the same core problem. Is using a drone to fly individual parcels on a singular route more efficient or cost-effective than using a van to deliver 100 parcels on one route? The McKinsey report estimates that to achieve a rough parity with delivery vans, a drone operator must manage 20 drones simultaneously:

“If drone operators can eventually manage 20 drones simultaneously, our analysis, using reasonable assumptions, suggests that a single package delivery will cost about $1.50 to $2. That is in line with the per-package cost for an electric car delivering five packages, and any type of van delivering 100 packages in a milk-run format when a driver delivers all packages in a single trip.”

Until that drones are able to become more efficient than vans, they will only be used within the last mile to automate delivery in places that are hard to access, like Royal Mail’s drone fleet designed for remote Scottish islands.

Portable lockers haven’t emerged, but maybe self-driving will

In 2016, McKinsey predicted AGVs (autonomous ground vehicles) with built-in lockers would “replace current forms of regular parcel delivery”. The idea was that the parcel lockers could travel to consumers without human invention, notifying them when it was outside so they could collect from one of the compartments on the locker. Then, it would travel to the next destination, allowing it to serve multiple consumers on a single trip.

The closest we got to that prediction is the driverless cars that Domino’s Pizza are testing in Houston.

Overall, vehicle automation in the last mile seems less focused on movable parcel lockers and more on self-driving technology. As a person will be needed to hand parcels over to consumers (particularly for consumers in flats or addresses hard to access via road) it’s highly unlikely that we will see driverless vehicles here.

Considering that carriers will still need to employ a driver, the only way self-driving technology makes sense to be used is if it presents more efficiency (if the driver could complete other tasks on route, like scanning parcels or updating tracking information) or significantly boosts road safety, to justify the increased costs.

Although progress is being made for self-driving, Accenture believes there’s no realistic chance that full-on self-driving will be available before 2030. While they’re still some way off for the last mile, driverless vehicles might be more appropriate in the mid-mile, particularly between two fixed distribution centres on repeatedly travelled routes, which could save costs and free drivers up to travel different routes.

Will the parcel industry be fully autonomous?

The pace of change in logistics tends to be fairly slow, but given the long-term trend of parcel volumes is clearly still heading upwards, efficiencies are only becoming more valuable over time, and automation promises to deliver plenty. In a decade’s time, we might see a quite different last-mile, where a consumer might see a curated set of delivery options on the checkout based on their previous purchases, location and preferences. These options probably won’t include delivery by drone or autonomous ground vehicle, unless the regulatory and technological picture changes rapidly. Our shopper might select delivery to a parcel locker, served by multiple carriers using semi-autonomous vehicles based on intelligent real-time routing, and the package could be picked and shipped largely autonomously out of the warehouse – but it will still probably be placed into the locker by a human.

The vagaries and challenges of B2C last-mile delivery will always require human input and ingenuity. That’s not to mention the power of friendly interaction and service with a smile, which greatly affects how customers experience their delivery.

In practice, most successful last-mile automation won’t be focused on replacing the human factor, but on improving productivity, removing friction and reducing costs. From a last-mile business’ perspective, getting the workforce on board with automation rather than resisting these changes will require thinking carefully about where automation can add value for employees as well as to the bottom line. That ensures that introducing and rolling out last-mile automation comes as a positive to all stakeholders, not as a zero-sum game where the business wins at its employees expense.

Topics:

Related articles

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?

5 Changes We Predict in eCommerce Delivery & Returns in 2024

Our predictions for 2024 in ecommerce delivery and returns, plus a roundup of our 2023 predictions.