Insight / Blog

Why are parcel lockers so popular, and how do they compare to PUDO?

Summary: Parcel lockers aren’t the only OOH delivery method. We explore their recent popularity and how they measure up against PUDO.

It seems like a week can’t go by in the last mile world without parcel lockers hitting the headlines. Recently, we’ve seen:

-

Amazon doubling the number of parcel lockers in the UK

-

DHL partnering with Quadient to roll out outdoor parcel lockers in Sweden

-

Deutsche Post DHL implementing carrier-agnostic lockers at train stations

-

PostNord rolling out SwipBox lockers in Finland to extend their Infinity network nationwide

-

InPost releasing their financial reports showing incredible growth of their network as well as increased user experience and sustainability savings.

At WMX Europe last week, many of the posts and carriers we spoke to have ambitious plans to scale their locker networks in the coming year, and businesses like Omniva are taking their successful locker deployments and offering them to other posts.

Even furniture giants IKEA are trialling a parcel locker service in collaboration with Shift and Access Self Storage in London. This is a particularly interesting one because of the natural bulky nature of its flat-pack products. At a £10 charge, the collect service would offer significantly lower prices to consumers than home delivery, which starts at £40.

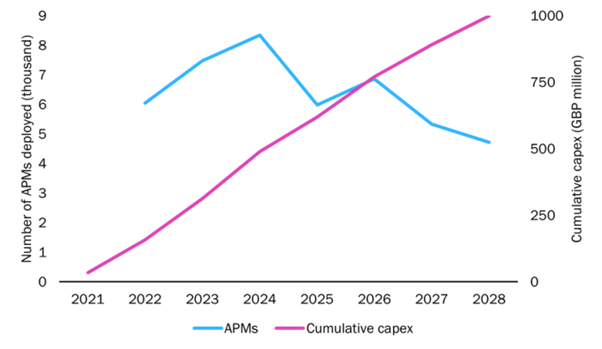

No matter where you look, parcel lockers are in demand. Projections from Analysys Mason and LME indicate that this growth in demand will result in the deployment of over 50,000 APMs (Automated Parcel Machines) before 2030, with a cumulative investment of £1 billion in the UK alone.

Here’s a simple truth: parcel lockers are a great out-of-home (OOH) delivery method, but they aren’t the only option. So, why have lockers become such a seemingly popular OOH option, and how do they compare to PUDO?

Record parcel growth accelerates the need for Out of Home delivery

2021 brought unprecedented levels of parcel volume growth alongside rising rates of ecommerce purchases. Although the first quarter of 2022 indicates that we might be coming down the other side of this growth spike, in the long-term we are likely to see ecommerce continue to grow.

The 2021 Parcel Shipping Index forecasts that global parcel volumes will double to 266 billion by 2026. Although carriers have done a great job at adapting so far, the World Economic Forum expects demand for last-mile delivery to grow a further 78% by 2030. Current home delivery models cannot sustain this level of volume and growth without putting an excessive number of extra vehicles on the road.

Jason Tavaria, chief executive of InPost UK, believes that “Home delivery is unsustainable and is reaching a tipping point.” InPost has its own reasons to believe this, but whether or not a tipping point is just around the corner, the combination of increasing parcel volumes and decreasing customer satisfaction with delivery clearly point to a need for change.

To continue to meet the anticipated demand for their services over the next few years, carriers need to utilise out-of-home delivery networks to consolidate deliveries, reduce the number of failed deliveries and make their existing capacity operate more efficiently. From a consumer perspective, OOH networks are required to facilitate increased flexibility and convenience. Our Post-Covid report showed that 58% of consumers were spending less time at home than they had been before the pandemic, and that flexibility was an important factor to 79% of shoppers when it comes to delivery.

All of these factors could be driving the development and growth of out-of-home delivery – but much of the focus appears to be on lockers, rather than a broader perspective of potential solutions and arrangements for out-of-home.

Why are lockers the popular choice?

Lockers are physical objects that can be fully owned and branded by carriers, giving them an advantage over PUDO in terms of media attention – and they have a sense of novelty and immediacy. A fresh block of lockers in a familiar location is a more recognisably new and interesting to consumers than a convenience store hanging up an “Amazon Hub” sign over the counter, and makes for a better photo for media to use. In addition, lockers can be installed in a variety of locations, allowing carriers to flex their brands in busy areas, combining OOH advertising and delivery. For example, DHL’s Packstation lockers in German train stations won’t just offer convenience; they’ll ensure that every passenger sees the DHL brand.

Depending on the location, lockers can potentially offer more flexibility than PUDO locations, for example with 24/7 access when installed in public spaces, versus PUDO locations which are limited by business opening hours. During the worst of the pandemic, lockers enabled contactless delivery, which was a major benefit, and a user journey involving no interactions with people still may appeal to some consumers.

According to InPost data, lockers achieve higher Net Promoter Scores (NPS) than PUDO counters. In France, where InPost has acquired PUDO business Mondial Relay, its newly deployed APMs (automated parcel machines) scored 75 on the Net Promoter Score, versus 64 for the existing PUDO counters. InPost attributes this rise to the ease of finding the locker and picking up the parcel.

One crucial piece of context: in 2019, a Capgemini report found that the overall NPS for French parcel delivery was -29. Against that backdrop, what’s most apparent from InPost’s data is that both forms of out-of-home delivery are performing remarkably well versus the market.

Lockers also have a role to play in carriers becoming more sustainable, reducing emissions per parcel thanks to consolidation, allowing more parcels to be delivered with fewer miles driven on the route. This role will become increasingly important over the next few years, particularly with emerging regulations and sharper competition as retailers consider environmental impact when deciding on a logistics partner. However, the same sustainable efficiencies and consolidation can be reached with PUDO locations, so this doesn’t necessarily explain the apparent emphasis on lockers.

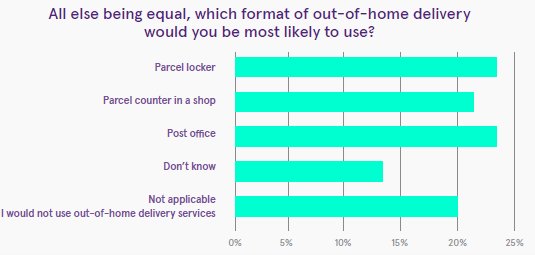

When we asked consumers to select a preferred out-of-home delivery location, we found that 24% chose parcel lockers, 22% chose a PUDO counter, and 24% chose a post office. There’s not a huge difference between the options in terms of consumer popularity then, although parcel lockers are slightly ahead of PUDO here. Notably, younger consumers (perhaps more likely to fall in the ‘digitally native’ category) were significantly more likely to prefer locker delivery than older shoppers – 34% of 18-24 year olds saying they would prefer a parcel locker compared to just 14% of over 55s.

Probably the most important lesson from this chart is that nearly three-quarters of those surveyed did have a favoured option, which suggests the need for carriers and posts to be offering a range of out-of-home delivery options.

Where PUDO shines

Lockers are clearly a hit with shoppers, they can be deployed in a range of different locations, and they offer all the amazing benefits of consolidation for carriers – they’re a great out-of-home delivery method. They do come with several disadvantages, however. First and foremost, whereas PUDO locations can cost almost nothing to deploy (using a PUDO app on existing store devices), lockers have a set of pretty significant costs associated, from build and installation to power and internet connectivity. Those costs can add up quickly given that out-of-home networks need density to perform optimally, and so require a reasonably large number of locations.

In addition, lockers tend to be carrier-specific rather than agnostic, meaning that lockers will face greater competition in finding locations that aren’t already occupied. Find out why carrier-agnostic lockers aren’t everywhere here.

Secondly, while lockers can theoretically be deployed in a huge range of locations, the practicalities of installation often mean negotiation with private citizens and businesses if a carrier wants to deploy a locker in privately owned land, or with public bodies if the land is public.

PUDO locations, on the other hand, are already built and are often conveniently placed in high-traffic areas. In the case of third-party PUDO locations, many of the costs are borne by the host location (e.g. purchasing devices if necessary, or the staff time required for training on a PUDO application.) Similarly, there will often be a period of negotiation involved in adding locations to your OOH network in the case of franchised or chain businesses. However, there are also incentives for these businesses to make a deal in order to reap the rewards of greater footfall. This can be true of locker installations when installed in host locations, but this is not as common a use case as PUDO in a convenience store.

Taken together, these factors mean that PUDO is a better option for building a larger out-of-home delivery network at a faster pace. As we’ve covered previously, Amazon is a great example, with its OOH network in the UK. At first, it invested in lockers. But to truly grow, they partnered with PayPoint to get its PUDO app out into as many of PayPoint’s 28,000 locations as wanted to use it. That access helped Amazon to have one of the largest collection point networks in the UK.

Networks need a mix of delivery modes

Out-of-home networks shouldn’t be solely comprised of lockers or PUDO. A balance of both modes gives consumers greater choice and flexibility to collect and return their deliveries in a way that suits them. This multi-modal approach allows carriers to adopt the right posture for different regions with different delivery needs and access requirements. Scaling quickly with PUDO locations can allow carriers to create extensive reach and the density that is crucial to out-of-home success. Then they can offer automation and an improved customer experience with locker deployments to augment the network and encourage further customer adoption.

Arguably more important than the nature of the out-of-home network is how carriers drive volume into it. Whether they’re investing significant capex into locker deployments and maintenance, or time and energy into rolling out a PUDO network through third-party hosts, the only way to achieve return on the investment is to ensure that enough volume comes into the OOH network. To achieve that, they need to be available across merchant checkouts.

Consumers who don’t know the network exists and aren’t given the option at the checkout won’t ever use it. Ensuring a clear and compelling presence at the checkout will be a crucial determinant of out-of-home success for carriers, regardless of which type of collection point they’re using.

Topics:

Related articles

Lessons from a decade in the first and last mile

A decade as Doddle taught us some lessons - and Blue Yonder helps us see what will matter in the next decade.

Parcel lockers vs parcel kiosks: which is best for parcel drop-off?

We explore the benefits and drawbacks of parcel lockers and kiosks to help decide the best self-service solutions.

What do out-of-home networks look like in the UK?

We dive into the biggest logistics operators and their current OOH networks in the UK