Insight / Blog

Turning up gems in delivery data

Data gives you invaluable direction. At Doddle, it’s been an eventful journey and we’re still evolving the model as we identify opportunities ahead of us. Along the way, we’ve had to make some hard decisions but with the benefit of hindsight, one thing we’ve done well is to rely on data to tell us where to go next. But it’s not just any and all data we can get our hands on – I blogged the other week about the dangers of chasing instant gratification with quick wins that boost metrics in the short term.

No, what I’m talking about is the data that really matters, strategically speaking – how current and historic performance indicate the long-term profitability of products, services, customers and customer segments. This is the stuff that’s more valuable than diamonds for retailers.

Delivery & returns is extremely challenging territory for many retailers and (perhaps myopically), I see it as the thing that will determine the enduring success or failure of many retailers over the next few years. But it feels like there’s a real paucity of investment in the capture and analysis of data around delivery & returns to help guide investment and decisions.

So, what questions do we ask to unearth the gems?

Now there’s a risk of backseat driving here, and it’s far easier to comment on how things should be done from this (relatively) safe distance. In my defence, we spend a lot of time at Doddle with retailers, so I’m not a stranger to the reality of retail logistics.

With those caveats in place: if I was in charge of assessing the online delivery proposition of a retailer, I’d start by getting the teams to dig out some key metrics from a historic period (something like 12 months):

-

AOV by delivery option

-

Frequency of order by delivery option

-

Return rate by delivery option

-

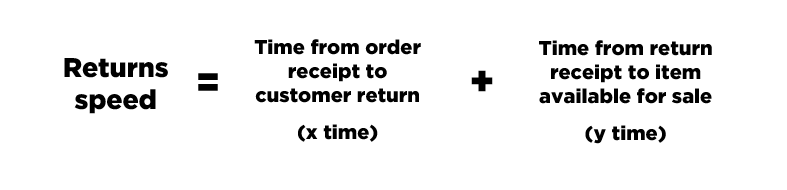

Return speed / re-sale value by delivery option

-

Value leakage by returns option

None of these in themselves will give a complete picture, but even by asking the question and looking at a longer-term view, we’ve found you get some interesting results.

Nuggets of insight

One major online retailer working with us found that the 15% of its customer base who used both home delivery and pick-up/drop-off (PUDO) locations were 138% more valuable than the typical ‘home-delivery-only’ shopper, by spending 9% more on every shopping occasion and shopping 2.17 times more frequently. There were some eyebrows raised when we sat down to review those results.

We’ve also found that many retailers don’t really think about speed of returns, and the associated value :

When we challenged a retailer to look into the returns rate and returns speed by delivery / returns option, they found a 13-day disparity between the X Time of their outbound delivery options, and a 10 day difference between the Y Time associated with various returns options. Both of these had an obvious, direct and, most importantly, measurable link to profitability.

Yet in both these cases, the analysis wasn’t being done – and that’s where we see a huge opportunity. It comes back to taking a long-term perspective, answering more difficult questions and taking a more holistic view on the value of delivery and returns as part of an investment in your brand. In my view there are few places where there is a greater opportunity to drive improved brand perception and customer loyalty.

Topics:

Related articles

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?

5 Changes We Predict in eCommerce Delivery & Returns in 2024

Our predictions for 2024 in ecommerce delivery and returns, plus a roundup of our 2023 predictions.