Insight / Blog

Why merchants aren’t offering OOH delivery

Summary: Nearly 1 in 4 (23%) of European merchants still don’t have a way to give consumers OOH options at the checkout – here’s why.

Our recent report, European Out-of-Home Delivery Options – An eCommerce Merchant Survey, showed that 77% of our survey respondents offered out-of-home (OOH) delivery at the checkout. Although this figure shows great promise, it highlights that nearly 1 in 4 (23%) of merchants across Europe still don’t have a way to give consumers OOH options at checkout.

In the UK, this figure drops even lower with only 53% of businesses offering OOH delivery to their shoppers.

As we’ve explored previously, adding OOH delivery to the checkout was followed by tangible improvements on conversion rate, average order value & Net Promoter Score for the majority of merchants. What we’ve found is that merchants who haven’t yet added out-of-home delivery options seriously underestimate the likelihood of seeing increased KPIs (conversion, average order value and Net Promoter Score) when compared with the benefits measured by those who did adopt OOH delivery; and that merchants have trouble getting the right technical level of integration from their carrier partners.

Why aren’t merchants offering OOH?

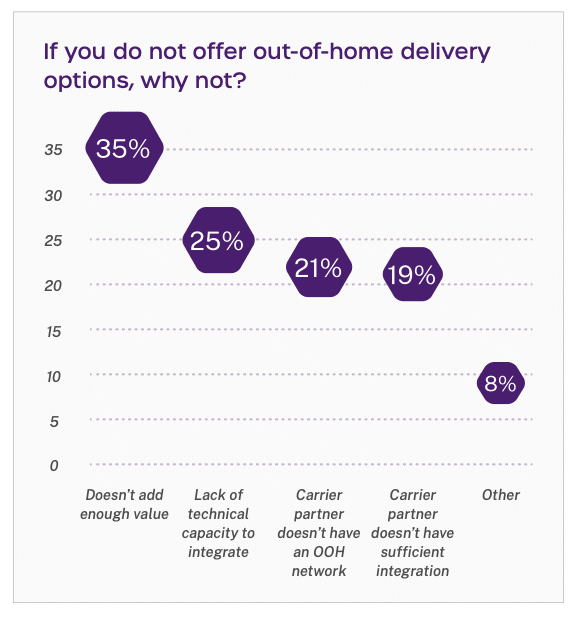

When asked why they do not offer OOH delivery options:

-

35% of merchants said it doesn’t add enough value

-

25% of merchants said they had a lack of technical capacity to integrate OOH options

-

22% of merchants said that their carrier partner doesn’t have an OOH network

-

18% of merchants said that their carrier partner doesn’t offer a signification integration option

Read our European merchant report on out-of-home delivery options

Fundamentally, these answers can be split into two camps. Firstly, the 35% of merchants who believe that out-of-home delivery options do not add enough value to justify offering them. That’s a significant share (who can be potentially converted by better information from carriers about the benefits of out-of-home delivery and the impacts on merchant KPIs).

The second, larger group is merchants who have integration challenges – whether lacking their own technical capacity to create an integration (25%) or feeling that their carrier partner did not offer a sufficient integration (18%). That means 43% of merchants not offering OOH in our survey are making that decision for addressable, practical reasons. If carriers can offer a sufficient suite of integrations catering to the varying needs of different tiers of merchant, this sizable minority should be easily won over to offering OOH delivery.

A perceived lack of value

The most common single reason for not offering OOH delivery options was the perceived lack of value in doing so. Merchants who haven’t seen the benefit first-hand don’t yet believe in it, which is where their carrier partners could and should be stepping in to give them clearer information and credible data to encourage them to adopt OOH deliveries.

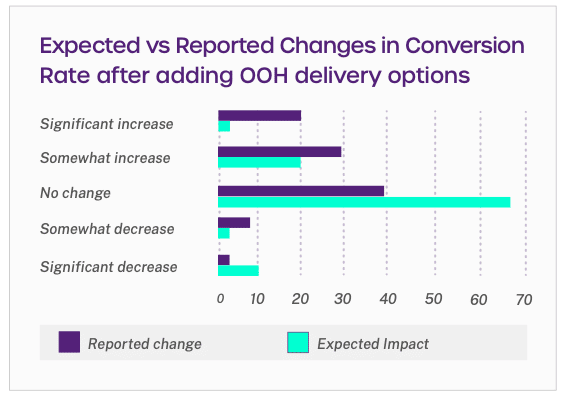

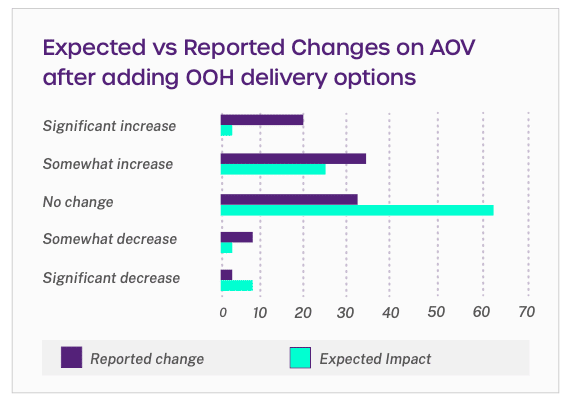

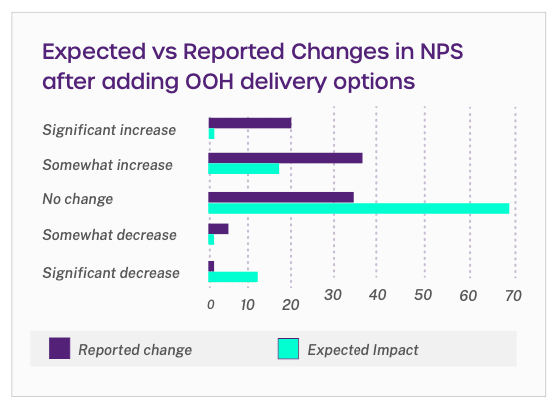

We asked those not offering out-of-home delivery about the impacts they would expect to see if they added out-of-home delivery options to their checkouts.

Just 2% believe that OOH delivery would significantly increase conversion – compared to 20% who reported that this actually happened. Overall, 22% of those who don’t yet offer OOH delivery believe they would see an improvement, versus the 50% who noticed an increase in conversion after introducing OOH options.

This pattern repeats for both of our other key factors; Average Order Value and Net Promoter Score. Respondents who do not yet offer OOH delivery significantly under-weight its impact on these KPIs compared to the tracked changes reported by those after introducing the new delivery option.

What this clearly shows is that there’s a knowledge gap among merchants, who don’t believe or expect out-of-home delivery to make a difference – and of those that do think it will change their KPIs, a not inconsiderable minority believe it will be bad for their business.

That contrasts with the experience of most merchants who do start to offer out-of-home delivery, and that means there’s a huge opportunity for carriers to do some case studies, gather some data, and start to encourage merchants about the potential upsides of OOH. Doing so gives them the chance to make their merchant clients more profitable, and to reduce the environmental impacts and costs of their deliveries at the same time.

Changing carrier for better OOH integrations and options

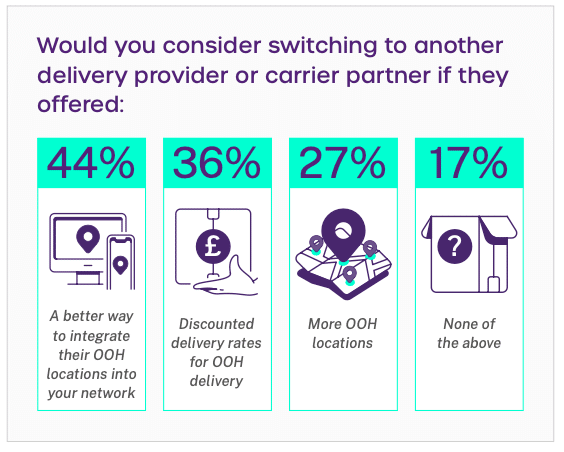

When asked if merchants would consider switching to another delivery or carrier partner, 83% of our survey respondents, whether they currently offer out-of-home delivery or not, said that they would consider switching carriers for better integrations, cheaper out-of-home rates or more out-of-home locations. Just 17% wouldn’t consider switching based on factors around out-of-home delivery, highlighting that this is becoming a key issue for merchants shopping for carrier partners.

Surprisingly, cost was not the leading priority, with 37% saying they would consider switching carrier for discounts on out-of-home delivery, second to 44% who said they’d consider switching for better integrations of OOH delivery into their checkouts. Given that this is nearly twice as many merchants as those who don’t yet offer OOH (23%), this shows that many of those merchants who currently have an OOH option on the checkout are still looking for better ways to display that offering and would be willing to change carrier to get it.

A two-pronged approach for carriers

Merchants at every size and scale must carefully weigh up the value of using their time and resource for technical work. They’re more likely to lack capacity for projects that they don’t see as much value in, and so the jobs for carriers are twofold: convincing merchants of the value is primary, because without that the incentive to integrate doesn’t exist at all. This is something we’ve touched on before, stressing the importance of why carriers need to be talking to merchants about conversion rates, sustainability, flexibility and guaranteed delivery.

Secondly, they need to be capable of providing their OOH location data in a mix of ways to suit the needs of different merchants. Some will be best served by a simple plugin offering a tried-and-tested user journey that is easy to add to their web platform – others will want a full API integration that allows them to completely customise the branding and UX. Catering to those needs encourages the maximum uptake of out-of-home delivery on checkouts, and that drives all the downstream benefits carriers love about out-of-home: consolidation, cost reduction, and increased sustainability.

Want to discuss your OOH checkout integration strategy? Talk to us.

Related articles

7 tactics to drive self-service parcel drop-off adoption

Focusing on parcel kiosks, we explore 7 tactics to encourage customer adoption and drive volume into out-of-home (OOH) delivery networks.

What are the different types of self-service parcel kiosks?

We explore the different types of self-service kiosk, outlining the pros, cons and best use cases for each.

What consumers think about parcel lockers and how carriers can encourage adoption

Parcel lockers offer carriers automation, consolidation and increased efficiency. But what do consumers really think about them?