Insight / Blog

5 key learnings from the “Out-of-home delivery in Europe” report

Out of home delivery has historically been a tricky topic to get hard facts on. There’s no shortage of debate and endless points of view, but much of the discussion has been reliant on assumptions (usually relatively sensible ones, at least) and finger-in-the-air estimates. Thankfully, the guys over at Last Mile Experts have put together one of the most comprehensive summaries of the state of OOH delivery in Europe, covering 28 countries and 213 networks.

For our part, here are the 5 most interesting titbits from the report.

1. Forecasting future volume is hard, but it’s going to be massive

In 2020, 10 billion parcels were shipped in the EU & Great Britain, the first time the 10 billion threshold had been crossed. By 2025, the report suggests we might see twice as many, and that figure could even double again by 2029. The challenge with all of these forecasts is to estimate the extent to which ecommerce growth, accelerated by COVID, will continue to remain this strong in the coming years, and the report illustrates how different assumptions about that growth rate might play out in terms of volume. The difference is staggering: at pre-COVID growth rates, we would reach 20 billion parcels in 2029. If growth continues at the same rate as it has during the pandemic, we’ll be there in 2023.

The report authors have estimated a “new normal” between these two options for their 20 billion by 2025 estimate. Such a figure truly puts into perspective the analysis later in the report on OOH networks – if we are to have double the volume of parcels by 2025, the efficiency and readiness of OOH will be a huge determinant of success for parcel carriers and postal operators.

Can carriers and posts achieve sustainability goals while parcel volume continues to rise?

2. Out of home delivery routes are between 3 and 4 times more efficient

Parcel volumes could feasibly double in the space of 5 years between 2020 and 2025. The infrastructure to deliver them cannot realistically do the same. As a result, parcel carriers will need to work their existing infrastructure much harder to deliver the new volumes. That logic is what is driving out-of-home network investment as a strategic priority. The report’s authors state that OOH routes are 3 to 4 times more efficient compared to door-to-door deliveries. The stat they’re drawing up suggests that deliveries to lockers allow a driver to serve up to 800 parcels, versus 200 for a dense urban door-to-door scenario.

OOH delivery doesn’t just offer carrier efficiency, but can also bring significant benefits to both retailers and consumers. Find out more, in our report on European Out-Of-Home Delivery Options here.

3. Could C2C usage drive a significant amount of OOH volume?

DPD’s impressively job-titled Executive Vice President for Marketing, Communications and CSR, Jean-Claude Sonet, is quoted in the report on the topic of consumer-to-consumer parcel sends. He anticipates a 30% growth rate annually for C2C volume throughout Europe, driven by increased adoption of recommerce, pre-owned and circular economy models. Perhaps most importantly though, Sonet reckons around 90% of this volume will be linked to OOH solutions, whether PUDOs or APMs, to use the language of the report (APMs are automated parcel machines, often referred to as parcel lockers.)

So DPD are forecasting that by 2025, 30% of total OOH volume will be driven by C2C usage. Besides the simple volume that would bring into an OOH network, it’s worth thinking about the second-order effects. If buying second-hand stuff online continues to grow at an impressive rate, and consumers use OOH solutions for delivering these orders, that will bring more and more shoppers into contact with OOH delivery propositions. In time, increased exposure like this could increase the rate of growth of PUDO and locker adoption among consumers for all deliveries, not just C2C.

4. Density, the MVP rule and the situation in Europe and the UK

The report notes that Last Mile Experts have a target figure for the minimum density required for a network to be successful, which is 1 PUDO or APM point per 10,000 inhabitants. However, they also cite two other benchmarks. The first is for the last mile to become “economically sustainable”, at 8 points per 10,000 inhabitants, and the second is for the last mile to be “environmentally friendly” at 10 points per 10,000 inhabitants.

However, all but 5 countries of the 28 covered by the report are below both of these markers. The Czech Republic, Poland, Slovenia, Denmark and Finland all exceed 10 points per 10,000 inhabitants, with Finland leading by some distance with 24 points per 10,000 inhabitants. Unsurprisingly, these are also nations with some of the highest percentage of deliveries occurring through OOH networks. The lack of truly dense OOH delivery networks across most of Europe is a barrier to further adoption by consumers, who need a truly convenient alternative to shift from home delivery. That said, this is a challenge being actively addressed by leading carriers. DPD are planning to double their network by 2025 to 100,000 points, and DHL recently announced a plan to increase their Packstation lockers to 12,500 installations in Germany by 2023.

One thing that the report doesn’t count towards these statistics in particular is Amazon, due to the difficulties assessing the exact size of their network and its geographic distribution (though the report does have a summary of what is known about Amazon’s network.) What we can say confidently is that Amazon has over 20,000 OOH delivery points in Europe, and at least in the UK has rapidly expanded its “Amazon Hub Counter” offering after initially primarily deploying lockers.

In any case, it’s clear that additional PUDO and locker points are being created at a fairly rapid rate across the continent, which will continue to push OOH networks forward and make them more convenient for consumers in the 28 countries.

5. What about the format of OOH points?

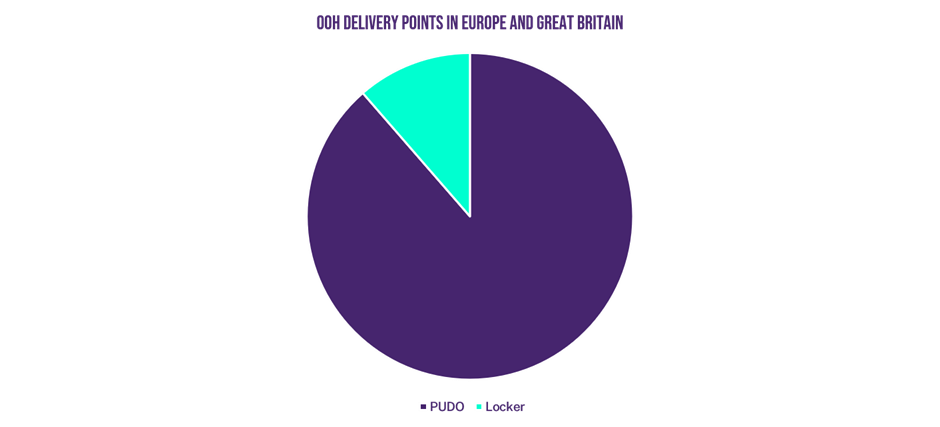

A key finding of the report is that just under 13% of OOH delivery points are lockers. Parcel shops, post offices and store counters continue to make up the vast majority of OOH delivery points.

We’ve recently looked at why parcel lockers are so popular and the reasons why some companies like Poland’s InPost are so keen to emphasise lockers as a primary method, when others appear to be less single-minded about the format they use. What’s clear is that while lockers are currently a relatively small part of the OOH mix, they’re likely to be a growing segment. The allure of automation and one-touch convenience which lockers can provide is hard to beat, and we anticipate that over time the obstacles to their deployment by carriers (primarily cost-based) will be reduced.

Related articles

Lessons from a decade in the first and last mile

A decade as Doddle taught us some lessons - and Blue Yonder helps us see what will matter in the next decade.

Important lessons from Leaders in Logistics 2024

Leaders in Logistics 24 dived into AI & automation, sustainability, changing ecommerce behaviours, emerging consumer expectations & predicted what the next decade had in store.

Postal results, reforms, and returns

Posts around the world are seeking reform, but how can they drive improved results in the short term?